HI Financial Services Commentary 08-08-2017

You Tube Video to Watch the Chat: https://youtu.be/lmJsOv9fJ6Q

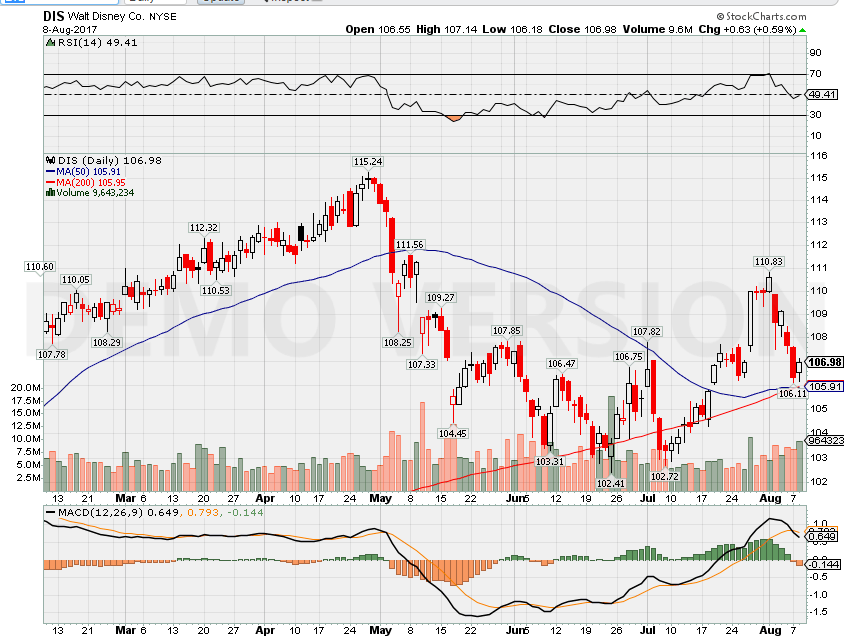

DIS missed on Revenue but beat on EPS.

Media took a huge hit today and they are down $4.06 after hours (3.8%) sitting at $102.92

Support at $100, $94 then $88 so why am I excited to see DIS heading back down

What’s happening this week and why?

Earnings and stocks (DJIA) = 30 stocks only have been on a ten day tear

Where will our market end this week?

Lower because Media and Retail sales finish up the week

DJIA – Bullish and Overbought

SPX – Bullish

COMP – Bullish

Where Will the SPX end August 2017?

08-08-2017 +2.0%

08-01-2017 +2.0%

What is on tap for the rest of the week?=

Earnings:

Tues: CVS, JLED, FOSL, HTZ, GDDY, MNST, PCLN, ZG, DIS

Wed: JMBA, CROX, ODP, WEN, JACK, NTES

Thur: DDS, KSS, M, NDLS, JWN, NVDA

Fri: JCP

Econ Reports:

Tues: JOLTS

Wed: MBA, Productivity, Wholesale Inventory, Unit Labor Costs

Thur: Initial, Continuing Claims, PPI, Core PPI

Fri: CPI, Core CPI

Int’l:

Tues –

Wed – JP: Machine Orders, PPI

Thursday –

Friday –

Sunday – JP: GDP, CN: Industrial Production, Retail Sales

How I am looking to trade?

COST and why didn’t I get out at $159

Because they’ve bounced back to $157.75

Because I have until June 2018

Because my first exit point is at a 50% to 75% profit

Earnings List:

AOBC 9/7 est

C 10/12 BMO

CLX 8/3 BMO

DIS 8/8 AMC

NVDA 8/10 AMC

COST 10/5 AMC

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Warning: A correction in the market is “inevitable” and there are three key factors that could spark chaos on Wall Street, according to James Advantage Fund president Barry James.

The investor likened the market to Yellowstone National Park’s famous supervolcano, which many believe is close to eruption. Stocks continued to hit record highs on Friday, with the Dow Jones Industrial Average setting its 8th consecutive all-time high.

“Even though [the market] looks beautiful—setting new highs, good momentum, and earnings have been coming in strong, [there are] things to worry about,” explained the portfolio manager recently on CNBC’s “Futures Now.”

Aside from the rise of passive investing, which James says is creating a “herd mentality” among investors, he also believed that the earnings picture isn’t telling the whole story.

“In the 18 months ending in June, we saw companies that had no earnings, they were losing money, outperform those that were making money,” said James. He highlighted many stocks’ performances this year may not be reflective of their revenues.

But the biggest threat to the market rally, according to James, is the current valuation levels of stocks.

“We went back to 1994 and researched team data that said [that if we look at cyclically adjusted P/E, one out of two times] the market was down in the next 12 months, and about one out of three times it was down more than 10 percent,” he said.

James’ observations seem to mirror a note released more than a week ago by Goldman Sachs, which found that when valuations have been this high, 10-year returns on the S&P 500 have been either in the single digits or negative 99 percent of the time.

In other words, the market could be in oversold territory, which James does believe.

“It doesn’t mean that we’ll see a volcanic eruption in the immediate future, and these market peaks take a long time, but we’re definitely in the latter stages of this market advance,” he said. “We’re going to see the inevitable correction, I just wish I could say I knew when.”

Greenspan: Bond bubble about to break because of ‘abnormally low’ interest rates

- Former Fed Chief Alan Greenspan said “abnormally low” interest rates will break a bubble in the bond markets.

- Greenspan is famous for warning markets about “irrational exuberance” and the consequences it can bring.

Friday, 4 Aug 2017 | 8:07 AM ETCNBC.com

Former Federal Reserve Chairman Alan Greenspan issued a bold warning Friday that the bond market is on the cusp of a collapse that also will threaten stock prices.

In a CNBC interview, the longtime central bank chief said the prolonged period of low interest rates is about to end and, with it, a bull market in fixed income that has lasted more than three decades.

“The current level of interest rates is abnormally low and there’s only one direction in which they can go, and when they start they will be rather rapid,” Greenspan said on “Squawk Box.”

That low interest rate environment has been the product of current monetary policy at the institution he helmed from 1987-2006. The Fedtook its benchmark rate to near zero during the financial crisis and kept it there for seven years after.

Since December 2015, the Fed has approved four rate hikes, but government bond yields remained mired near record lows.

Greenspan did not criticize the policies of the current Fed. But he warned that the low rate environment can’t last forever and will have severe consequences once it ends.

“I have no time frame on the forecast,” he said. “I have a chart which goes back to the 1800s and I can tell you that this particular period sticks out. But you have no way of knowing in advance when it will actually trigger.”

One point he did make about timing is it likely will be quick and take the market by surprise.

“It looks stronger just before it isn’t stronger,” he said. Anyone who thinks they can forecast when the bubble will break is “in for a disastrous” experience.”

In addition to his general work at the Fed, which also featured an extended period of low rates though nowhere near their current position, Greenspan is widely known for the “irrational exuberance” speech he gave at the American Enterprise Institute in 1996. The speech warned about asset prices and said it is difficult to tell when a bubble is about to burst.

Those remarks foreshadowed the popping of the dot-com bubble, and the phrase has found a permanent place in the Wall Street lexicon.

“You can never be quite sure when irrational exuberance arises,” he told CNBC. “I was doing it as part of a much broader speech and talking about the analysis of the markets and the like, and I wasn’t trying to focus short term. But the press loved that term.”

The bull market could continue forever’ — strategist Jim Paulsen outlines conditions

- The stock market “has an awful good gig going,” Jim Paulsen, chief investment strategist at Leuthold, says.

- The Dow was coming off its seventh straight record high ahead of Friday’s release of the government’s July employment report.

Matthew J. Belvedere | @Matt_Belvedere

Friday, 4 Aug 2017 | 8:01 AM ETCNBC.com

The stock market “has an awful good gig going,” with the economic recovery reaching all corners of the globe and U.S. inflation and interest rates still at historic lows, Leuthold Chief Investment Strategist Jim Paulsen told CNBC on Friday.

“We’ve got a fully employed economy, rising real wages. We restarted the corporate earnings cycle. We’ve got strong confidence among business and consumers,” he said on “Squawk Box.”

“The kick is we can do all of this without aggravating inflation and interest rates,” he said. “If that’s going to continue, I think the bull market could continue to forever.”

The Dow Jones industrial average was coming off its seventh straight record high, a second close above 22,000 and was on track for a positive week ahead of Friday’s release of the government’s July employment report.

“Ultimately the bull market does continue until we aggravate some inflation, and until we have to raise bond yields and interest rates some more,” Paulsen said.

“I think that’s going to happen eventually, but it doesn’t look like it’s going to happen anytime soon. So I think the bull probably continues through the end of this year,” he said.

While the Federal Reserve has raised rates twice this year — with about 50-50 odds of another hike in December ahead of the Friday jobs data — the cost of borrowing money remains at historic lows, which aids the economy and the stock market.

https://www.cnbc.com/2017/08/02/fed-balance-sheet-reduction-almost-always-ends-in-recession.html

The Fed’s about to try something that almost always has ended in recession

- The Fed has tried to reduce its balance sheet six times in the past, with five ending in recession, MKM Partners data show.

- The balance sheet stands at $4.5 trillion and is composed mostly of Treasurys and mortgage-backed securities.

- The Fed is expected to announce the beginning of a program to cut the size in September.

Wednesday, 2 Aug 2017 | 1:30 PM ETCNBC.com

The Federal Reserve‘s looming attempt to shrink its mammoth portfolio of bonds comes with an ugly track record: Virtually every time the central bank has tried it in the past, recessions have followed.

Over the past several months, the Fed has prepared markets for the upcoming effort to reduce the $4.5 trillion it currently holds of mostly Treasurys and mortgage-backed securities. The balance sheetballooned as the Fed sought to stimulate the economy out of its financial crisis morass.

The Fed has embarked on six such reduction efforts in the past — in 1921-1922, 1928-1930, 1937, 1941, 1948-1950 and 2000.

Of those episodes, five ended in recession, according to research from Michael Darda, chief economist and market strategist at MKM Partners. The balance sheet trend mirrors what has happened much of the time when the Fed has tried to raise rates over a prolonged period of time, with 10 of the last 13 tightening cycles ending in recession.

“Moreover, outside of the 1920s and 1930s, there is no precedent for double-digit annual declines in the balance sheet/base that will likely begin to occur late next year,” Darda said in a note.

Indeed, the Fed’s efforts have been unprecedented.

Three rounds of purchases through a program known as quantitative easing or, more colloquially, “money printing,” brought the balance sheet to his level. Recently revealed plans show how the Fed will scale back.

Since it began the balance sheet expansion, the Fed has reinvested the proceeds it gets from bonds each month to keep the size stable. In a program that is expected to be announced in September, the Fed will begin letting a specified size roll off each month and reinvest the rest. The roll-off target will be small and increase quarterly until it reaches $50 billion a month.

Current market expectations are that the Fed will keep rolling off proceeds until the balance sheet hits around $2 trillion to $2.5 trillion, a process that could take four or five years. Fed Chair Janet Yellen likes to say the process will be akin to “watching paint dry” and won’t be disruptive to markets.

However, skeptics question whether it will be so painless.

“Against this historical portrait, a pressing question arises: will credit markets and equity volatility remain quiescent moving into the second half of next year when balance sheet reduction and rate hikes — a double-barreled tightening — begin to move along at full force?” Darda said.

He believes that if the Fed follows a slow trajectory that is mindful of low inflation trends “then we think there will be nothing to worry about.” However, he cautions that the Fed may not have as much room to tighten policy as it thinks.

Markets generally seem to agree with Darda.

While Fed officials have indicated that one more rate hike this year is likely, traders give it just a 45.5 percent chance, according to the CME. Fed funds futures contracts imply a rate by the end of 2018 at 1.45 percent, which point to barely two rate increases between now and the end of next year.

By contrast, Fed projections released in June pointed to four moves during the same period.

Various economists, including a group calling itself Fed Up, are urging policymakers to increase their current inflation target from 2 percent and hold off on further rate hikes.

HI Financial Services Mid-Week 06-24-2014