HI Financial Services Commentary 12-19-2017

What I want to talk about today?

We hope this reaches you and yours with everyone in good health and enjoying this wonderful time of year. We’ve been monitoring the key provisions of the proposed tax legislation and significant details are emerging regarding the final provisions agreed on between the House and Senate versions. Here they are:

- The Corporate tax rate will be 21% and will start in 2018

- The max individual tax rate will be reduced to 37%

- $10,000 maximum on deductions for property taxes and other state/local tax expenses.

- Interest on up to $750,000 primary residence mortgage will be deductible – a substantial reduction from prior law.

- The Corporate AMT will be eliminated. Individual AMT remains but will apply to far fewer taxpayers.

- No healthcare mandate or tax penalty for failure to obtain health insurance.

- The standard deduction amount will double – but the exemption for dependents will be eliminated.

- Student loan interest will still be deductible.

There are lots of other provisions not reflected above, and the ones above may still shift some. But we now believe this framework (with the details included) will be finalized next week and get to President Trump prior to Christmas.

What I do to prepare for next year

I run my fundamental checklist on the companies I trade

Run a couple of screeners to find stock that dropped more than 20%, off the highs by 10 % and stocks that end the year within 5% off the yearly lows

COST, DHI

I’m looking for laggards in the financial sector – Banks, Credit cards, region banks, PayPal,

Looking for companies that may repatriate money into the US

What happening this week and why?

Waiting for Tax Reform

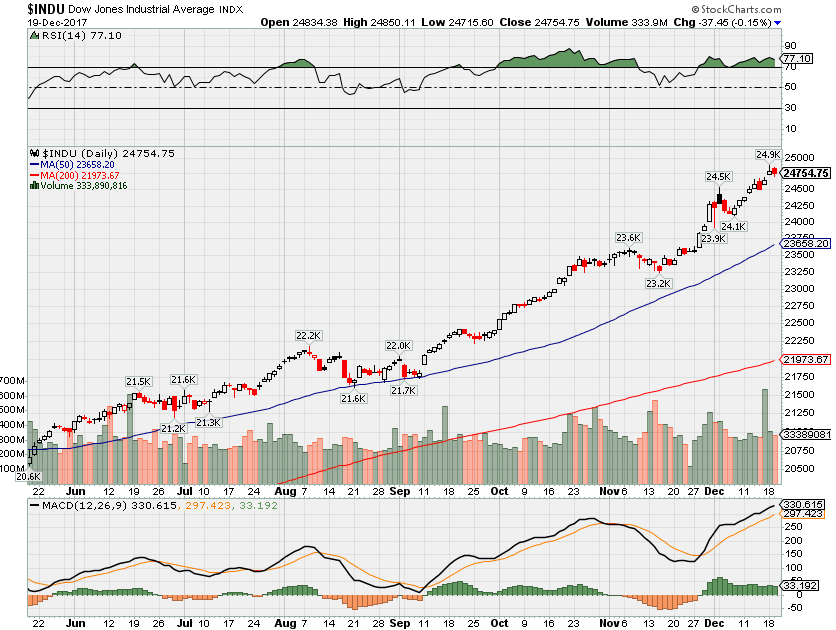

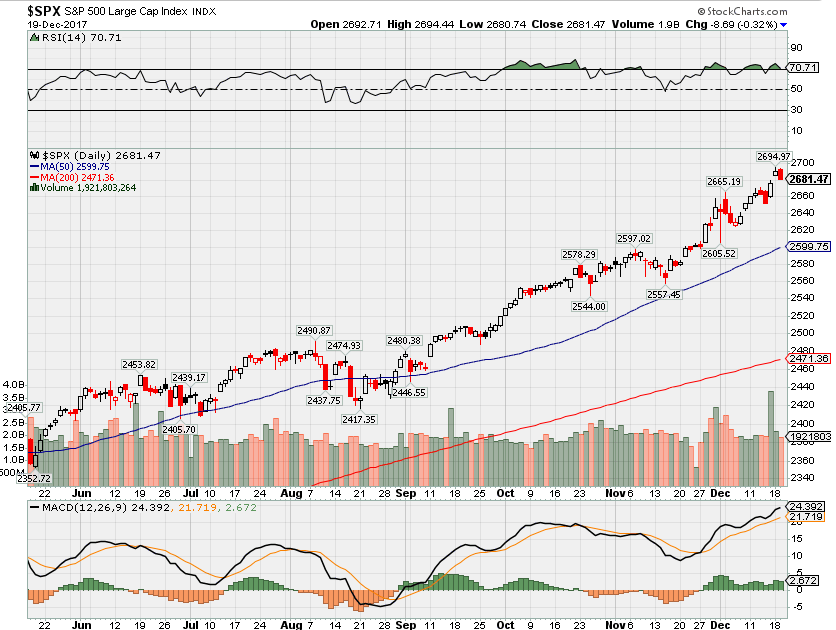

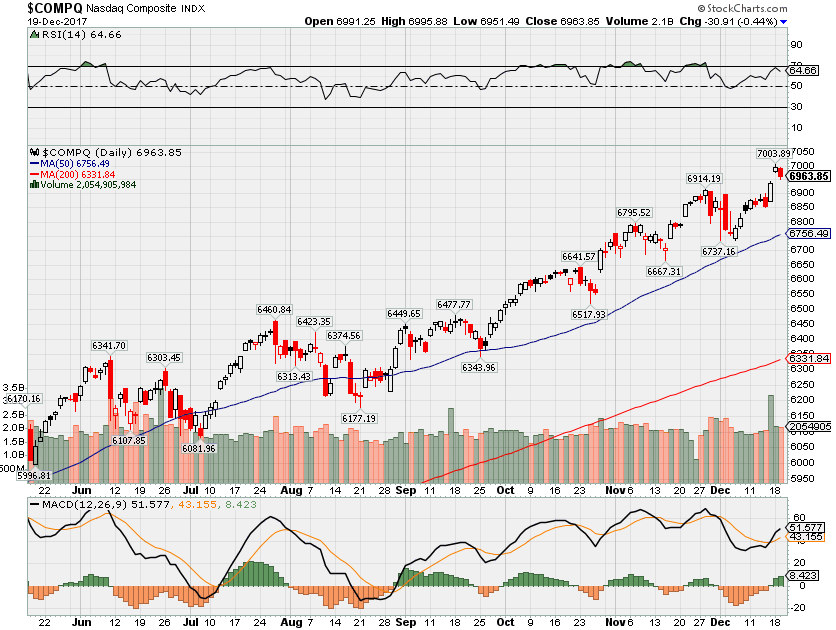

Where will our markets end this week?

Higher

SPX – Bullish and overbought

COMP – Bullish

Where Will the SPX end December 2017?

12-19-2017 +2.0%

12-12-2017 +1.5%

12-05-2017 +1.5%

What is on tap for the rest of the week?=

Earnings:

Tues: NAV, FDX, MU, RHT

Wed: BB, GIS, BBBY

Thur: KMX, PAYL, NKE

Fri:

Econ Reports:

Tues: Building permit, housing start, current account balance

Wed: MBA, Existing Home sales

Thur: Initial, Continuing Claims, GDP-3rd Est, GDP Deflator, Phil Fed, FHFA Housing Price Index

Fri: Durable Goods, Durable ex-trans, PCE Prices, PCE CORE, Personal Income, Personal Spending, Michigan Sentiment, New Home Sales

CHRISTMAS ON MONDAY AND MARKET CLOSED

Int’l:

Tues –

Wed –

Thursday –

Friday-

Sunday –

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

https://harrydent.com/exclusives_new/harvard-economist-warns-700-gold-by-2018/

Harvard Economist Warns “$700 Gold by 2018″

By Harry Dent

Investors are fleeing to gold in a desperate attempt to weather the recent market volatility… but is this long time “safe-haven” actually poised to collapse wiping out trillions of dollars of wealth in the process?

One highly respected Harvard economist is stating an emphatic “yes!”.

“While many economists will argue that gold is not in a bubble… and insist it will soar to $2,000, $5,000 and even $10,000, my research has said otherwise” says Harvard economist Harry Dent in his latest report. “I’ve never been more certain of anything in over 30 years of economic forecasting.”

Market volatility, worries over the Europe Central Bank, negative interest rates, and China are among a laundry list of events that are driving panicked masses to buy the yellow metal. But this is only inflating the gold bubble that is poised to pop at any moment, he says.

Dent, who pioneered a whole new science of economic forecasting in the early 1980’s has been able to accurately predict almost every major economic event over the past 30 years. —including the collapse of Japan, The Great Tech Boom of the 1990’s, and the 2008 market crash.

Now his latest prediction his proving controversial among financial circles across the country.

Traditionally investors flock to gold as a way to hedge against inflation. But according to Dent’s research,we’re about to see the exact opposite happen.

Dent warns that we are about to experience an economic crisis far worse than 2008 — the full-blown collapse of the stock market and massive deflation.

And that investors who attempt to hide their money in the “safe haven” of gold, could damage their wealth to an even greater degree.

This scenario was practically preordained — as far back as the mid-1990s when the bubble in stocks began and real estate followed and Baby Boomers were heading for their peak spending years into 2007.

“When you understand this event, including the fundamental reasons driving it, you need not panic. You will see there’s a tremendous upside to what will unfold over this decade and beyond.” Says Dent. “After all, when you’re able to know what’s coming – and position yourself accordingly – the years ahead could be prosperous times.”

What is Dent saying the one investment you need to buy right now to protect yourself, instead of gold is?

This material has been prepared by Dent Research. This document is for information and illustrative purposes only and does not purport to show actual results. It is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action. All investments entail risks. There is no guarantee that investment strategies will achieve the desired results under all market conditions and each investor should evaluate its ability to invest for a long term especially during periods of a market downturn.

1131175

Blog/Dow Jones

Posted Dec 15, 2017 by Martin Armstrong

The Trump Tax Reform reducing the corporate tax to 21% and taking effect January 1st, 2018 rather than being delayed until 2019, will be one of the biggest positive catalysts for US equities in decades. This is very interesting because it is now fundamentally validating what our computer has been projecting for highs going up to the 40,000 level on the Dow back in 2009.

Many of the domestic and institutional investors overseas are NOT in this market. They will now be forced to reposition their portfolios once the bill is passed. How to Trade a Vertical Market is absolutely critical at this point in time. This is by no means going to be easy.

We are already above the top of the Upward Channel and this will be 21,017.30. Our projections for 2017 stood at 25,648.40 and this rises to 28,045.71 for 2018. This is the next area of resistance. Once we push through that projection, the market will come back to test it. That will be the start of the slingshot upward.

The same model produced the projection at 195.97 for 1928. The year 1928 opened above the projection at 203.40, fell back to retest it dropping to 194.50, and then entered the slingshot running to 301.60 intraday and closed that year at 300.00. Keep in mind our projection model gives us 25,648.40 so we are not yet through that level in 2017.

This is why I have always warned AGAINST fundamental analysis. The fundamentals ALWAYS unfold to validate what our computer forecasts to start with. Our forecast that BREXIT would win and Trump back in 2016 was possible ONLY because the computer was picking up the change in public sentiment which is driven by economics. The Trump Tax Reform is a reflection of the discontent underlying the economy. The Democrats will naturally vote in block against it because they simply like the higher taxes even if it produces fewer jobs and lower economic growth. They cannot change their color now.

FUND FLOWS: Year-End Profit Taking and Window Dressing Are in Full Swing

And it looks like Italians are going to the polls.

WealthManagement.com Staff | Dec 18, 2017

The second week of December saw EPFR-tracked U.S. Money Market Funds post inflows for the fourth time in the past five weeks and flows into U.S. Equity Funds hit a six-month high as year-end profit taking, window dressing, Fed watching, and risk reduction held sway. High Yield Bond Funds experienced net redemptions for the seventh week running and Emerging Markets Bond Funds for only the fourth time year-to-date ahead of the U.S. Federal Reserve’s third rate hike this year while outflows from Alternative Fundsclimbed to levels last seen in the fourth quarter of 2016.

Reports that Italians will be going to the polls in early March hit Europe Equity Funds, with redemptions hitting their highest level in over a year, and Global Equity Funds—which on average allocate nearly 40 percent of their portfolios to Developed Europe—posted their first outflow in exactly a year.

Overall, EPFR Global-tracked Equity Funds collectively absorbed $8.6 billion during the week ending Dec. 13, despite another rough week for Dividend Equity Funds, which have now seen over $38 billion flow out since the beginning of the year. Bond Funds took in $1.2 billion and Money Market Funds over $22 billion.

At the single country and asset class fund levels, redemptions from Norway Bond and France Equity Funds hit 54- and 62-week highs while, Emerging Markets Country Fund groups, Peru and India Equity Funds experienced their heaviest redemptions since the second quarter and midway through the fourth quarter of 2016, respectively. Outflows from Convertible Bond Funds climbed to a 21-week high, investors pulled money out of Bank Loan Funds for the sixth time in the past seven weeks and Inflation Protected Bond Funds took in fresh money for the eighth week in a row.

HI Financial Services Mid-Week 06-24-2014