HI Financial Services Commentary 04-19-2016

What is the most common investor mistake? Trading – getting in and getting out at all the wrong times, for all the wrong reasons. Kenneth Fisher

What solves the timing problem in trading? Collar Trading

I can honestly say I’ve never missed and up day in the stock market,

ANYTHING I make on the way down is a profit as stocks come back up

YES the long put allows me to sleep at night knowing I can’t lose everything when the stock market is closed

So I started out today looking at the stock market and trying to figure what the heck was going on.

How did our market recover with 5 quarterly earnings for the S&P being negative?

All the free money from the Fed has filtered thru the system.

There are still major outflows from funds, low to no interest in bonds or treasury investments.

Junk bonds recovered for some unexplainable reason

Short covering can’t bring the market back 12% ‘

Valuations are stretched and at the high end of the range right now

i did not fully get

“Don’t forget it is a tax break FOR 70% of the GDP since it is made of consumer spending”. could you pls explain in tomorrow’s session ?

What’s happening this week and why?

105 S&P 500 companies have earnings this week – Headline Driven

Earnings are beating on the top line (EPS) and missing on the bottom line (Revenues)

Weak Guidance for the most part

Hope for the ECB announcement Wednesday Night

Next week we have the BOJ Announcement

NAHB Housing Market Index 58 ve est 59

VIX bounces as it hit 13 which it is at right now

Building permits 1086 vs est 1200

Housing starts 1089 vs est 1170

Last week we had 8 fed chairs included Yellen speak and it was a mixed bag

Where will our market end this week?

Up Slightly

DJIA – Technically Bullish, broke above the cup handle pattern, Slightly Over-bought and MACD is flat

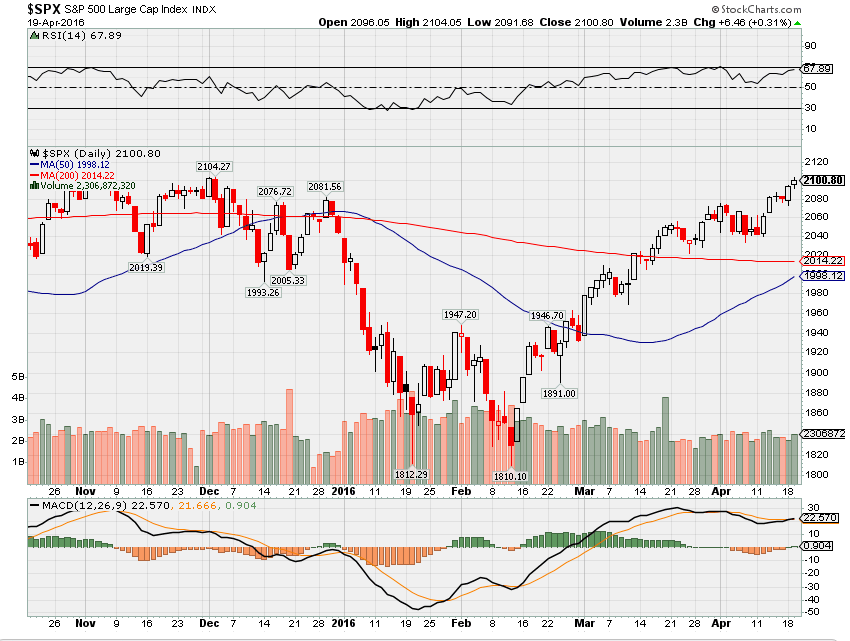

SPX – Same as DJIA but we held the 2100 level

RECORDING Market Commentary 04-19-2016

RECORDING Market Commentary 04-19-2016

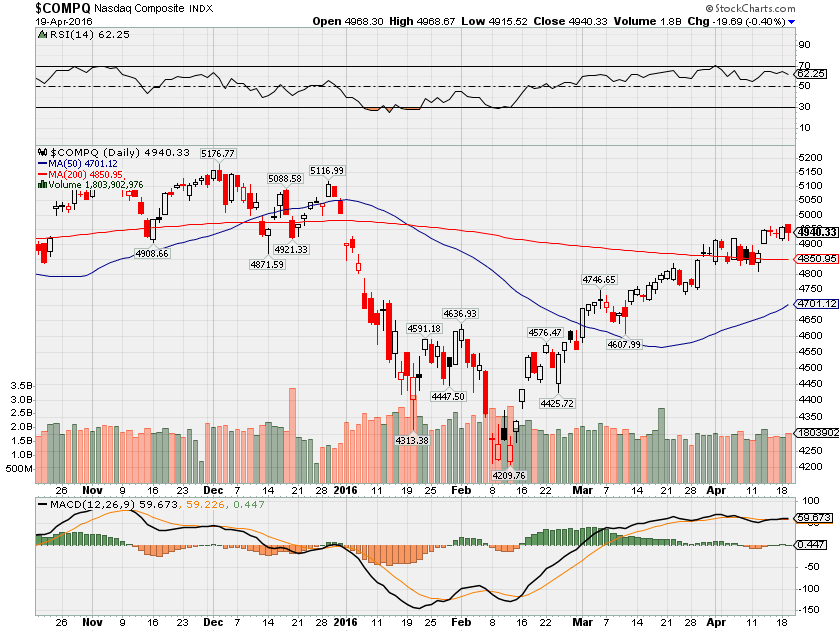

COMP – Bullish, breakout of cup and handle MACD Flat

Where Will the SPX end April 2016?

04-19-2016 +2.5%

04-13-2016 +2.5%

04-06-2016 +2.5%

What is on tap for the rest of the week?=

Earnings:

Tues: DFS, DOV, GS, HOG, INTC, ISRG, JNJ, PM, VMW, YHOO

Wed: ABT, AXP, KO, EMC, FFIV, LVS, MAT, NEM, QCOM, USB, VMI, YUM

Thur: AMD, ALK, GOOGL, SAM, DHI, GM, JCI, MSFT, SLB, LUV, SBUX, UA, V

Fri: CAT, GE, HON, KMB, MCD

Econ Reports:

Tues: Building Permits, Housing Starts

Wed: MBA, Crude, Existing Home Sales

Thur: Initial, Continuing Claims, Phil Fed, FHFA Housing Price Index

Fri:

Int’l:

Tues – JP: Merchandise Trade

Wed –

Thursday – EMU:ECB Announcement, JP: PMI Manufacturing Index Flash

Friday – DE:FR:EMU: PMI Composite Flash

Sunday –

How I am looking to trade?

Prepared for earnings and thinking of rolling up the Long Puts to protect at a higher strike price

Questions???

www.myhurleyinvestment.com = Blogsite

HI Financial Services Mid-Week 06-24-2014