HI Financial Services Commentary 09-12-2017

You Tube Link: https://youtu.be/48BYbCa0Ibs

THIS year my family has decided it was a year to do HARD things:

I wanted to get up at 4:30 AM to exercise, study scriptures and market, 5:30 every

Summer project cut down 100’ to 115’ cottonwood trees

Hike to the Havasupai Falls with brothers this year

Pay off all debt except homes

Bring on two new advisors – Keve close to having Jeffrey T Smith come on board

Let me go over things that I encountered last week while hiking to the Havasupai Falls in the Grand Canyon:

1st: “I want to do what you are doing because it is so easy.”

It’s not easy and you can’t learn to be successful managing money doing it as a hobby

Because you were successful once on a single trade doesn’t mean you have it down

Extreme Pressure must become your friend

2nd: Experts don’t know S#%@ so don’t rely on them

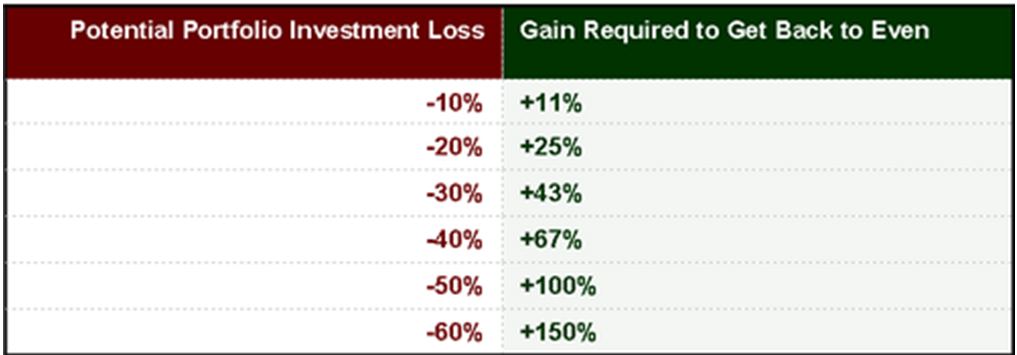

3rd: Learn the rule of losses

4th: Running from the market or going to cash means you have NO investment strategy because the market will not only jerk you around but teach you not to be a Jerk!

5th: Sometimes there just is not a great time for a trade. Don’t ever have to push for a trade even though you think you can make money no matter what direction a stock moves.

6th: Mistakes (Errors) happen because you can’t predict the future.

What’s happening this week and why?

Slow week and nothing going on until Friday with options expiration

Seeking Alpha, Tax reform comments and new AAPL Iphones 8 and the X

Where will our market end this week?

Lower due to options expiration

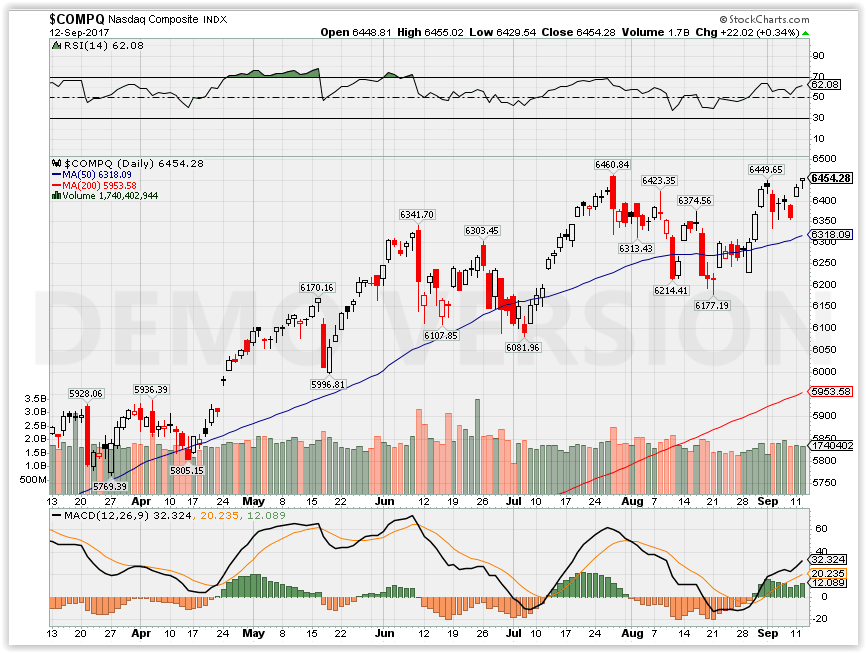

SPX – Bullish

COMP – Bullish

Where Will the SPX end August 2017?

09-05-2017 -2.5%

09-12-2017 -2.0%

What is on tap for the rest of the week?=

Earnings:

Tues:

Wed:

Thur:

Fri: ORCL

Econ Reports:

Tues: Jolts

Wed: MBA, PPI, Core PPI, Treasury Budget

Thur: Initial, Continuing Claims, CPI, Core CPI

Fri: Empire, Retail Sales, Retail ex-trans, Capacity Utilization, Industrial Production, Business Inventories, Mich Sentiment, Options EXPIRATION

Int’l:

Tues –

Wed – CN: Industrial Production, Retail Sales

Thursday –

Friday –

Sunday – CN: Housing Price Index

How I am looking to trade?

Earnings List:

C 10/12 BMO

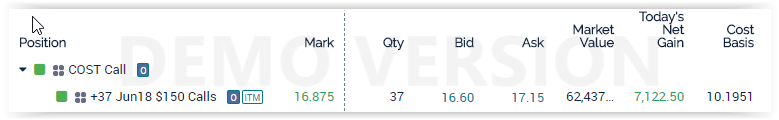

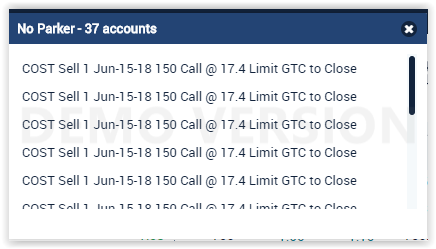

COST 10/5 AMC

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

HI Financial Services Mid-Week 06-24-2014