HI Financial Services Commentary 11-21-2017

YouTube Link: https://youtu.be/EiwBxo3AQCs

What do you want to talk about today?

Let’s talk about the what if’s

Why I say one thing at night and do something different the next mornings

Markets change overnight EVEN with a rules based investment strategy

20% ROI and out they go

100% trade/investment and out they go

Its make as much as you can until the money is needed

What you do and when you get out is different when you invest and when you trade

What happening this week and why?

Vacation week with Thursday markets closed and Friday a half day

News Driven by the what if we….. get tax reform, repatriation, FOMC rate hike, new Fed Chair, debt ceiling

Whats the next news?= Black Friday sales that come out Monday

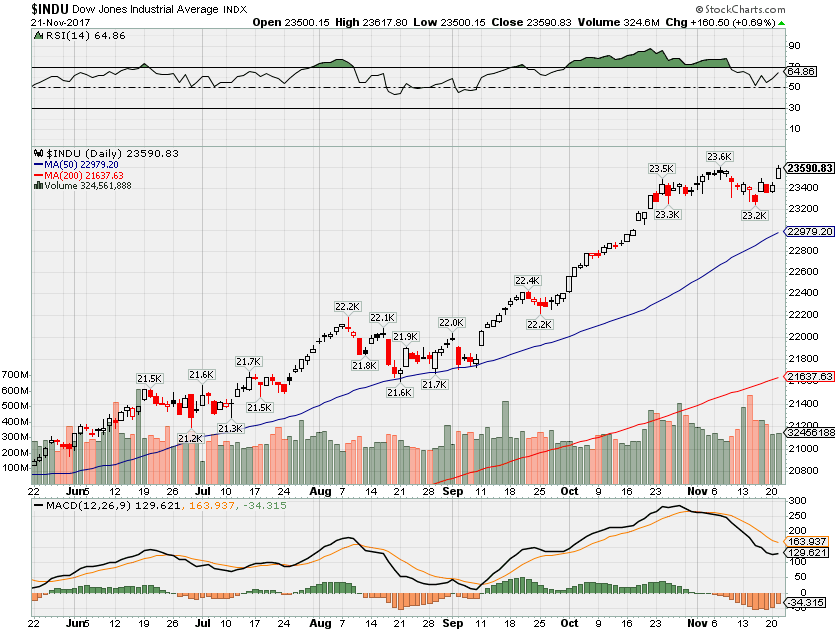

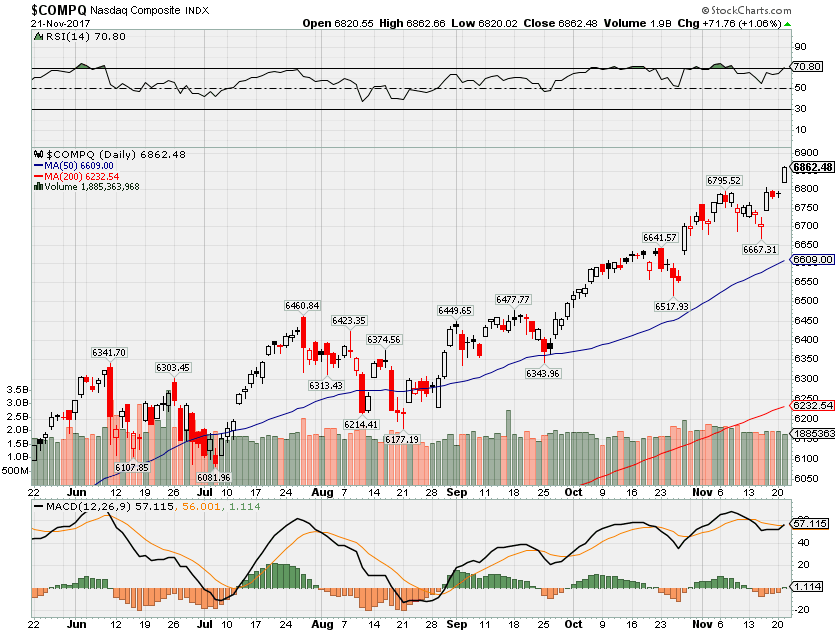

Where will our markets end this week?

Higher

Where Will the SPX end November 2017?

11-21-2017 +1.5%

11-14-2017 +1.5%

11-07-2017 +2.0%

10-31-2017 +2.0%

What is on tap for the rest of the week?=

Earnings:

Tues: CPB, CHS, DLTR, KIRK, LOW, HRL, GME, GES, HPQ

Wed: DE, RMAX

Thur:

Fri:

Econ Reports:

Tues: Existing Home Sales

Wed: MBA, Durable Goods, Durable ex-trans, Michigan, Initial, Continuing Claims

Thur:

Fri:

Int’l:

Tues –

Wed –

Thursday –

Friday-

Sunday – CN: Industrial Production

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

https://www.cnbc.com/2017/11/17/how-to-find-out-what-facebook-knows-about-me.html

How to find out what Facebook knows about you

|

|

|

|

|

Published 2:01 PM ET Sun, 19 Nov 2017 Updated 10:56 AM ET Mon, 20 Nov 2017

- Between information you’ve provided and your usage habits, Facebook knows a lot about you

- CNBC will walk you through how to find out what Facebook knows about you

- You’ll see options to help limit what Facebook can discover about you along the way

I recently quit Facebook, but decided to return for one final task: To find out exactly what Facebook knows about me.

After some quick digging, I found out that Facebook knows:

- Where I’m logged in and on what computer

- I like smartphones and am an early tech adopter

- I’ve clicked ads for laptop briefcases

- I am most likely to interact with ads from Lyft and Nike over others

- I’m liberal but prefer to read about Republican news stories

- I’m married

- My birthday is in March

- I work for CNBC

- I tend to access the social network from a tablet or smartphone.

I provided some of this information to Facebook, while other info Facebook gathered based on my interactions.

I’m going to deactivate my account again, but before I do I wanted to walk you through how to find out what Facebook knows about you, too.

Before we get started, know that you can click any image below to see a larger version. Let’s go.

First, open your Facebook page and tap “Settings” then “Ads.”

This is where you’ll see a compilation of what Facebook knows about you, including your interests, advertisers you’ve interacted with (did you like a post? Open a link to a product Facebook showed you?) and more. Note that you’ll be able to tweak the settings, too, so you can turn off interest-based ads, control who can see your interactions with ads, and more.

Facebook knows what you’re most likely to interact with

Here, Facebook shows me the ads I might see in my news feed based on interests and apps I’ve logged into using Facebook. Lyft, Netflix, Indiegogo, Warby Parker, Zillow, Nike, the “Internet of Things” and others all appeared on my page.

Switching between the tabs, I found that Facebook also knows I like dachshunds (I own one, though I’m not sure how Facebook knows that), current events, chickens (weird), wool (incorrect) and merino (odd, since I recently bought a couple Merino sweaters but not through Facebook!)

It might know your political party

Facebook also shows the political party in thinks you’re a member of. To find yours, tap the “lifestyle and culture” tab under your interests. Facebook thinks I’m interested in the Republican Party. That’s incorrect, so I guess this is a win for me in terms of privacy.

It knows your habits

Facebook can provide your information to advertisers based on whether you’re married or not, who you’re employed by, your title, your education and more. It knows where I work, where I went to school and that I’m married, but mainly because I told it so when I setup my profile. Here, you can see that these were all toggled to “On.”

Facebook’s page shows that it knows my birthday is in March — something I input so I can get the Happy Birthday posts on my birthday each year — but also knows that I’m a frequent traveler, that I’m an engaged shopper and that I’m a tech early adopter.

All true. It even says my political party skews liberal, which is odd since that contradicts the earlier political party suggestion. It also knows, based on my device usage, that I’m most likely using 4G or Wi-Fi connections, prefer Google’s Chrome web browser and mostly access the network from smartphones or tablets.

Facebook uses this information to “help advertisers reach people who are most likely to be interested in their products, services, and causes.” Facebook says it compiles this information based on what I’ve provided and my Facebook activity.

It knows your location and the computer or phone you use to access Facebook

Facebook’s “Security and Login” page shows where you’re logged in and on what computer. It knows I’m currently using a Windows PC from Englewood Cliffs, New Jersey, where CNBC headquarters is. It also shows where my previous devices have logged in, all the way back to a Motorola phone i used in Los Angeles in January. Together, Facebook knows I’ve been to Los Angeles, my hometown in New Jersey, Baltimore, Maryland, Philadelphia, Newark and my office. Kind of creepy.

It knows the ads you clicked based on all of these habits

Facebook knows the exact ads I clicked on a specific day, allowing it to take this data and better target new ads to you. I’ve clicked ads for iPhone cases, new bags and smartphones over the past year.

It knows what you did years ago

If you tap the “On This Day” option under “Explore” on the left tab of Facebook, it’ll show you what you were up to years ago, even if you didn’t post about it. Facebook compiles information from other users who have tagged you in locations, photos and more, and then shows you exactly what you were doing at a specific point in time. I hid most of this in my photo above for privacy, but I can see pictures of myself from high school that were posted by my friends years ago.

That’s the information that Facebook shows it knows about you. If you find it a bit creepy, here’s how to deactivate your Facebook account.

https://www.cnbc.com/2017/11/20/longtime-bull-jeremy-siegel-says-market-near-to-a-top.html

Market is ‘clearly near to a top,’ says longtime bull Jeremy Siegel

- Next year will likely bring lower returns and perhaps a “pause” for the stock market, Wharton School finance professor Jeremy Siegel told CNBC.

- “We have one more push and I think it’s connected with the corporate tax reform,” the longtime bull said.

- Next year he sees returns of less than 10 percent.

Published 4:15 PM ET Mon, 20 Nov 2017 Updated 22 Hours AgoCNBC.com

Next year will likely bring lower returns and perhaps a “pause” for the stock market, longtime bull Jeremy Siegel told CNBC on Monday.

In fact, he believes the market is “clearly near to a top.”

“We have one more push and I think it’s connected with the corporate tax reform,” the Wharton School finance professor said in an interview with “Closing Bell.”

While he’s not warning everyone to sell everything, he sees valuations and political uncertainty slowing down the stock market in 2018.

“Clearly now at these valuations we’re not going to get the double-digit returns that certainly we’ve gotten over the last six or seven years, on average,” he said.

Siegel expects returns under 10 percent.

“What do you look forward to in 2018 that could keep this market … as buoyant as it’s been this year? It’s been a great run,” he said. “We might have a pause.”

Siegel is known for his bullish predictions. In July 2015, he said the Dow Jones industrial average could hit 20,000 by year-end. In November of that year he pushed his timeline back to 2016. The Dow broke the mark on Jan. 25, 2017.

In February, he told CNBC that Dow 22,000 was “on the horizon.” The blue chip index hit that level in August.

His latest call is for Dow 24,000 by the end of 2017, but has said it is predicated on the passage of tax reform.

Treasury Secretary Steven Mnuchin told CNBC on Friday that he expects a GOP tax cut bill to be sent to President Donald Trump to sign by Christmas.

— CNBC’s Tae Kim and Berkeley Lovelace Jr.

The debt time bomb that keeps growing and now equals nearly half of US GDP

- Corporate debt is at its highest level relative to U.S. GDP since the financial crisis, and while not a concern, a snap higher in rates or an economic slump could make it a bigger worry.

- The corporate debt market has been a focus after an exodus of the high-yield debt market in recent weeks, with a near-record $6.8 billion leaving junk bond funds.

- Debt of nonfinancial companies has grown $1 trillion in just two years and now totals $8.7 trillion, roughly 45 percent of GDP, according to Informa Financial Intelligence.

Published 3:38 PM ET Mon, 20 Nov 2017 Updated 23 Hours Ago

Corporate debt is at its highest level relative to U.S. GDP since the financial crisis , and while not now a concern, that mountain of corporate IOUs could quickly turn into a heap of worry under the right circumstances.

Fueled by low interest rates and strong investor appetite, debt of nonfinancial companies has increased at a rapid clip, to $8.7 trillion, and is equal to more than 45 percent of GDP, according to David Ader, chief macro strategist at Informa Financial Intelligence.

According to the Federal Reserve, nonfinancial corporate debt outstanding has grown by $1 trillion in two years.

“Everything is fine until it isn’t,” Ader said. “We don’t need to worry about that until we’re in a slowdown and profit declines.”

Low rates have encouraged companies to borrow, but instead of using the money to expand, they have used it to boost their share prices, he said.

Source: Informa Financial Intelligence

The corporate debt market has been in the spotlight after this month’s sell-off in high-yield bonds triggered concerns the riskiest issues may be sending a warning to the broader markets, including the much bigger investment-grade debt market and stocks.

The high-yield market is different from the investment-grade market in that it reacts more as a risk market, like stocks.

Strategists look at the sell-off as mostly a correction, centered on certain sectors in the riskiest part of the credit market. Telecom and health-care junk bonds were the hardest hit, as investors pulled a near-record $6.8 billionfrom high-yield funds in the week through last Wednesday.

“We’re keeping an eye on it but it looks like it was one of those typical productive corrections, rather than the beginning of the end,” said Robert Tipp, chief investment strategist and head of global bonds and foreign exchange at PGIM Fixed Income.

With a growing economy and strong profit picture, there is little concern now about the overall corporate debt market, which so far is not reflecting overly aggressive borrowing against inflated assets, Tipp added. Companies have a lot of cash on hand, and “against that you can find cases of credits that are extended but you can also find a lot of pretty presentable credits.”

Investment-grade corporate debt is closing in on a record for 2017, with $1.274 trillion in issuance year to date, versus last year’s total $1.286 trillion, according to Informa Global Markets.

The new issue market was active Monday, with five investment-grade and six high-yield issues expected to price. The average estimate for this week’s investment-grade issuance was $7 billion, reflecting a lighter holiday week volume, but that could turn out to be higher, according to Chris Reich, senior analyst at Informa Global Markets.

High-yield debt issuance so far this year totals $240.9 billion, higher than 2016’s $217.1 billion but lower than prior years, which peaked at $336 billion in 2012, according to Informa.

Rick Rieder, BlackRock’s global chief investment officer of fixed income, said he is not concerned about the leverage but warns there’s something reminiscent of previous crises.

“The only thing I would say that is concerning — there is some rhyming nature to the fact there are no covenants in deals anymore and structure doesn’t matter anymore,” he said. “That does give you some pause. I’m not worried about the leverage. It’s not going to be a 2018 dynamic. I am worried about longer term that some of the lack of covenants or collateral or structure,” he said.

There are major changes underway that could, in theory, slow the amount of issuance. One is the tax law proposal that would treat foreign profits differently and no longer encourage corporations to keep money overseas. Some major companies have issued debt against their foreign cash to buy back stock or pay out bigger dividends, said Ader.

Another change is the proposal to restrict the amount of corporate debt interest a company could write off. Strategists say the law affects mostly the most indebted companies in the high-yield market.

Source: Liscio Report

The overall fixed income market will also feel the effects of global central banks moving away from easy policies. The Fed, expected to raise rates at its December meeting, has also forecast three rate hikes for next year. It is also expected to actively reduce the amount of purchases it is making in the Treasury and mortgage markets. The European Central Bank is also paring back its purchases of debt.

Andrew Brenner, global head of emerging markets, fixed income at National Alliance, said he thinks the sell-off in high yield could be overfor now, but it may come back in the beginning of next year as the European Central Bank begins to wind down its bond purchases and the Fed looks set to raise interest rates.

“It’s not different this time. The leverage is a problem, but the leverage is not a problem right away because interest rates are very low,” he said. “It makes sense for corporates to do this.”

Tipp said the new Fed, expected to be led by Trump nominee Jerome Powell, may not be as aggressive as some believe, or even as hawkish as it’s been in the final year of Fed Chair Janet Yellen’s tenure.

“The markets have taken it in stride,” Tipp said. “If the economy keeps cruising along, but they don’t get the inflation number to hike, it could be a very good year for the market.”

Economic expansion is not showing signs of nearing an end, but once in a while the markets will take a pause. Disruptions could come if tax cuts and the resulting stimulus don’t happen, or if the market is derailed by the Fed or the ECB, or even by some political event, he said. “That’s when you have a correction.”

HI Financial Services Mid-Week 06-24-2014