RECORDING Market Commentary 03-15-2016

HI Financial Services Commentary 03-15-2016

What do you do when you don’t understand what’s going on in today’s stock market? – PART II

What is the end game for your trading?

When I started it was to tons of money = Millions of Dollars Years 2006-2007

Then When I had what I deemed “enough for emergencies, ie pay off a house” is it came to the point I wanted to protect what I had gained. (end 2007 to 2009)

That I quite a 9 to 5 Job and I was trading to not have to work again (2009 to today)

Which turned into a business trading (2009 to today)

Right Now I’m in the market for the financial freedoms successful trading offers – TODAY

What are those freedoms = For me my time is my time which means = take kids to school, show up at their school for events, coach the kids in sports, get out to visit my dad with cancer AND most recently stay in the hospital with my brother who has lung cancer and will have a lung removed next week.

NOW: SPX remains NEUTRAL as the index consolidates at resistance around its 200DMA and November lows.

- SPY has support between $201 and $201.30, the highs of March 10 and March 4.

- The next next area of support around $199.50, the close from March 10 and an intraday consolidation zone during the two previous sessions.

- Resistance is around $202.40 to $202.50. This is near an intraday support zone from Friday afternoon and also matches Monday’s close.

- The next clear line of resistance is $204, the lows from February and July.

We think that current conditions are unfavorable for trading the index because positive and negative factors are evenly balanced:

- BULLISH FACTORS: Shorter-term momentum is very BULLISH, with the 5,10,20, and 30DMAs rising and in proper sequence.

- BEARISH FACTORS: The longer-term 50, 100, 200DMA are falling and remain in BEARISH sequence, with the 50 under the 100, and the 100 under the 200DMA.

- OVERBOUGHT: The index is 4.5% above its 50DMA, near the top of the longer-term band. We think the SPX needs to retest its rising 50DMA at some point in the next 1-3 months.

The calendar is also a major issue with the Fed and several other key data points tomorrow. We think this complicates trading the index and believe that it’s a better time to focus on individual stocks — especially those with unusual option activity. We see little upside potential in the near-term given how much it has run and the fact it’s already pushing resistance. However, the rising 10DMA precludes getting short yet.

GAME PLAN: Premarket trading has SPY around the $201.30 support level. There could be a small bounce from here, but we think it’s better to target a drop toward the early-March support zone around $199.50 to buy the index. We like individual stocks more than the index.

CALENDAR: Retail sales and PPI were mostly inline today, but the Empire manufacturing index unexpectedly rose above 0 on strong orders, shipments and outlook. While Empire often diverges from broader data points, this positive surprise fits into a pattern of improvement we, along with Jack Welch, have cited. It also comes the same day that MS strategists cut their S&P 500 outlook on increased recession fears. We continue to question Wall Street’s read on the economy and believe that erring on the side of BULLISHNESS will profit investors. NAHB’s housing market index at 10 a.m. ET could have some impact on homebuilders and related stocks. We also have major political primaries today.

- Tuesday: Retail sales, Empire index, NAHB, Political primaries. Key earnings: | ORCL

- Wednesday: Mtg apps, CPI, housing starts/building permits, IP/CapUtil, oil inventories, FOMC. Key earnings: | FDX CTRP WSM SLW

- Thursday: Jobless claims, Philly Fed. Key earnings: | ADBE

- Friday: Dudley & Rosengren of Fed, consumer sentiment. Key earnings: TIF |

LONG TERM VIEW: Our longer-term view is NEUTRAL but believe the broader picture is increasingly positive.

- SPX is in a range between 1812 and 2130.

- Long-term momentum is neutral, with SPX range bound and moving averages convoluted.

- We believe the economy is accelerating and will surprise to the upside, which increases the likelihood of the SPX hitting new highs this year.

- We believe SPX will pull back to a rising 50DMA before breaking out to new highs, so are waiting for that opportunity to buy more aggressively.

If we do break the bottom of this range, the Feb 2014 low around 1730-1740 is the next likely support.

What’s happening this week and why?

Nothing right now as we wait for the FOMC Rate decision and then you might get the bounce up on hopium

Where will our market end this week?

Higher – No rate hikes for “a considerable” amount of time

DJIA – Broke above the 50 SMA Bullish

SPX – Technically bullish with resistance at the 200 SMA

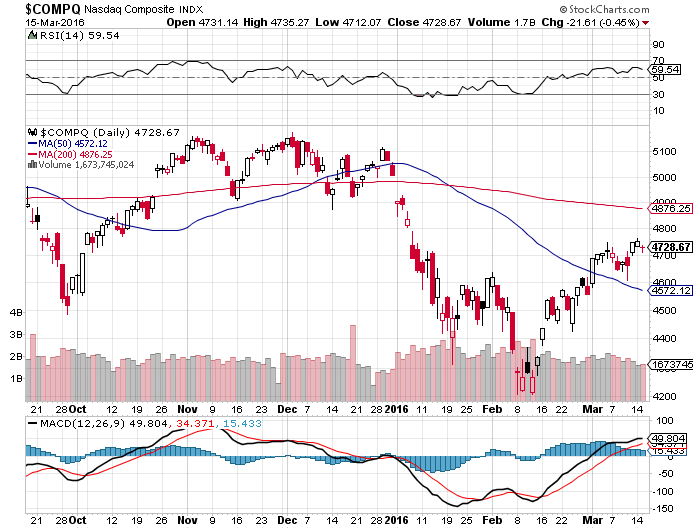

COMP – Bullish but is no-man’s land right now

Where Will the SPX end March 2016?

03-15-2016 +4%

03-09-2016 +4%

03-01-2016 +4%

What is on tap for the rest of the week?=

Earnings:

Tues: JASO, ORCL

Wed: JBL, FDX, GES

Thur: ADBE, ARO

Fri: TIF

Econ Reports:

Tues: Retail Sales, Retail ex-auto, PPI, Core PPI, Empire, Business Inventories, NAHB Housing, Net Long Term TIC Flows

Wed: MBA, Crude, CPI, Core CPI, Housing Starts, Building Permits, Industrial Production, Capacity Utilization, FOMC Rate Decision,

Thur: Initial, Continuing Claims, Phil Fed, Leading Indicators, Current Account Balance

Fri: Michigan Sentiment OPTIONS EXPIRATION

Int’l:

Tues –

Wed – JP: Merchandise Trade

Thursday – EMU: HICP, JP: BOJ Minutes

Friday –

Sunday –

How I am looking to trade?

AAPL shares with April 110 short call

BIDU 155/160 or 165 bull put and 200 Jun Short Calls

DIS with 95 and/or 92.50 long puts

NFLX, F, ZION, SNDK, NVDA, Shares

FB, V in collars

BABA I have 90 March Long puts and $110 April short calls

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

| Apple: Go Cheap, Go India |

http://seekingalpha.com/article/3957893-apple-go-cheap-go-india

Apple’s March Event: Bad Timing

http://seekingalpha.com/article/3957446-apples-march-event-bad-timing

50/20/30 Rule in where your Income Goes

https://www.learnvest.com/lp/how-to-budget-your-money-with-the-502030-guideline/?utm_source=taboola&utm_medium=paidcontent&utm_campaign=502030mobile&utm_content=surfer

Apple: Where Are The Shorts?

Morgan Stanley sees 30% risk of world recession

http://www.cnbc.com/id/103467547

Disney: The Entertainment Company That Keeps Growing And Growing

1 comment

I’m gone to tell my little brother, that he should also

pay a visit this web site on regular basis to take updated

from most up-to-date news update.