HI Financial Services Commentary 08-29-2017

https://youtu.be/FURV-6FuNAE

Let’s talk this ridiculous market

Last night I send this email out to my clientele

Hello,

North Korea shot a missile over the edge of the country of Japan. Right now the futures are down 94 points and will most likely be down as much tomorrow. It all depends on the reaction of the United Nations, Asian Countries, and of course the tweets from Trump. Will this cause the US and Japan to abort their military exercises and go to war mode is a possibility. Who’s to say Trump won’t order the launch of some of our ballistic warheads into the state capital building in North Korea? We have some protection on, some have a little protection and some are just stock positions. We’ve had support levels hold but here are some stocks we may add protection to immediately tomorrow.

AAPL shares look good and right now are ok leaving the shares unprotected

AOBC shares are up in the futures tonight so buy more guns and camping equipment

BAC shares are down 20 cents and may get protection

BIDU is breaking the $220 level with no support until $200 so protection will be added immediately

C will get some short term protection

COST long options are out to Jun 2018 so we can wait it out

DIS has support at 102 and 101 so below $100 we will add protection

F looks good

FB has Protetion’

NVDA has Protection

SPY are ok with little protection

V has protection

ZION looks good and isn’t down with the futures tonight

I will be stuck to my computer and the TV tomorrow watching accounts as the situation unfolds. Feel free to call if you want to go over your portfolio. This time of year we normally have a 5% to 7% pullback but the market has been beating its historical performance so far. I will error on the side of protection instead of just hoping things change. Be prepared to see protection added to tomorrow to protect us through October as a minimum time frame.

Thanks,

Dow dropped 134 points to lows of the day

Consumer Confidence came in at 122.9 vs est 120.3

I sat for the first hour and waited for the e-mini future to clear out and then Consumer confidence came out the first half hour the market was open which beat handily

What’s happening this week and why?

North Korea and Harvey but tomorrow the week basically ends

Where will our market end this week?

Higher because retail investor interprets Ave Work week reports

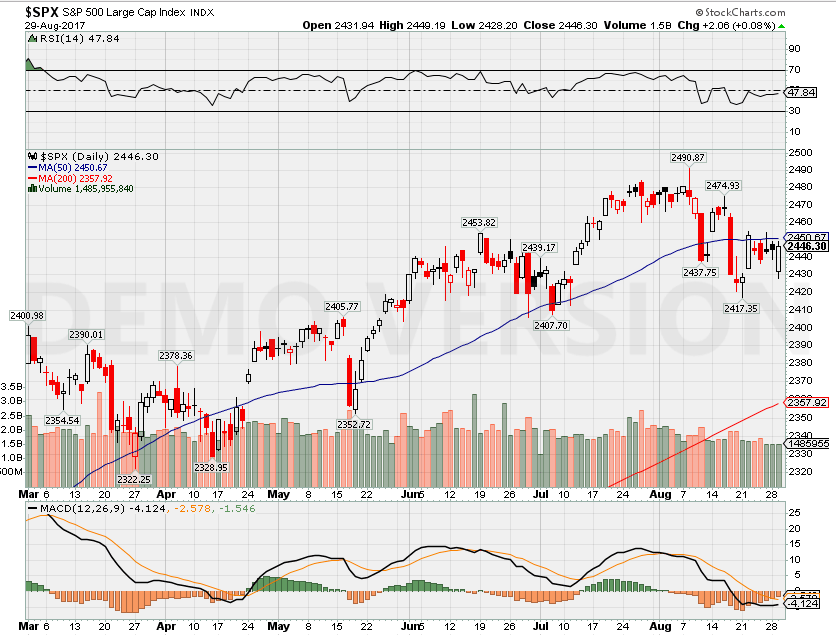

SPX – Bearish

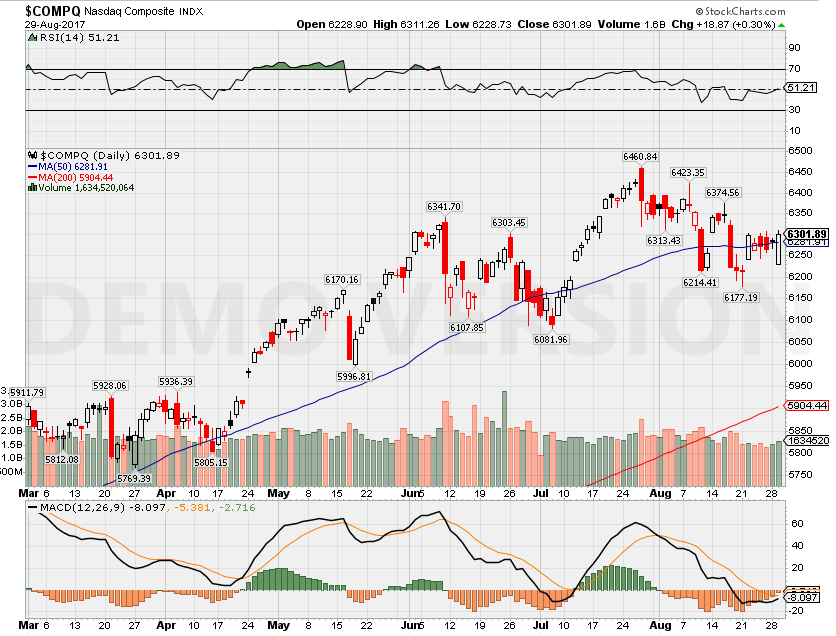

COMP – Bearish

Where Will the SPX end August 2017?

08-29-2017 -0.5%

08-22-2017 +1.0%

08-08-2017 +2.0%

08-01-2017 +2.0%

What is on tap for the rest of the week?=

Earnings:

Tues: BBY, HRB

Wed: CTRP, FIVE

Thur: DG, CPB

Fri:

Econ Reports:

Tues: Consumer Confidence, Case Shiller

Wed: MBA, ADP Employment, GDP 2nd Est, GDP Deflator

Thur: Initial, Continuing Claims, Challenger Job Cuts, PCE Prices, Personal Income, Personal Spending, Chicago PMI, Pending Home Sales

Fri: Ave Workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment Rate, ISM Index, Consumer Spending. Michigan Sentiment. Auto, Truck

Int’l:

Tues –

Wed – CN: CFLP Manufacturing PMI

Thursday – CN: PMI Manufacturing Index

Friday –

Sunday –

How I am looking to trade?

I added another long call when the drop happened off the 200 day SMA.

Earnings List:

AOBC 9/7 est

C 10/12 BMO

COST 10/5 AMC

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Apple’s September 12 Event Faces Headwinds From The East

Aug. 29, 2017 1:09 PM ET

Summary

Added risk heading into iPhone launch event, as the entire component supply chain in Asia could be at risk.

Surveys suggest 40-50mn in demand given price elasticity curve according to Barclays.

Production delays have yet to be resolved, whereas market volatility is very common in the month of August and September.

Investors should assess the stock on the sidelines, as there’s not enough supportive commentary heading into the event.

Furthermore, we explore some ways to hedge exposure to hardware/semiconductor stocks via aerospace, as defense contractors seem better positioned in the coming weeks.

Apple (AAPL) is set to unveil its next-generation iPhone 8 on September 12, 2017. While the stock typically exhibits momentum in this sort of unveiling, and sells on the news. We’re now seeing a pattern of broad weakness in the tech sector among momentum names, and quality growth stocks as well.

Much of the component supply chain is based in Asia, where the entire region is embroiled in nuclear conflict, which reports now suggest continued retaliatory efforts by the North Korean government, as they have launched a missile right over Japan, prompting international tensions, yet again.

This is likely to undermine confidence heading into a key event for Apple, which is why execution must be near flawless for investors to stomach the near-term geopolitical tensions, all while balancing their appetite for risk.

Apple iPhone price sensitivity heading into the event

Heading into the event, there has been some troubling signs on the high end, as it was indicated via a wireless smartphone survey at Barclays America that only a small sub-segment of buyers would be interested in a $1,000-plus priced iPhone.

Source: Barclays America

Internationally, the figure averages into 10% of buyers willing to pay $1,200, whereas 12.5% are willing to pay $1,000. This basically implies that 22.5% of current iPhone owners are willing to pay for the most expensive variant, which suggests 54 million iPhone 8 units as we estimate 240.33 million shipments in FY’18. The figures from Barclays sounds sort of reasonable, as rumors suggest that pricing is likely to start at approximately $1,000-plus for the new iPhone variant with storage configurations likely adding a couple hundred additional dollars to the price.

Will new technical features bring consumers back?

Smartphone buyers typically replace phones because they either broke it, want a new battery, or because they want new tech. However, the primary reason consumers upgrade to a new smartphone is because they broke their phone, and have gone through enough charge cycles to wear down the battery, which has resulted in a situation where fixing the phone isn’t even worth the hassle. Hence, consumers opt to upgrade for those two reasons prior to ever wanting the new features from a refreshed lineup.

Source: Barclays America

However, this year is special, as Apple has finally come to the table with a brand-new design, better display (that’s slightly larger), and with better security features. We can drill into more technical details in another article, but it’s basically a super-enhanced mid-cycle refresh, as they’ve finally resolved some of the logistical/technical hurdles to creating a true next-generation iPhone.

So, while the survey respondents may not prioritize “new tech” in a typical cycle, this cycle may drive a discrepancy in buying behavior. However, investors may not respond as strongly when exiting the iPhone launch event, as expectations are heightened, and if the reports are accurate then there’s very little room left to add hype at the event, as everything about the new iPhone has already been leaked.

Hence, it’s difficult to chase the stock heading into the event, or buy shares ahead of the event, given the weakness in tech stocks from geopolitical tensions, and heightened speculation over a broad market swoon (typical in August and September). As such, the iPhone unveil tends to overlap in a month where stocks in general are prone to dip, and expectations are already played up into the event with numerous leaks dampening the likelihood of an “expectation surprise.”

Quick look at the chart

Source: TC2000

We’re expecting the stock to drop over the foreseeable month or two, which positions investors to buy post the Apple launch event, and move past the usual war games between North and South Korea. Keep in mind, Samsung’s (OTC:SSNLF) V-NAND fourth-generation facility is based in South Korea, SK Hynix also owns various fabs in South Korea. LG, the largest OLED panel maker, is building an $8.9 billion OLED line in Paju, which basically sits along the DMZ (demilitarized zone).

Furthermore, various semiconductor equipment makers are based out of Japan (Tokyo Electron, KLA Tencor, etc.) so basically a huge chunk of the entire semiconductor supply chain is split between the two countries. Though we doubt North Korea would ever target a Chinese territory, there’s still the potential that things could turn wayward in Taiwan if tensions worsened between the US and China.

Therefore, politicians are communicating conflict avoidance, but with North Korea backed into a corner, it’s hard to imagine Kim Jong-un sitting back on his hands issuing the same threats. Sure, the fly over missile above Japan was harmless, and not unprecedented in history. However, given how much further North Korea has progressed with its nuclear program, it wouldn’t be surprising if they added more fuel behind their threats. Hence, we think conflict in South East Asia will intensify, because this communist regime is entirely dependent on their ability to get back into the nuclear race, and if they cannot, they’ll lose what political momentum they’ve managed to develop within their isolated country. Basically, they’re hinging their entire economic/political agenda on this one technology, so they have more negotiating leverage, which may lead to crazy demands from the world’s most unstable dictator.

Hence, we’re not certain if North Korea is just a side narrative or is the biggest threat to tech stock valuations this year. The world cannot afford a war on the Korean peninsula because it would grind the entire component supply chain to a halt. There’s no back-up facilities to building smartphones anywhere else in the world. Basically, Apple is entirely dependent on things going smoothly between China, Japan, North/South Korea, and the United States. We could say this about a lot of other tech companies too, but Apple would have no way of producing and selling phones if ships stopped moving through certain ports across the South/East China Sea and the Sea of Japan.

Final thoughts

This is perhaps the worst environment we’ve seen heading into a major iPhone unveiling. Yes, Apple has a great product to showcase, but the excitement seems priced in prior to the event, and could quickly dissipate on weakening macro data points, continued tensions in Asia, and confirmation of less than stellar iPhone 8 supply.

Though if things start improving in the region, various semiconductor/hardware names would respond positively. Furthermore, the focus would shift from market risk to business specific fundamentals, which would make us more bullish.

Putting capital at risk while Donald J. Trump and Kim Jong-un trade words, hurl missiles, issue threats, and so forth is a bit risky. A potential downside hedge to tech supply chain exposure would be aerospace names like Lockheed Martin (LMT), which designs the THAAD missile defense systems and manufactures them. Hence, capital flows have shifted, and it would not surprise us if tech stocks suffer the most from any further conflict escalation while aerospace and defense stocks continue to surge.

Cho’s investment research provides extensive coverage on stocks with price target recommendation and buy, sell, hold recommendation so investors can manager their investment portfolios more successfully. Investors can expect useful research that’s fundamentally themed so investors can make timely trades or long-term investments. The research is intended for a broad audience and is priced appropriately at $60/month or $480/year. To learn more about Cho’s Investment Research click here.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

ESPNU Radio on SiriusXM to Launch, Comprehensive 24/7 College Sports Audio Channel

Tue August 29, 2017 10:06 AM|PR Newswire|About: SIRI

Available nationwide exclusively on satellite radios and the SiriusXM app

ESPN and SiriusXM also announce 5-year extension of their broadcasting agreement

PR Newswire

NEW YORK, Aug. 29, 2017 /PRNewswire/ — SiriusXM and ESPN are teaming up to deliver an exclusive 24/7 college sports channel, programmed by SiriusXM, that will give fans the most comprehensive and in-depth college sports coverage available. ESPNU Radio on SiriusXM (channel 84) will debut Thursday, August 31, and will be available exclusively to SiriusXM subscribers via satellite radios, the SiriusXM app and on connected devices including smart TVs, Amazon Alexa devices and Sony PlayStation.

ESPNU Radio on SiriusXM will combine the talented college sports hosts and analysts from both companies. It will continue to feature SiriusXM’s long-running daily college sports programs The First Team (weekdays, 7-10 am ET), Full Ride (weekdays, 10am-1pm ET), Playbook (weekdays, 1-4pm ET) and Off Campus (weekdays, 4-7pm ET), as well as the weekend shows College Sports Sunday and College Football Sunday.

SiriusXM hosts and analysts on the channel include Greg McElroy, Rick Neuheisel, Steve Spurrier, Phil Savage, Jonathan Vilma, Ryan Leaf, James Laurinaitis, A.J. Hawk, Danny Kanell, Brad Hopkins, Charles Arbuckle, Tom Brennan, Bobby Cremins, Fran Fraschilla, Seth Greenberg, Steve Lappas, Taylor Zarzour, Mark Packer, Chris Childers, Rachel Baribeau, Andy Staples, David Moulton and Braden Gall.

Throughout each week, ESPN’s college sports talent will join the channel to provide analysis and discuss the topics of the day. ESPN college football analyst Kirk Herbstreit and college basketball analyst Jay Bilas will appear weekly on ESPNU Radio on SiriusXM throughout their respective seasons. Other high profile ESPN commentators and analysts will also be heard regularly on the channel.

ESPNU Radio on SiriusXM will simulcast ESPN shows including the popular College Gameday live each Saturday morning during the college football season, the College Football Top 25 Show, College Football Live Daily, College Basketball Gameday and others. The channel will also broadcast some of the year’s biggest college sporting events live, including the College Football Playoff Semifinal and National Championship games, which will also air on ESPN Radio, channel 80.

The channel will now be the exclusive home for the first run of several ESPN college sports podcasts including those hosted by Kirk Herbstreit and Ian Fitzsimmons, Jay Bilas, Dan Dakich and Seth Greenberg.

ESPNU Radio on SiriusXM will also broadcast live on location from select College Gameday destinations, and special events including the College Football Playoff Semifinals and National Championship.

“SiriusXM has been a strong partner with us for 16 years now,” said Traug Keller, senior vice president, Audio and Talent, ESPN. “With this new extension, we look forward to continuing to bring our unique and diverse content to SiriusXM. The addition of ESPNU Radio to SiriusXM’s lineup will bring ESPNU’s signature perspective and the sounds of the game to a broader swath of fans.”

“With fans in all corners of the country eagerly anticipating the start of college football season, we are very excited to collaborate with ESPN to deliver those fans the country’s most comprehensive college sports audio channel,” said Scott Greenstein, SiriusXM’s President and Chief Content Officer. “ESPNU Radio on SiriusXM showcases an extraordinary team of hosts and analysts from both SiriusXM and ESPN and fans can get it virtually anywhere – in the car, at home, or on the go. This is an exciting expansion of our longstanding broadcast agreement, which continues to give our subscribers access to ESPN’s top notch array of programming and platforms on ESPN Radio, ESPN Xtra and now ESPNU Radio.”

ESPN and SiriusXM have signed a five-year extension of their comprehensive content distribution agreement. SiriusXM subscribers will continue to hear the ESPN Radio and ESPN Deportes Radio channels, as well as the exclusive ESPN Xtra channel, which simulcasts several shows including First Take, the forthcoming show hosted by Mike Greenberg, The Paul Finebaum Show, the soon-to-debut program hosted by Bomani Jones and Pablo Torre, audio broadcasts of ESPN Films’ acclaimed 30 for 30 documentaries, 30 for 30 podcasts, SC Featured and more. The agreement also extends SiriusXM’s rights to broadcast a host of live sports events including the College Football Playoff and other college football bowl games, the NBA regular season and NBA Finals and more.

About ESPN Radio

ESPN Radio, the country’s largest sports radio network, ESPN Deportes Radio, and ESPN Podcasts comprise ESPN Audio.ESPN Audio launched its first podcast in 2005 and tallied nearly 293 million downloads in 2016. ESPN Audio podcasts cover the spectrum of sports content and most popular titles include Fantasy Focus Football, The Lowe Post and FiveThirtyEight Politics, as well as podcast versions of Mike & Mike, The Dan LeBatard Show, First Take, Pardon the Interruption, Baseball Tonight, and Around The Horn.

ESPN Radio, which launched January 1, 1992, provides more than 9,000 hours of talk and event content annually, reaching 20 million listeners a week on 500 nationwide stations, including more than 375 full-time affiliates and clearance in the top 25 markets. ESPN owns and/or operates stations in New York, Los Angeles, and Chicago. ESPN Radio programming is also available on SiriusXM and via digital distributors Apple Music, Slacker Radio and TuneIn.

About ESPNU

ESPNU launched March 4, 2005. The 24-hour college sports television network televises more than 650 live events annually. Action includes a variety of top football and men’s and women’s basketball games, as well as Olympic sports from 26 Division I conferences. ESPNU is the destination for premier collegiate and high school programming, including elite football, basketball, baseball, softball and lacrosse events. ESPNU, as part of ESPN’s wide-ranging agreement with the NCAA, has extensive coverage of NCAA Championship events. It is also the television home for ESPN Radio’s The Dan LeBatard Show and the new Golic and Wingo show, which debuts in January.

About SiriusXM

Sirius XM Holdings Inc. (SIRI) is the world’s largest radio company measured by revenue and has more than 32 million subscribers. SiriusXM creates and offers commercial-free music; premier sports talk and live events; comedy; news; exclusive talk and entertainment, and a wide-range of Latin music, sports and talk programming. SiriusXM is available in vehicles from every major car company and on smartphones and other connected devices as well as online at siriusxm.com. SiriusXM radios and accessories are available from retailers nationwide and online at SiriusXM. SiriusXM also provides premium traffic, weather, data and information services for subscribers through SiriusXM Traffic™, SiriusXM Travel Link, NavTraffic®, NavWeather™. SiriusXM delivers weather, data and information services to aircraft and boats through SiriusXM Aviation™ and SiriusXM Marine™. In addition, SiriusXM Music for Business provides commercial-free music to a variety of businesses. SiriusXM holds a minority interest in SiriusXM Canada which has approximately 2.8 million subscribers. SiriusXM is also a leading provider of connected vehicles services, giving customers access to a suite of safety, security, and convenience services including automatic crash notification, stolen vehicle recovery assistance, enhanced roadside assistance and turn-by-turn navigation.

To download SiriusXM logos and artwork, visit http://www.siriusxm.com/LogosAndPhotos.

This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about future financial and operating results, our plans, objectives, expectations and intentions with respect to future operations, products and services; and other statements identified by words such as “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “believe,” “intend,” “plan,” “projection,” “outlook” or words of similar meaning. Such forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally beyond our control. Actual results and the timing of events may differ materially from the results anticipated in these forward-looking statements.

The following factors, among others, could cause actual results and the timing of events to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: our substantial competition, which is likely to increase over time; our ability to attract and retain subscribers, which is uncertain; interference to our service from wireless operations; consumer protection laws and their enforcement; unfavorable outcomes of pending or future litigation; the market for music rights, which is changing and subject to uncertainties; our dependence upon the auto industry; general economic conditions; the security of the personal information about our customers; existing or future government laws and regulations could harm our business; failure of our satellites would significantly damage our business; the interruption or failure of our information technology and communications systems; our failure to realize benefits of acquisitions or other strategic initiatives; rapid technological and industry changes; failure of third parties to perform; our failure to comply with FCC requirements; modifications to our business plan; our indebtedness; our principal stockholder has significant influence over our affairs and over actions requiring stockholder approval and its interests may differ from interests of other holders of our common stock; impairment of our business by third-party intellectual property rights; and changes to our dividend policies which could occur at any time. Additional factors that could cause our results to differ materially from those described in the forward-looking statements can be found in our Annual Report on Form 10-K for the year ended December 31, 2016, which is filed with the Securities and Exchange Commission (the “SEC”) and available at the SEC’s Internet (HHH) site (http://www.sec.gov). The information set forth herein speaks only as of the date hereof, and we disclaim any intention or obligation to update any forward looking statements as a result of developments occurring after the date of this communication.

Source: SiriusXM

Media contacts:

Tara Chozet

ESPN Radio

tara.c.chozet@espn.com

(860) 766-2206

Andrew Fitzpatrick

SiriusXM

andrew.fitzpatrick@siriusxm.com

(212) 901-6693

Baidu, Jianghuai plan self-driving car production for 2019

Aug. 29, 2017 9:48 AM ET|About: Baidu, Inc. (BIDU)|By: Jason Aycock, SA News Editor

Baidu (BIDU -0.9%) and Jianghuai Auto used an event to reveal plans for a self-driving car in mass production in the second half of 2019, according to China News Service.

Jianghuai is the first of a set of key partners for Baidu’s autopilot program, the report says. Baidu will provide technology with high-precision mapping, self-positioning, environmental awareness and decision-making as part of a comprehensive auto-driving solution.

Baidu started working on high-precision map research in 2013, it says.

Now read: Baidu, China’s top internet firm »

HI Financial Services Mid-Week 06-24-2014