HI Financial Services Commentary 01-16-2018

YouTube Link: https://youtu.be/m8IEAv6Luq0

What I want to talk about today?

Started up 280 then down 103 to finish down 10.33 What Happened?

When see open +280 Emini profit taking and swing trading profits

VIX up 10% 11.66

News about the government possible shutdown ? For every new program the President wants to shut down two others

There were no more buyers and the market acted as market makers ran out of positions

Over extended market – HOW LONG will it last?

Eirhorn – Long Short trader and the few losers on the short side ruined the portfolio.

What happening this week and why?

Earnings – Bank earnings, Options Expiration and Wed China Economic Reports

Where will our markets end this week?

Higher

DJIA – Bullish we entered the over bought mark RSI

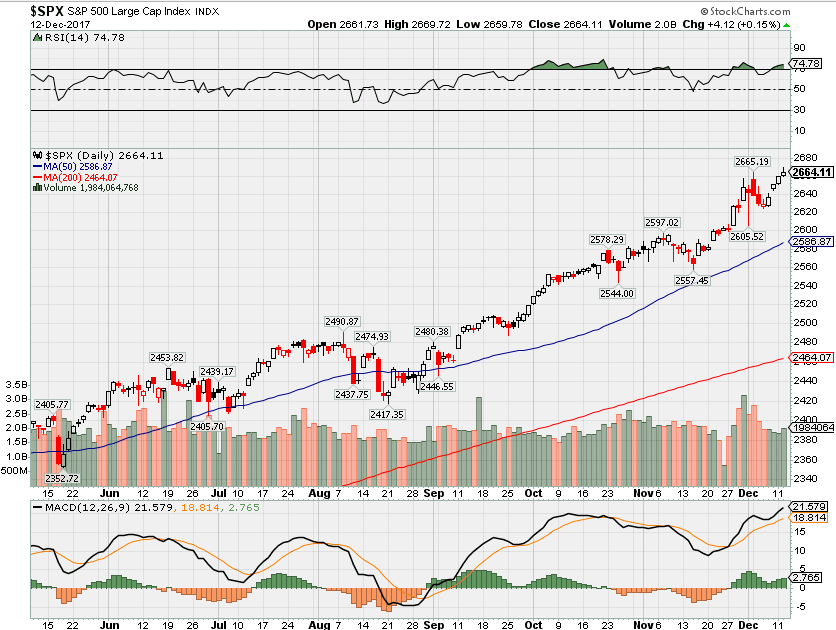

SPX – Bullish overbought on the RSI

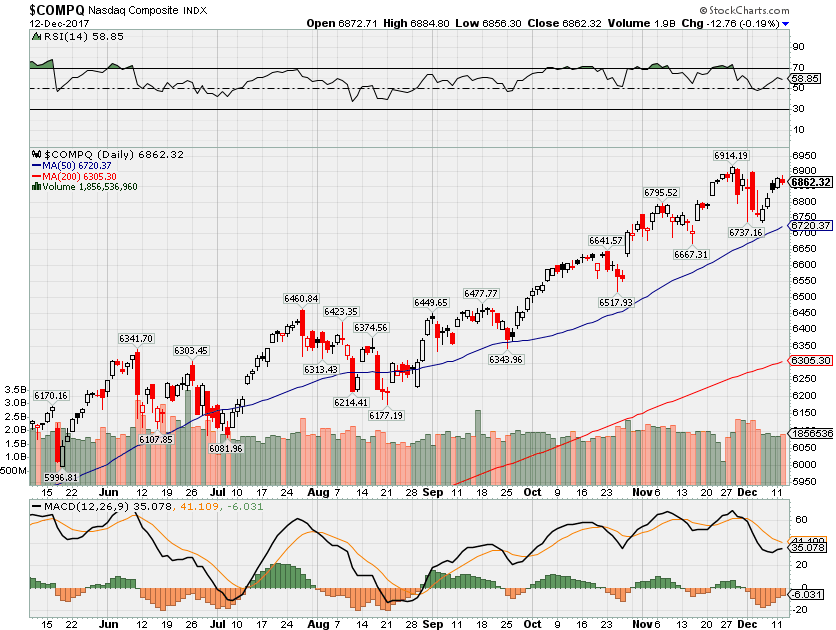

COMP – Bullish and overbought on the RSI

Where Will the SPX end January 2018?

01-16-2018 +2.0%

01-09-2018 +1.5%

01-02-2018 +1.5%

What is on tap for the rest of the week?=

Earnings:

Tues: UNH, CSX, C,

Wed: BAC, SCHW, GS, USB, AA

Thur: KEY, MS, AXP, IBM

Fri: FHN, SLB, SYF, STI

Econ Reports:

Tues: Empire

Wed: MBA, Industrial Production, Capacity Utilization, NAHB Housing Market Index, NET Long term TIC Flows

Thur: Initial, Continuing Claims, Housing Starts, Building Permits, Phil Fed

Fri: OPTIONS EXPIRATION

Int’l:

Tues –

Wed – CN: Housing Price Index, GDP, Industrial Production, Retail Sales,

Thursday –

Friday-

Sunday –

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

How am I looking to trade?

AAPL – 02/01 AMC

AOBC – 03/01

BAC – 01/17 BMO

BIDU – 2/22

C – 01/16 BMO

DHI – 01/31 BMO

DIS – 02/06 AMC

F – 01/24

FB – 01/31 AMC

FCX – 01/25 BMO

MO – 01/31

KMX – 04/04 BMO

SODA 02/14

V – 02/01 AMC

ZION – 1/22 AMC

https://www.cnbc.com/2018/01/10/buffetts-cryptocurrency-predictions-are-scary-heres-how-to-cope.html

If you own bitcoin, Buffett’s cryptocurrency predictions are scary. How to cope

- When you could lose 30 percent of your investment in one day, stress seems inevitable.

- This unique asset requires unique fortitude.

Published 10:42 AM ET Wed, 10 Jan 2018

Updated 2:48 PM ET Wed, 10 Jan 2018CNBC.com

Billionaire investor Warren Buffett says cryptocurrencies are headed for trouble.

“We’ll never have a position in them,” Buffett, chairman and CEO of Berkshire Hathaway, told CNBC’s “Squawk Box” Wednesday morning. “I can say with almost certainty that they will come to a bad ending.”

If those ominous words aren’t enough to stress investors out, earlier this week, the popular cryptocurrency ripple plunged almost 13 percent and bitcoin shed nearly 8 percent of its value.

Owning an asset that’s been called both a fraud and the future can be an emotionally intense experience.

When bitcoin lost 30 percent of its value on Dec. 22, for example, one post on Reddit read: “I just re-financed my house to get in. I’m freaking out.” Another user offered support to the frantic: “If anyone’s actually depressed or suicidal, come to r/SuicideWatch. We love to listen and talk there.”

It’s the 24-hour cycle of cryptocurrencies that can wear on people’s nerves, said Jim Smigiel, CIO of absolute return strategies at SEI Investments Co.

“With other speculative investments, like private equity and venture capital, you can’t check your phone every five minutes,” he said. With cryptocurrencies, “You’re able to track the minute-by-minute value of it.”

“Looking at something with such high volatility all the time is not conducive to an investor’s mental health,” Smigiel said.

Here’s how to keep calm on the cryptocurrency roller coaster:

Look away

Bitcoin’s volatility is part of what makes it irresistible, said Willemien Kets, associate professor at the University of Oxford’s Department of Economics.

“We know from social psychology that the best way to get people hooked on something is to give them a reward on a very uncertain time frame,” Kets said.

Don’t fall into the trap. Checking the value of cryptocurrencies constantly is unproductive, Kets said.

“You can’t do anything about the price movement itself,” she said.

Instead she recommends people decide on a price point at which they’ll sell — say, if the asset drops below $10,000 — and set their phone to alert them at that threshold.

Jack Tatar, co-author of “Cryptoassets: The Innovative Investor’s Guide to Bitcoin and Beyond,” pointed to another reason why constant phone checks are futile.

“It’s very hard to realize the gains you see on your phone,” Tatar said. “These markets are not as liquid as the stocks and bond market. You can check your phone and see you’re up to $30,000, but if you wan’t to realize that gain, you probably won’t be able to do that.”

That’s because it can take days for a cryptocurrency transaction to complete, during which the value can change substantially. Despite his advice, Tatar admitted he, too, can’t look away.

“My son has tried to tell me to take a few days off,” he said. “But I just can’t.”

Buy to hold

When people buy and sell in a dizzied cycle, they miss the bigger picture of cryptocurrencies and the blockchain technology on which it’s traded, said financial advisor Ric Edelman, founder and executive chairman of Edelman Financial Services.

“There’s no question that digital currencies are the future,” Edelman said. “You should be prepared to own it for years.”

He said his decision to hold bitcoin for more than a decade has paid off.

“I’ve watched it go from $1 to $1,000, back to $200 and then to $16,000,” he said.

Although he acknowledged that such ups and downs are intolerable for some people.

“If owning this asset is causing you to stare at the ceiling at night, you shouldn’t own it,” he said. “There’s more to life than money.”

“I’ve watched it go from $1 to $1000, back to $200 and then to $16,000.”-Ric Edelman , financial advisor

Peter Ayton, who studies behavioral decision theory at the City University of London, said it’s hard to expect people to be rational with cryptocurrencies. Many people who’ve been seduced by bitcoin are individuals who might not fully understand what they’re buying, he said.

“When you have something as volatile as bitcoin, it doesn’t lend itself to long-term strategic thinking,” Ayton said.

Diversify beyond bitcoin

Michael Sonnenshein, investments director at cryptocurrency firm Grayscale, said people might be less anxious if they’re not banking on just one cryptocurrency.

Fortunately, you don’t have to: There are currently some 2,000 cryptocurrencies to chose from. And more investment firms are looking into establishing index funds for cryptocurrencies. For example, Grayscale is soon launching a “basket of digital currencies,” in which investors’ money will be spread across five digital currencies.

Diversifying is useful for another reason, Edelman said: “It’s so early, we don’t know which cryptocurrencies will survive.”

Invest only what you can afford to lose

Tatar said people must restrict how much of their investments go to cryptocurrencies.

“You’re seeing too many people jumping in and betting the ranch, and just saying ‘yee-haw!'” he said. “They’re not disciplined enough to realize they have to stay within their asset allocation models.”

“Re-balancing” your investments is essential with cryptocurrencies, he said, because of their tendency to rapidly change value.

“If you’ve invested 20 percent of your portfolio into bitcoin, and all of a sudden you check and, lo and behold, your bitcoins have increased so much that they’re now 35 percent of your portfolio, you can rebalance and go back to your asset allocation,” Tatar said. “That should protect you from some of that volatility.”

“You’re seeing too many people jumping in and betting the ranch, and just saying Yee-Haw!”-Jack Tatar , co-author, Cryptoassets: The Innovative Investor’s Guide to Bitcoin and Beyond

It’s not just the owners of cryptocurrencies who are stressed, Smigiel said. Recently, he finds himself consoling his clients who haven’t bought any bitcoin, ripples or ethereum.

“We also see anxiety on the flip-side — the people who feel they are missing out,” he said. “And so you’re anxious either way.”

https://www.cnbc.com/2018/01/10/the-fed-worrying-about-the-next-recession-considers-changes.html

The Fed, worrying about the next recession, considers changes

- More and more, Fed officials are beginning to think seriously about a dramatic change to monetary policy that would revise or even scrap its current, flailing 2 percent inflation target.

- Economist Larry Summers notes that the Fed typically has lowered interest rates by 5 percentage points over time to stimulate the economy in recessions, but it doesn’t have 5 points now.

- The solution gaining the most traction and mention by officials and academics is called “price-level targeting.”

Published 12:00 PM ET Wed, 10 Jan 2018 Updated 3:06 PM ET Wed, 10 Jan 2018CNBC.com

Even while the economy and markets are booming, Federal Reserve officials are worrying about how they’ll respond to the next recession, and they don’t especially like the picture they see.

It’s one where the economy starts contracting but the Fed, still at a low interest rate, has little ability to respond. It lowers rates to zero but that amounts to only a fraction of the stimulus it has provided in past downturns. Once again, the Fed faces the quandary of what more it can do when it’s at zero and can’t cut anymore and is forced to contemplate extraordinary, uncertain and controversial measures like quantitative easing.

More and more, Fed officials and academic economists are wondering if there’s a better way and beginning to think seriously about a dramatic change to monetary policy that would revise or even scrap its current, flailing 2 percent inflation target.

The Fed has missed that target almost since it was implemented in 2012, undermining its credibility in markets and possibly entrenching expectations that inflation will always run below target.

Former Treasury Secretary Larry Summers, speaking at a Brookings Institution conference this week on the Fed’s inflation target problem, urged the Fed to get moving on a fix. He noted that the Fed typically has lowered interest rates by 5 percentage points over time to stimulate the economy in recessions. The Fed doesn’t have 5 points now, so the next recession will find the central bank less able to kick-start growth, possibly enabling a longer, deeper downturn.

Source: Larry Summers

“The overwhelming likelihood is that when recession comes, policy will not have sufficient room to cut rates as much as it would like to within the current framework,” Summers said.

Quoting a recent research paper, Summers suggested the Fed could be at a zero interest rate 30 to 40 percent of the time in the future unless it changes its current regime. “I am completely unconvinced that (quantitative easing) can be our salvation next time around,” Summers said.

Out of fiscal bullets as well?

The recent tax bill, which boosted the deficit outlook, means the fiscal side will have less ability to respond next time around as well.

The solution gaining the most traction and mention by officials and academics is called “price-level targeting,” and at least three Fed officials in recent weeks have talked about it, though with varying levels of support. Currently, Fed policy calls for the Fed to hit a 2 percent inflation target over time. It continues to shoot for that inflation rate even while it continuously misses that goal.

Price-level targeting would ratchet up the seriousness of the effort. It would account for those past misses and prompt the Fed to aim for a higher target in the future to make up for its prior shortcomings. The belief is that this would convince markets and consumers of the Fed’s commitment, running a higher inflation rate to account for prior gaps.

“The price-level target will keep rates lower for longer,” San Francisco Fed President John Williams said at the Brookings conference. Williams has been among the most outspoken advocates of making the change.

Over time, it’s hoped that a price-level target would keep the Fed away from zero, giving the policymakers ammunition to fight the next recession.

Cleveland Fed President Loretta Mester spoke last week on several changes, including price-level targeting, saying the Fed could consider changes to its inflation target, but she was careful not to advocate any single solution.

“Each framework is worthy of further study, and now may be an appropriate time to undertake such study because the economy is growing, labor markets are strong and inflation is projected to move back to our goal,” Mester said.

Boston Fed President Eric Rosengren also advocated discussion of the topic, noting the Fed’s persistent failure to hit its target.

“The Great Recession was a big enough event that we might want to reassess and say, “How do we make sure we don’t have those kinds of events?” he said at Brookings.

There’s little conviction that price-level targeting or any of the alternatives is a silver bullet. Some wonder why the Fed, if it can’t hit its inflation target, will be able to hit a price-level target. By advocating higher inflation for a time, there’s concern that the Fed will introduce more volatility to both inflation and growth.

And practically speaking, any change is a long way off. Fed Chairman nominee Jerome Powell hasn’t been approved yet by the Senate, though he’s supposed to start his term in three weeks. Former Fed Chairman Ben Bernanke, an advocate of a variant of price-level targeting, says the new chairman will likely appoint a committee to discuss the issue and the debate could take a year to 18 months.

“Somewhere in 2019 there will be some pretty serious discussions,” Bernanke said.

At the slow pace that the Fed changes policy and regimes, if it wants to change something in two years, it better begin talking about it now. But no one can say if that change will take place in time for the next downturn.

Legendary investor Bill Miller: Market could be headed for a ‘melt-up’ of 30%

- “Those 10-year yields go through 2.6 percent and head towards 3 percent, I think we could have the kind of melt-up we had in 2013, where we had the market go up 30 percent,” said Bill Miller, the founder of Miller Value Partners.

- The 10-year U.S. Treasury yield rose to 2.53 percent on Tuesday and hit its highest level since March.

- Miller is considered one of the best investors ever, after beating the market for 15 years in a row while working at Legg Mason.

Published 4:53 PM ET Tue, 9 Jan 2018 Updated 6:30 PM ET Tue, 9 Jan 2018CNBC.com

Worried about higher interest rates putting a dent on the stock market’s rip-roaring rally? Fear not, a rise in rates will actually help stocks, according to legendary investor Bill Miller.

“Those 10-year yields go through 2.6 percent and head towards 3 percent, I think we could have the kind of melt-up we had in 2013, where we had the market go up 30 percent,” Miller, the founder of Miller Value Partners, told CNBC’s “Closing Bell” on Tuesday. “If we can get the 10-year towards that 3 percent level, you’ll see the same thing.”

“In 2013, people finally began to lose money in bonds. They took money out of bond funds and put it into equity funds,” Miller said.

Miller is considered one of the best investors ever, after beating the market for 15 years in a row while working at Legg Mason.

Stocks have been on a rip-roaring rally for more than a year, as economic data and corporate earnings have improved. On Tuesday, they closed at fresh record highs. But some experts fear the improvements in the economy could force the Federal Reserve to tighten monetary policy faster than they forecast, thus pushing interest rates higher.

The 10-year U.S. Treasury yield rose to 2.55 percent on Tuesday and hit its highest level since March.The yield has not traded above 3 percent since early 2014. It last traded above 2.6 percent last March.

But Miller thinks the stock market could get another boost from lower corporate tax rates. President Donald Trump signed a bill in December that slashed the corporate tax rate to 21 percent from 35 percent.

“The tax cuts are probably partly in the market, but maybe not wholly in the market because we’re seeing things like companies raising the minimum wage, giving bonuses,” he said. “The people that are getting those $1,000 bonuses probably have a marginal propensity to consume of 99 percent.”

Miller also said he likes airline stocks like Delta Air Lines given their lower valuations compared to other sectors of the market. “The valuations are not demanding,” he said. The investor added he still likes bank stocks.

HI Financial Services Mid-Week 06-24-2014