RECORDING Market Commentary 03-09-2016

HI Financial Services Commentary 03-09-2016

What do you do when you don’t understand what’s going on in today’s stock market?

Get out of Dodge and most likely book a loss !!!!!!!!!!!!!!!!!!!!!!!

Trade Small – ie… use less contracts / $$$$

Look at the different scenarios as they could play out with your portfolio

Make sure you have protection and wait it out

Look for opportunities

SO….. Remember I trade with my wife’s risk tolerance

I built up a portfolio spread trading in a ridiculously bullish market from 2006 to the end of 2007

AND then I went strictly to collar trades

THEN I use the big credits on the short call to create spread trades within the collar (S/S, extra-long positions, Ratios)

Worried about stocks? Don’t watch so much: Buffett

If investors are worried about their retirement savings after watching 2016’s wild market fluctuations, Warren Buffett has some advice.

“I would tell them don’t watch the market closely,” the Oracle of Omaha said. The billionaire and philanthropist who has amassed a fortune of more than $64 billion tells CNBC’s “On The Money” that buy-and-hold is the best strategy.

“The money is made in investments by investing,” Buffett said in a recent interview, “and by owning good companies for long periods of time. If they buy good companies, buy them over time, they’re going to do fine 10, 20, 30 years from now.”

Despite a whipsaw market unnerved by everything from China’s economy to the Federal Reserve’s interest rate policy warns individual investors against making a lot of stock moves with their portfolio.

“If they’re trying to buy and sell stocks, and worry when they go down a little bit … and think they should maybe they should sell them when the go up, they’re not going to have very good results,” Buffett said.

Now in his 51st year of leading Omaha-based conglomerate Berkshire Hathaway, Buffett is frequently ranked among the world’s wealthiest men, which include Microsoft’s founder Bill Gates and Mexican entrepreneur Carlos Slim Helu.

Berkshire Hathaway owns more than 80 businesses, including household staples like Dairy Queen, GEICO, Fruit of the Loom and Benjamin Moore. The conglomerate also has major stakes in giants likeIBM, American Express, Coca-Cola and Kraft Heinz.

In looking for companies to invest in, Buffet used the following example: “If you had a chance to buy into a good company in your hometown … and you knew it was a good company and knew good people were running it, and you bought in at a fair price, you wouldn’t want to get a quote every day.”

Instead of frequently checking a stock’s price, “you’d look to the earnings and dividends over the years as determining whether you made a good investment or not. And that’s what people should do with stocks.”

Publicly traded shares are “little pieces of businesses. And the businesses are generally pretty darn good.”

Time is usually your friend

Market down ytd and DIS, AAPL, BIDU, NVDA, F have been added to accounts

What’s happening this week and why?

Consumer Credit 10.5B vs est 16.5 B

Wholesale Inventories .3 vs est -0.2

Uncertainty on the ECB and more stimulus !!!

Uncertainty in China??? Import and Exports were horrible

Little to no US economic reports

In fact the political delegates for the primaries are running the show

Where will our market end this week?

Higher

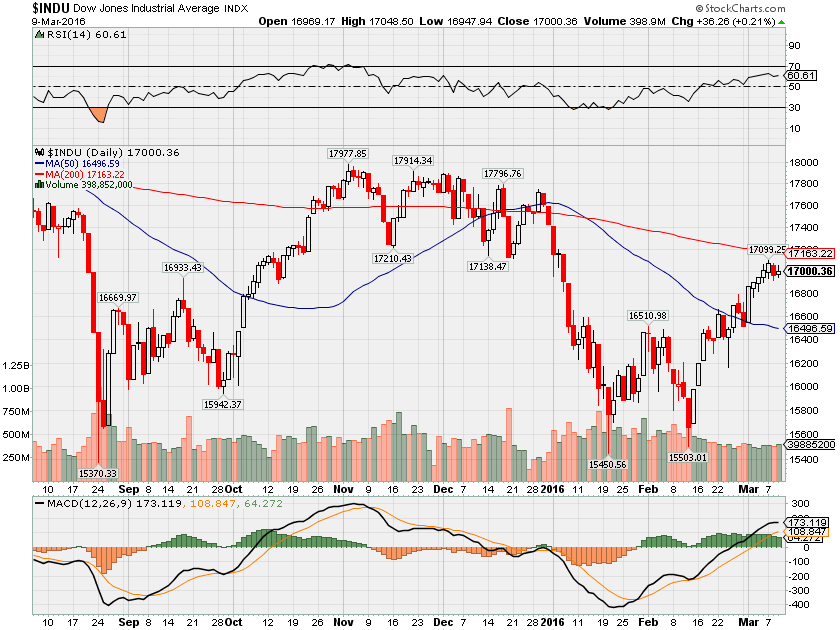

DJIA – Technically Bullish but we are running up against the 200 SMA

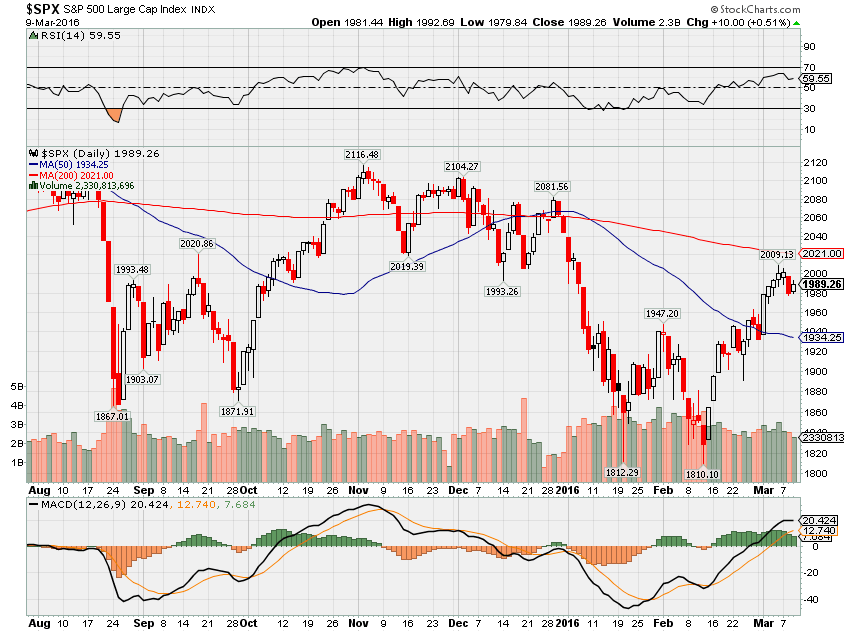

SPX – Technically Bullish and running up against the 200 SMA

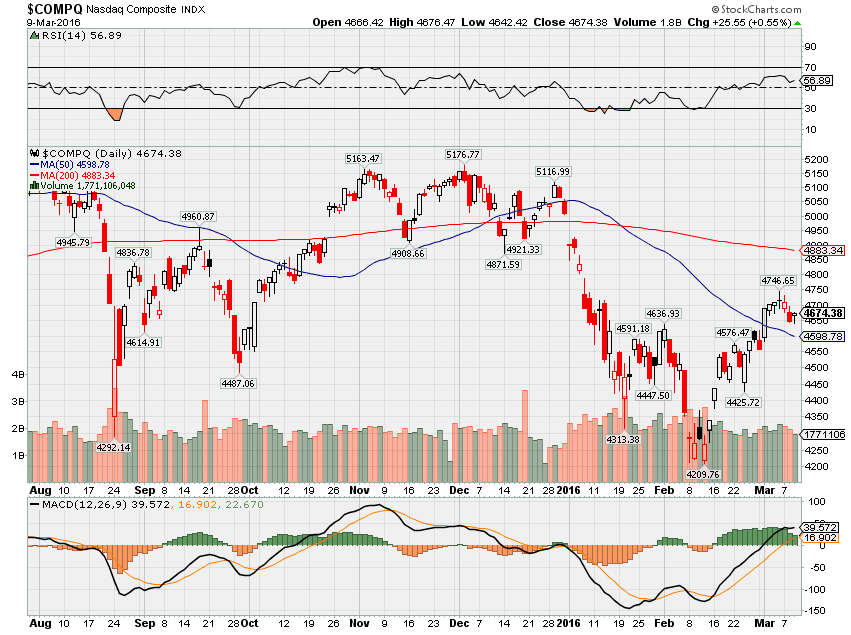

COMP – Technically Bullish and in no man’s land for the next leg up or down

Where Will the SPX end March 2016?

03-09-2016 +4%

03-01-2016 +4%

What is on tap for the rest of the week?=

Earnings:

Tues: DKS, DRYS, LINE, PNY, ZAGG

Wed: EXPR, SQ

Thur: DG, LOCO, INP, MED, SMRT, MTN

Fri: KIRK

Econ Reports:

Tues:

Wed: MBA, Wholesale Inventory, Crude

Thur: Initial, Continuing Claims, Treasury Budget

Fri: Import, Export

Int’l:

Tues – DE: Industrial Production, EMU: GDP

Wed – CN: CPI, PPI

Thursday – FR: Industrial Production

Friday –

Sunday – CN: Industrial Production, Retail Sales, JP: Machine Orders

How I am looking to trade?

AAPL shares with April 110 short call

BIDU 155/160 or 165 bull put and 200 Jun Short Calls

DIS with 95 and/or 92.50 long puts

NFLX, F, ZION, SNDK, NVDA, Shares

FB, V in collars

BABA I have 90 March Long puts and $110 April short calls

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Ford: Trying To Be Big In This Growth Market

The Potential Disney Stock Catalyst Nobody Saw Coming

How To Short Apple Acceptably

http://seekingalpha.com/article/3956609-read-short-apple#alt1

Lynn Tilton’s $2.5B credit funds have new manager

http://www.cnbc.com/id/103447088

Ford: This Key Growth Driver Will Lead To Better Times

Today’s Apple Products Are Absurd

Facebook Vs. The World

HI Financial Services Mid-Week 06-24-2014