HI Financial Services Commentary 10-02-2018

YouTube Video: https://youtu.be/7npF3Juy4Ds

What I want to talk about today?

What is you favorite stock?= Made the most money with it or it is the easiest one for you to read it’s trends

BIDU = Made the most amount of money

FSLR = In the trade for 15 minutes and made over 52K

How well you know the companies you want to trade

I love AAPL, V, DIS, NVDA, NFLX, SNDK, EAS, MSFT, XOM, MUR, COP, BS

IF you buy F 1000 shares at $13

AND you make up $2 of the $4 = $2000/9 = 222 more shares of stock for proactive stock management

1200 * $11= $13,200 or REMEMBER 1000*13=$13,000

What if F gets back to $13 * 1200= $15,600 for $2600 profit or 2600/13000=20% ROI

What happening this week and why?

Ave work Week reports on Friday and waiting for a China Trade Resolution

Where will our markets end this week?

Higher

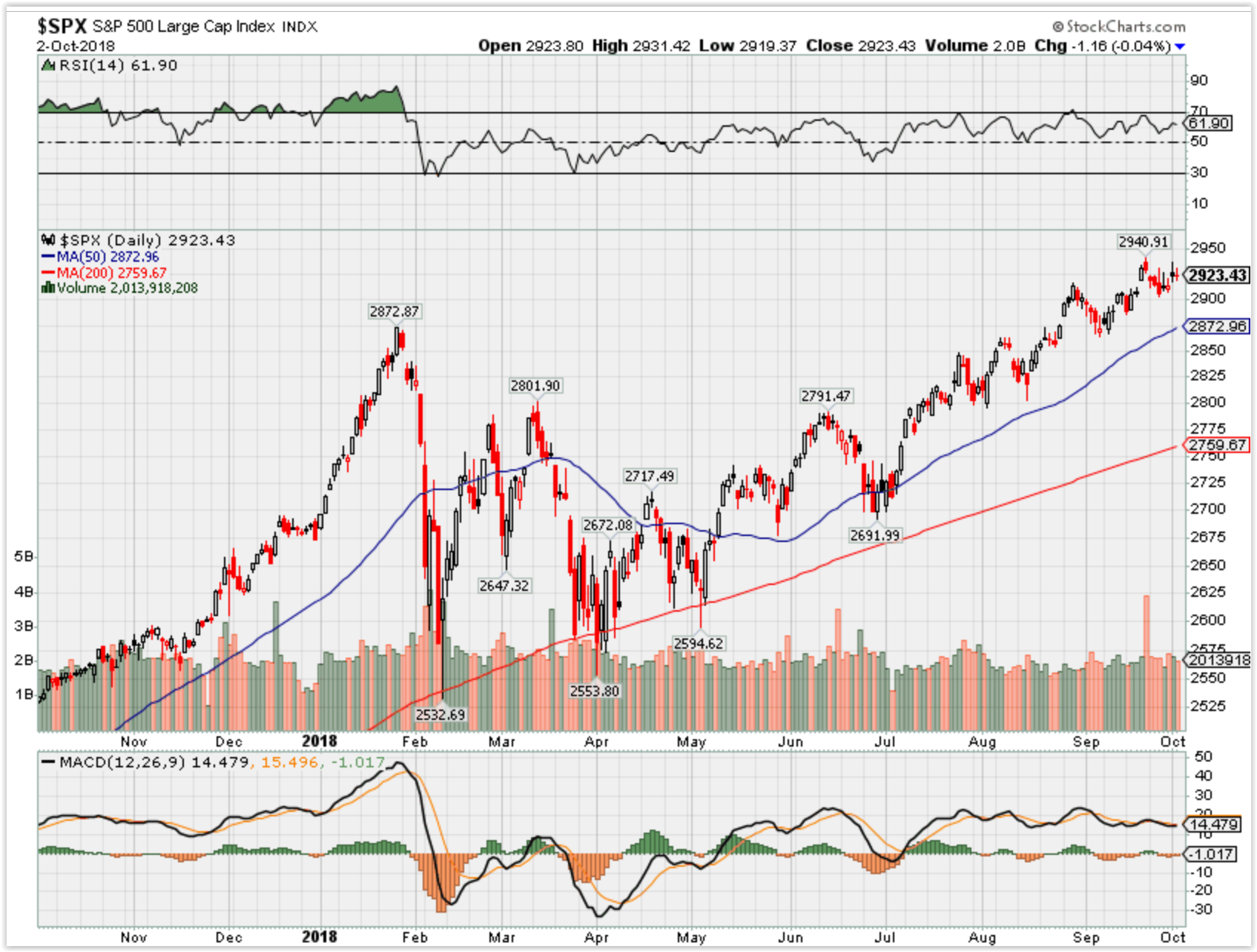

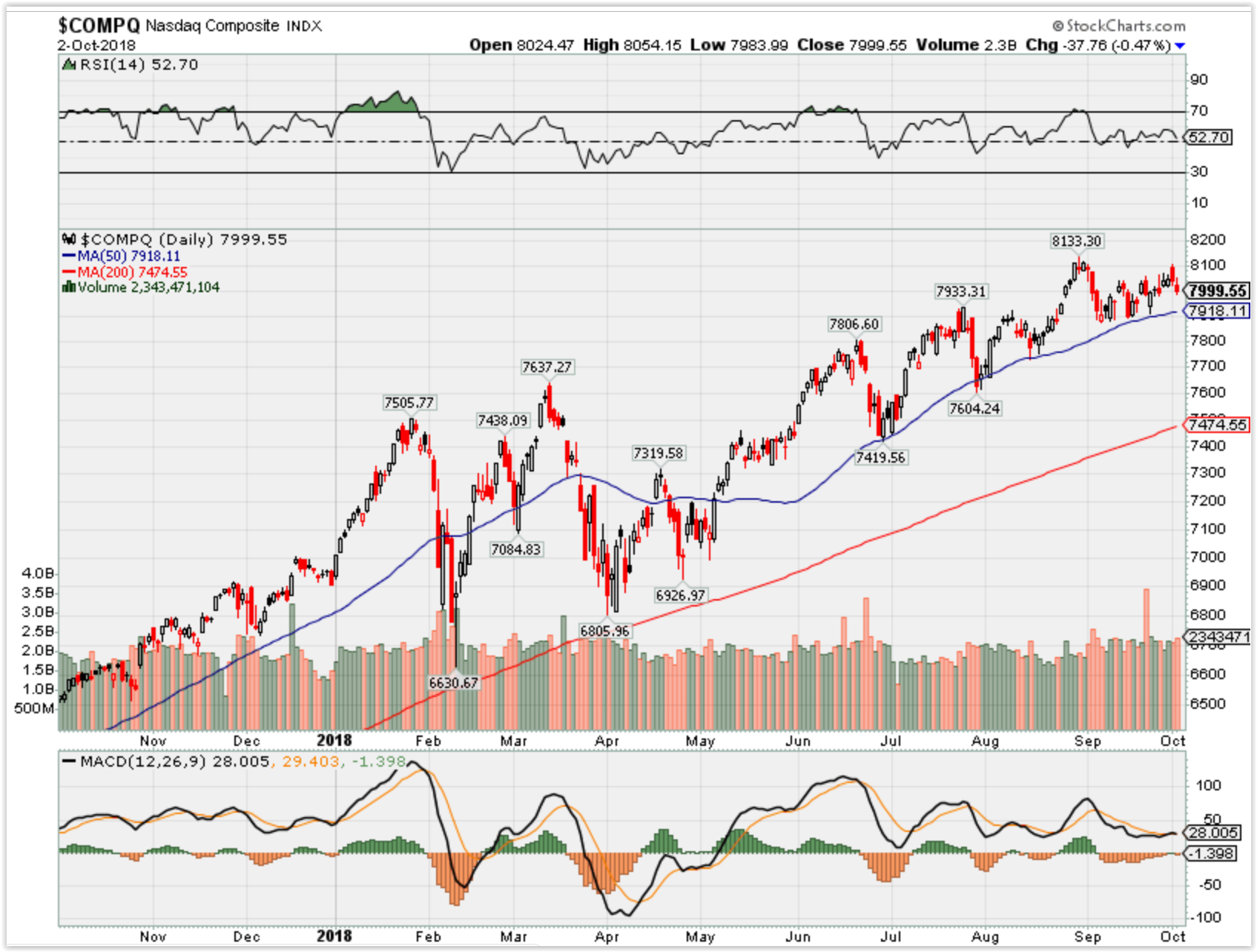

DJIA – Still Bullish and Just touching the Overbought

Where Will the SPX end October 2018?

10-02-2018 +1.5%

Earnings:

Tues: PAYX, PEP

Wed: LEN, PIR

Thur: COST

Fri:

Econ Reports:

Tues: Auto, Truck

Wed: MBA, ADP Employment, ISM Services

Thur: Initial, Continuing, Factory Orders

Fri: Ave Workweek, Non-Farm Payroll, Private Payroll, Unemployment Rate, Hourly Earnings, Consumer Credit, Trade Balance

Int’l:

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

I have 200 Jun 2020 Long Calls on FB that sometime today I could have dollar cost averaged for $16 a contract

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Look at EWZ

https://www.cnbc.com/2018/09/27/house-poised-to-pass-tax-cut-bills-despite-unlikely-senate-vote.html

House passes tax-cut bills despite unlikely Senate action

- Among other changes, the measures would make recently enacted tax cuts for individuals permanent, expand retirementand education savings accounts and create tax-advantaged Universal Savings Accounts.

- An existing Senate bill with bipartisan support includes some retirement-related provisions that are in the House package, such as removing the 70½ age limit for contributions to traditional individual retirement accounts.

Sarah O’Brien | @sarahtgobrien

Published 12:47 PM ET Thu, 27 Sept 2018 Updated 12:46 PM ET Fri, 28 Sept 2018

A three-bill legislative package known as Tax Reform 2.0 cleared the GOP-dominated House during votes on Thursday and Friday.

While the legislation is expected to be dead on arrival in the Senate, some proposed changes to retirement savings could remain in play.

Among other changes, the bills would make recently enacted tax cuts for individuals permanent, expand retirement and education accounts and create tax-advantaged Universal Savings Accounts.

While supporters say a second round of tax cuts would lead to continued economic growth, critics point to its $627 billion price tag over the next 10 years, based on an analysis by the Joint Committee on Taxation. That’s on top of the $1.5 trillion the already-passed cuts are projected to cost during the same period.

“The Senate is not expected to debate these bills,” said Nicole Kaeding, director of federal projects for the Tax Foundation, a nonpartisan tax-policy research group.

She said, however, that several of the legislation’s retirement-related provisions are similar to an existing bipartisan bill in the Senate that could be considered later this year.

That bill, the Retirement Enhancement Security Act (S. 2526) would remove the 70½ age limit for making contributions to traditional individual retirement accounts and would make it easier for small businesses to band together to offer 401(k) plans, among other provisions.

It also would make it easier for 401(k) plans to offer annuities by creating a regulatory “safe harbor” and, as long as plan administrators meet certain requirements when choosing an annuity provider, they’d get some legal protection.

Although that provision initially was excluded from the Tax Reform 2.0 package, it was added via an amendment that was tacked on to one of the House bills late Wednesday.

“Some parts of [Tax Reform 2.0] might have some issues, but we’re optimistic that the retirement piece might get some traction in the Senate,” said Paul Richman, vice president of government affairs for the Insured Retirement Institute, which advocated for the amendment.

House GOP leaders were committed to pushing the tax bills through this month before members head to their districts to campaign ahead of the November midterm elections.

Even if most of the provisions in the House bills end up shelved, they could be revived next year when a new Congress is in place or at another time, depending on the balance of power.

Here are some highlights of the bills that passed this week.

Making tax cuts permanent

The first bill is called the Protecting Family and Small Business Tax Cuts Act of 2018 (H.R. 6760). In addition to making permanent the cuts to individual tax rates that took effect this year, it would lock in other changes that are set to expire at the end of 2025.

Reduced tax rates through 2025

| Rate | Single | Head of household | Married filing jointly |

| 10% | Up to $9,525 | Up to $13,600 | Up to $19,050 |

| 12% | $9,526 to $38,700 | $13,601 to $51,800 | $19,051 to $77,400 |

| 22% | 38,701 to $82,500 | $51,801 to $82,500 | $77,401 to $165,000 |

| 24% | $82,501 to $157,500 | $82,501 to $157,500 | $165,001 to $315,000 |

| 32% | $157,501 to $200,000 | $157,501 to $200,000 | $315,001 to $400,000 |

| 35% | $200,001 to $500,000 | $200,001 to $500,000 | $400,001 to $600,000 |

| 37% | Over $500,000 | Over $500,000 | Over $600,000 |

That means the doubled standard deduction and elimination of personal exemptions would become permanent, along with the increased child tax credit, the elimination of most deductions and the $10,000 deduction cap on state and local taxes. The higher federal estate tax exemption of $11.2 million per individual also would be extended.

Separately, the bill would continue the higher deduction for medical expenses. Under rules implemented in last year’s tax legislation, qualifying medical expenses in excess of 7.5 percent of your adjusted gross income can be deductible if you itemize. Instead of letting that floor rise to 10 percent in 2019 as scheduled, H.R. 6760 would extend the lower threshold through 2020.

The measure also would make the 20 percent deduction for so-called pass-through businesses permanent.

A focus on savings

The second bill, the Family Savings Act of 2018 (H.R. 6757), includes changes to retirement and education accounts and creates a new tax-deferred savings account.

For starters, the measure would remove the age limit on individual retirement account contributions. Currently, IRA owners cannot make additional contributions beginning in the year they turn 70½. Roth IRAs, by contrast, do not have a contribution age limit.

It also would exempt people with less than $50,000 in their retirement accounts from taking required minimum distributions, which start when you turn 70½. It also would allow families to withdraw up to $7,500, penalty-free, from retirement accounts for costs related to a new child, whether by birth or adoption.

Additionally, 529 education accounts could be used to cover the cost of home schooling, for fees related to a trade apprenticeship and to help pay off a student debt.

The bill also endorses Universal Savings Accounts, which would allow savers to set aside tax-advantaged money for basically anything.

The accounts, which would come without restrictions on when (or why) the owners can make use of them, would work similarly to Roth IRAs. Up to $2,500 of after-tax income yearly could be contributed to an account, while the withdrawals — including any investment gain or interest — would be tax-free.

Another provision would allow smaller firms to more easily band together to offer their employees a 401(k) plan. As it stands, so-called multiple employer plans restrict exactly which businesses can team up.

For start-up businesses

The third bill is called the American Innovation Act of 2018 (H.R. 6756). Just 15 pages long, it would let new businesses deduct up to $20,000 in start-up expenses in the year they are incurred as long as they meet certain qualifications.

https://www.cnbc.com/2018/09/28/women-are-losing-sleep-over-this-retirement-savings-fear.html

Women are losing sleep over this retirement savings fear

- Seven out of 10 women are “very concerned” about having enough moneyto cover their long-term care expenses, according to Nationwide.

- More than 60 percent of high-income adults over age 50 have no idea what their long-term care costs will be.

- Too often, families fail to discuss the financial impact of providing care.

Darla Mercado | @darla_mercado

Published 11:02 AM ET Sat, 29 Sept 2018

When it comes to retirement savings, living too long can be a blessing or a curse.

For women, who tend to outlive men and spend years caring for family members, it’s a major cause of anxiety. Those were the findings of a recent survey by the Nationwide Retirement Institute.

In February, the institute performed an online poll of 1,007 adults over age 50 with household income of at least $150,000 and 522 adults over age 50 who are or have been caregivers.

Of the participants, 71 percent of women said that they were worried about having enough money to pay for long-term care expenses.

That worry was especially keen among caregivers: 3 out of 4 said they were concerned about keeping up with long-term care costs.

Women feel the strain of long-term care keenly, as they tend to be the ones looking after their elderly and infirm parents and spouses.

“Sons want to care for mom and dad and be supportive, but they feel comfortable identifying an expert to navigate that,” said Joanna Gordon Martin, founder and CEO of Theia Senior Solutions.

“Daughters feel that it’s their responsibility to provide care, even if they don’t understand the complexity of the landscape,” she said.

Here’s what women need to know about planning for long-term care.

A slippery slope

It’s no secret that paying for long-term care is a costly endeavor. In 2017, the annual national median cost of bringing in a home health aide was $49,192, according to data from Genworth.

A year’s worth of care in a semiprivate room at a nursing home is even more: $85,775 was the annual national median cost, according to Genworth.

See below for details on assisted living expenses.

Assisted living costs across the nationThe cost of assisted living in 2016, by state.+-30k40k50k60k70kSource: Genworth Financial. Graphic: Nicholas Wells | CNBC. © Natural Earth

North Carolina

Annual cost: $36,000

Rank: 45

Recruiting family members to help out with these needs adds on a different kind of cost.

Seven out of 10 of the participants in Nationwide’s study said they would like the option of relying on a family member if they needed long-term care.

Without the appropriate planning in place, things can quickly become overwhelming and may potentially endanger the caregiver’s career.

“It’s a slippery slope,” said Martin. “It starts with ‘I’ll go to one or two appointments’ and then it eventually becomes ‘I’ll fly down to Florida.'”

Indeed, on average, caregivers in Nationwide’s study said they spend 56 hours a week caring for loved ones.

The best laid plans

Despite the fact that survey participants had a clear idea of how they wanted to be cared for, few people were talking to their family members about it.

About half of the individuals in the Nationwide study said they were speaking with their spouses about the cost of long-term care. Only 10 percent said they spoke with their kids about it.

“People want a family member to care for them, but they aren’t taking the steps to have the conversation,” said Holly Snyder, vice president of Nationwide’s life insurance business.

Here’s where to begin.

Talk to your spouse and the kids: You can’t prepare your family to provide care if you don’t make your wishes known well ahead of time. Work with your advisor and your family to discuss where and how to receive care, as those choices can be a significant factor in determining the cost.

Bring in your financial advisor: Your advisor can also help you come up with a way to pay for those expenses. Your funding choices for long-term care can include a traditional long-term care insurance policy, a hybrid cash-value life insurance policy to help cover these expenses or self-insuring with your own wealth — as long as you have the money.

Hammer out your legal documents: Head off legal battles at the pass. Get a health-care proxy in place so that you designate a trusted individual to oversee your medical care and ensure that professionals comply with your wishes in case you’re unable to communicate.

Also, consider a power of attorney for your finances. You would select a trusted person to make financial decisions for you and ensure your bills get paid if you’re incapacitated.

Don’t forget the small details: Imagine that your elderly parent has a medical emergency and is on the way to the hospital. Would you be able to answer questions on medications and allergies? Spell out those details in a written plan so that you’re ready.

“It’s not just the financials that are in play, but who are the doctors?” asked Martin. “What are the medications? Who will care for the dog? Have that plan in place.”

https://www.cnbc.com/2018/10/01/chinese-tech-stocks-like-tencent-and-baidu-could-see-recovery.html

Chinese tech has taken hefty blows but giants like Tencent and Baidu are not out for the count

- Baidu, Alibaba and Tencent, collectively known as the BATs have lost around $165 billion in value year-to-date.

- Each have been burdened with their own troubles and all have been impacted by the negative sentiment towards Chinese stocksas a result of the trade war with the U.S.

- With a home market of over a billion people, a push by the Chinese government into new technologies like AI, and continued growth of digital services, the BATs may have taken a couple of hefty blows this year, but they’re certainly not down for the count.

Published 22 Hours Ago Updated 20 Hours Ago

At the start of the year, China’s largest technology companies known as the BATs, or Baidu, Alibaba and Tencent, looked unstoppable. Things continued to go very well for the big three throughout the first half of the year, with all of the firms’ share share prices hitting record highs.

But since the summer, investors in the BATs have been tearing their hair out as stock prices began to fall, ruining the decent start to 2018. Collectively, the BATs have lost around $165 billion in value year-to-date, each for their own reasons.

U.S.-listed Alibaba and Baidu have been caught up in the broader sell-off in Chinese stocks resulting from weak sentiment because of the U.S.-China trade war.

Tencent, meanwhile, has been hit by regulatory woes. The Chinese government has raised concerns about eye problems in the world’s second-largest economy and cited video games as one of the causes. Beijing suggested slowing down approvals of new games. Tencent makes a huge amount of money from games and concerns over the future of this part of its business have weighed on its stock.

But looking beyond the trade war rhetoric and short term problems, the BATs certainly have enough firepower to have market leadership. They also pose a major challenge to major U.S. tech names known as the FANGs or Facebook, Amazon, Netflix and Alphabet, the parent company of Google.

Just look at the growth and size of their businesses. Tencent grew 30 percent year-on-year in the second quarter of the year, Alibaba increased revenues 61 percent, while Baidu saw 32 percent growth.

All of these business are expanding rapidly into new geographies and areas. Tencent’s massive games business continues to have traction despite regulatory issues and the giant also owns WeChat, China’s most popular messaging app with over a billion monthly users. Tencent is pushing WeChat Pay, the payments service that runs within WeChat.

Alibaba continues to grow its core commerce business, while Baidu, which has seen hits to its core search business, has been investing heavily in artificial intelligence and autonomous cars.

The BATs have also spent billions of dollars investing in other companies, to the point where they are not only technology firms, but investors too. Bernstein Analyst Bhavtosh Vajpayee recently dubbed Tencent the “SoftBank of China.” SoftBank is the Japanese firm that has its own $100 billion Vision Fund which it invests in big tech firms across the world.

While heavy investment could be seen as a negative by investors because it weighs on profits, it could also set these companies up for future growth. The investments made by the BATs could provide good returns in the event of an initial public offering or acquisition of these companies. Or the firms that the BATs have invested in could just be acquired by either one of them.

And perhaps the biggest factor working in their favor is the impenetrable nature of the Chinese market for the FANGs. Google has not been in the Chinese market since 2010 after it withdrew over concerns about censorship. Facebook is blocked, Netflix is not available and Amazon has a very tiny business in the country.

Even though recent reports suggested Google is looking to enter the market, the company will find it difficult to dislodge the dominance of Baidu. Amazon could find it a huge task to take on Alibaba. And Facebook will face an uphill battle getting its product to stick, particularly as Tencent’s WeChat is woven into the fabric of Chinese society. China still remains a huge opportunity for the FANGs but it continues to be out of reach.

With a home market of over a billion people, a push by the Chinese government into new technologies like AI, and continued growth of digital services, the BATs may have taken a couple of hefty blows this year, but they’re certainly not down for the count.

https://www.cnbc.com/2018/10/01/new-trump-trade-deal-leaves-nafta-largely-intact.html

Here are some key differences between Trump’s new trade deal and NAFTA

- The Trump administration’s new trade deal with Canada and Mexico leaves much of the old North American Free Trade Agreement intact.

- There are some key differences, however, particularly when it comes to the dairy and auto industries.

- The updated agreement, the subject of more than a year of intense negotiations between the three countries, includes some high-profile compromises from both Washington and Ottawa.

The Trump administration’s new trade deal with Canada and Mexico leaves much of the old North American Free Trade Agreement intact. There are some key differences, however, particularly when it comes to the dairy and auto industries.

The updated agreement, the subject of more than a year of intense negotiations between the countries, includes some high-profile compromises from both Washington and Ottawa.

The U.S., for example, won expanded access to Canadian markets for U.S. dairy producers, long a major sticking point for the Trump administration. For its part, Canada won a key concession from U.S. negotiators that preserved a dispute resolution process.

The updated agreement also includes key provisions governing the auto industry that will encourage more U.S. car production while protecting Canadian and Mexican companies from President Donald Trump‘s threats of wider U.S. tariffs.

Here’s a quick look at key provisions:

- It will require 75 percent of auto components to be built in North America, up from 62.5 percent.

- Forty to 45 percent of auto components will have to be made by laborers making at least $16 an hour.

- In a concession to Mexican and Canadian business, the deal largely exempts passenger vehicles, pickup trucks and auto parts from possible Trump administration tariffs.

- S. farmers are getting slightly more access to Canadian dairy markets.

Trump had long threatened to scrap the deal in full, so the changes and the rebranding offered the president a chance to laud the deal as a promise fulfilled.

“Throughout the campaign, I promised to renegotiate NAFTA, and today we have kept that promise,” Trump said Monday in announcing the deal. Later in the day, he pushed back on the notion that it’s merely an updated version of the previous pact.

“It’s not NAFTA redone. It’s a brand-new deal,” the president said during a news conference in the White House Rose Garden.

The deal is subject to approval by Congress.

A question of impact

The sweeping agreement includes hundreds of pages, covering thousands of individual products. While the updated provisions will have an impact on the specific companies or industries covered, the updated agreement is expected to have little overall economic impact.

“My expectation all along was that there would be few major changes and NAFTA would go from being one of the worst deals ever to the one of the best,” said Jim O’Sullivan, an economist at High Frequency Economics.

One of the biggest changes to the deal involves the name: Trump insisted the three countries use the name United States-Mexico-Canada Agreement, or USMCA, replacing NAFTA.

“It’s a good day for Canada,” Prime Minister Justin Trudeau told reporters after a late-night Cabinet meeting to discuss the deal.

In a joint statement, Canada and the United States said it would “result in freer markets, fairer trade and robust economic growth in our region.”

The global financial markets also like the deal, largely because it removed the prospect of an all-out trade war between the U.S. and two of its biggest trading partners.

“The bigger issue is the positive impact on confidence and sentiment,” O’Sullivan said.

During the 2016 presidential campaign, Trump promised to rewrite NAFTA or leave the trade deal altogether.

Canada was initially left out of the deal when the U.S. and Mexico reached an agreement last month to revamp NAFTA. On Aug. 31, the Trump administration officially notified Congress of the deal with Mexico. That created a 90-day deadline that would allow outgoing Mexican President Enrique Pena Nieto to sign the updated agreement before he leaves office Dec. 1.

Autos

The most important provisions, in dollar terms, cover the auto industry, which has come to rely on a complex cross-border supply chain that moves billions of dollars’ worth of parts and components to factories located in all three countries. Trump’s threats to revoke NAFTA entirely could have added substantial costs to that supply chain, raised showroom car prices or left some models unprofitable to manufacture.

While the USMCA avoids tariffs, it will make it harder for global automakers to build cars cheaply in Mexico and is aimed at bringing more jobs into the United States.

In August, Mexico agreed to provisions that would require that 40 to 45 percent of a car’s parts and assemblies be built in countries where auto workers earn at least $16 an hour in order for a carmakers to qualify for NAFTA’s duty-free benefits.

In a concession to Mexican and Canadian companies, the final agreement hammered out Sunday largely exempts passenger vehicles, pickup trucks and auto parts from possible Trump administration tariffs.

If Trump imposes so-called Section 232 autos tariffs on national security grounds, Mexico and Canada would each get a tariff-free annual quota of 2.6 million passenger cars for export to the United States. That’s well above their current export levels.

Pickup trucks built in both countries will be exempted entirely. If the U.S. does impose tariffs, Mexico will also get an auto parts quota of $108 billion a year, while Canada will get a parts quota of $32.4 billion annually.

The deal sets a five-year transition period after the agreement enters into force for the regional value content requirement for autos to increase to 75 percent, from the current 62.5 percent. The pact also requires that vehicle manufacturers source at least 70 percent of their steel and aluminum from within the three countries.

Dairy

Trump’s biggest talking point – better access to Canadian markets for U.S. American dairy farmers – will likely to have the least impact, in dollar terms.

Canada reportedly agreed to give U.S. dairy farmers access to about 3.5 percent of its roughly $16 billion annual domestic dairy market. Under the deal, the Canadian government will be allowed to compensate dairy farmers hurt by the deal.

Canada had agreed to open up wider access to dairy markets under the proposed Trans-Pacific Partnership, which Trump withdrew from in January 2017. Trump administration officials say the new USMCA widens U.S. access to Canada’s dairy market beyond TPP levels.

For its part, Canada won a key concession from the U.S., which agreed to preserve a trade dispute process that Ottawa pushed hard to maintain. Canada relies on the settlement process to protect its lumber producers from anti-dumping tariffs imposed by the U.S.

The new agreement does limit the settlement process involving investor disputes to sectors that are dominated by state-run firms, including energy, telecom and infrastructure companies.

— Reuters contributed to this report.

HI Financial Services Mid-Week 06-24-2014