HI Market View Commentary 08-26-2019

We are in a headline driven market with large volatility swings

Late night we were down between -300 to 455 at 1 pm MST

This morning the Durable goods 2.1 vs est 1.5

Durable ex-trans -0.4 vs est 0.1

Technical Bounce off the 200 SMA

SO Today I have some sort of protection on core positions

DITM Covered calls, Long put because by Thursday big money will be out of the market

Where will our markets end this week?

Lower

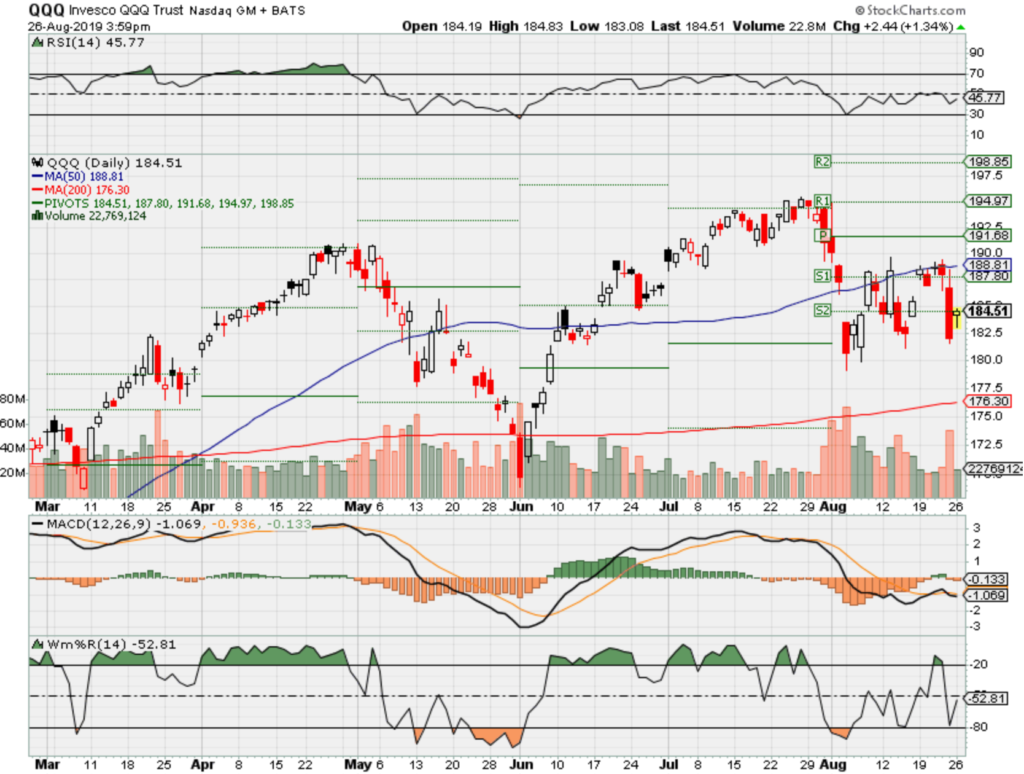

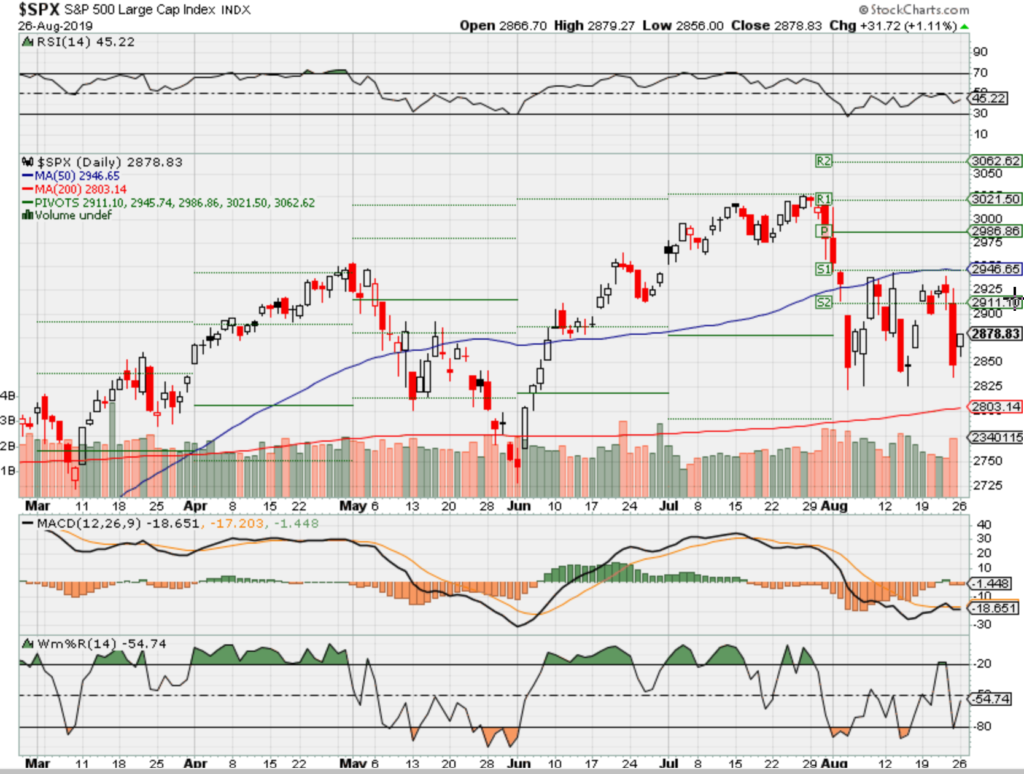

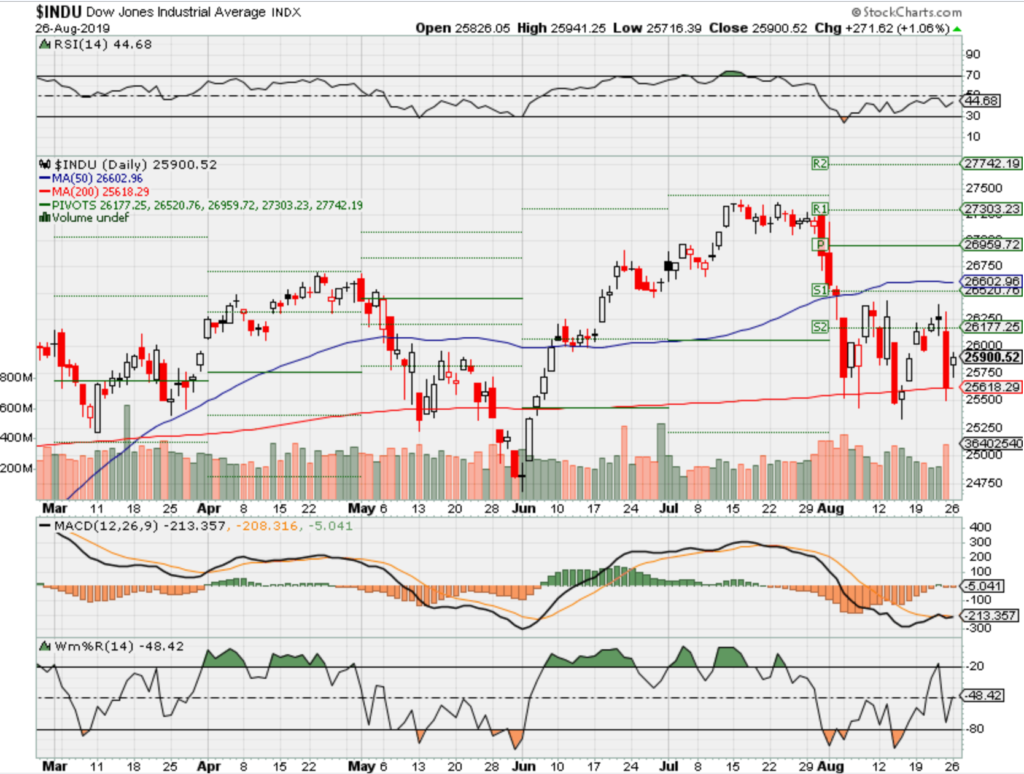

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end Sept 2019?

08-26-2019 -1.0%

Earnings:

Mon:

Tues: AMWD, ADSK, HPE

Wed: CHS, XPRS, TIF, FIVE, GES, PVH, TLYS

Thur: ANF, BBY, DG, BURL, SASF, DELL, AOBC, MRVL

Fri: BIG, CPB

Econ Reports:

Mon: Durable, Durable ex-trans

Tues: FHFA Housing Price Index, S&P Case Shiller, Consumer Confidence,

Wed: MBA,

Thur: Initial, Continuing, Pending Home Sales, GDP, GDP Deflator,

Fri: Personal Income, Personal Spending, Chicago PMI, Michigan Sentiment

Int’l:

Mon – Conclusion of G7 Meeting

Tues –

Wed –

Thursday –

Friday-

Saturday/Sunday – Non Manufacturing PMI, NBS Manufacturing PMI

How am I looking to trade?

I’m preparing for earnings = Adding long puts

AOBC – 08/29

MU – 9/19 est

MRVL 8/29

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

https://seekingalpha.com/article/4287243-ford-surprisingly-stable-business-company-major-risk

Ford: A Surprisingly Stable Business, But The Company Has A Major Risk

Aug. 21, 2019 9:17 PM ET

Summary

Ford Motor Company is an iconic American company that has survived numerous recessions and market conditions.

The current dividend yield is over 6.5% and is well-covered based on EPS and FCF. The dividend is also reasonably safe from the perspective of debt.

Ford is the middle of multi-year $11B restructuring plan that should improve operations and profitability in Europe and South America.

In North America, Ford is shifting strategy to focus on its franchise strengths of pickup trucks, SUVs, commercial vehicles, and the Mustang.

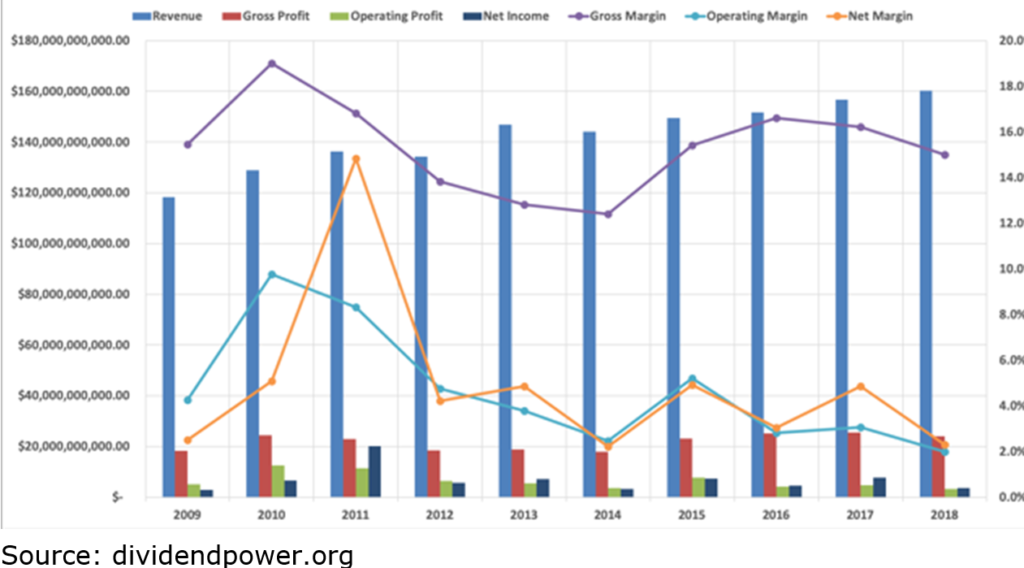

Ford has grown revenue consistently since 2009, but this has not translated to consistent bottom line growth.

Thesis

Ford Motor Company (F) is a stock that I have never looked at before. I am analyzing this stock at the request of some of my readers who commented on my recent article on the Dividend Kings. The company was not on my radar as a dividend growth stock since the dividend has been constant since 2015. There is also a recent historical negative for Ford since the U.S. automotive industry in its entirety performed very poorly during the Great Recession. But saying that, Ford, did not go bankrupt and did not get a bailout in the same sense as other automotive companies. The company survived and has been profitable since 2010 and started paying a dividend in 2012. Today, the main appeal for Ford is the regular dividend yield, which is over 6.5% and well-covered. But beyond the yield, the company has been consistently growing the top line since 2009, and the business is stable. However, top line growth has not translated to consistent bottom line growth. Ford may be appropriate for some investors seeking income, due to the high yield and annual extra dividend. But I do not view it as a buy for conventional dividend growth investors until the company achieves more consistent results.

Overview of Ford

Ford is an iconic U.S. auto manufacturer that traces its history back 116 years to June 1903. Today, Ford is the second largest U.S. auto manufacturer by vehicle sales volume and in the top five globally. Ford has three reporting segments: Automotive, Mobility, and Ford Credit. Automotive has sprawling operations in six geographic regions of North America, South America, Europe, China, Asia Pacific, and Middle East & Africa. Mobility is Ford’s autonomous vehicle and smart mobility effort. Ford Credit is the company’s vehicle financing and leasing operations in support of dealers and consumers. Ford owns two major global brands that are Ford and Lincoln. It also owns the Troller brand in Brazil. Ford is controlled by the Ford family through a dual class share structure. The family has 40% of the voting power through ownership of all the Class B shares. Notably, the Ford family owns only about 2% of the stock due to capital raises resulting in dilution. The company’s Executive Chairman and one other board member is part of the Ford family.

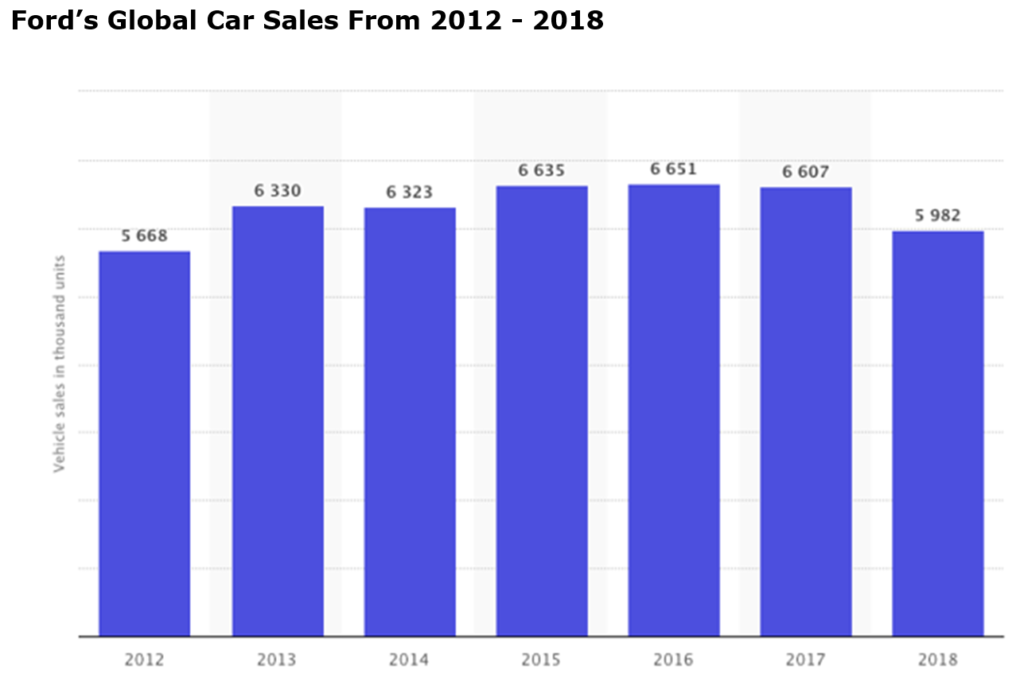

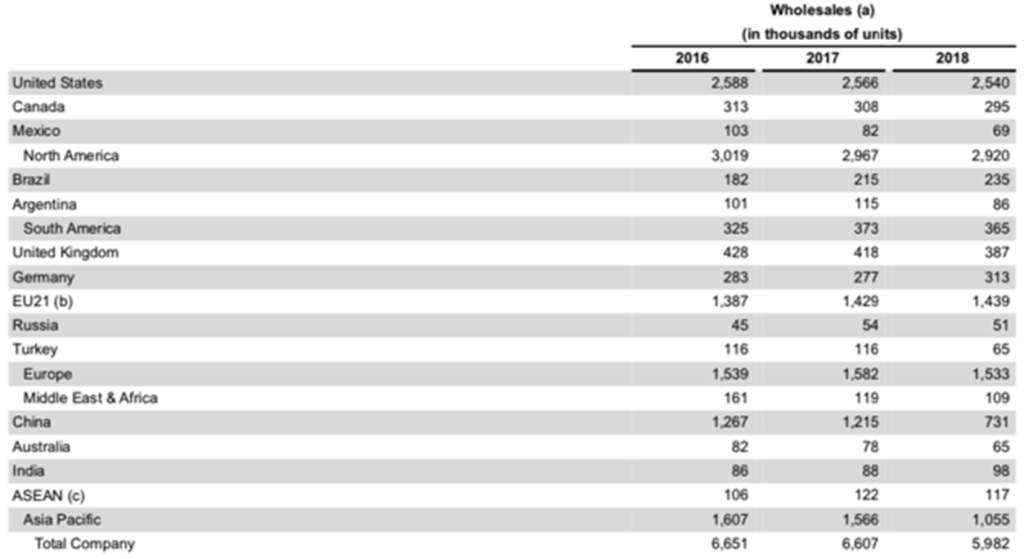

Ford produced about 5,982,000 vehicles worldwide in 2018. Globally, Ford has about 6% – 7% market share. Ford’s largest market is North America where the company has roughly 13% – 14% market share. In the U.S., Ford’s market share is slightly higher at 14% – 15%. This is down from the before the Great Recession but since then the company has consistently maintained its market share. Ford also has about 7.5% – 9% market share in South America and 7% – 7.5% market share in Europe but the market share is higher in commercial vehicles. Notably, Ford only re-entered the Chinese market in 2014 after a long hiatus but now has about 2% – 3% of the market. Ford has much smaller operations in the rest of the world, including the rest of Asia Pacific, the Middle East and Africa.

Ford’s Revenue Growth and Profitability

Ford’s business is growing. Revenue has increased dramatically since 2009 from ~$118B to over $160B in 2018. In the same time period, the company’s gross profit has increased from ~$18B to about $24B. Some of this growth was due to recovery of the global economy and the simultaneous increase in global vehicle sales after the Great Recession. But some of the revenue increase has also been due to growth efforts by Ford including entering the Chinese market. The chart below shows that Ford’s global car sales attained over 6.5 million vehicles between 2015 and 2017, as seen in the chart below. This was about 1 million more vehicles sold than in 2012. Unfortunately, increasing sales and revenue has not translated to the bottom line as discussed below.

Ford’s Global Car Sales From 2012 – 2018

Source: statista.com

Ford Automotive vehicle sales declined in 2018 due to slowing overseas sales resulting from a slowing global economy combined with the exit of sedan models (discussed below). Ford’s vehicle sales in China have dropped significantly to 731 thousand in 2018 from 1,215 million in 2017. As seen in the table below, Ford’s vehicle sales have also slowed in Mexico, Argentina, Turkey, Middle East & Africa, and Australia. This slowdown has continued into 2019 with sales declining (22%) in South America, (32%) in China, (9%) in Asia Pacific, and (22%) in the Middle East and Africa on a year-over-year basis. Sales in Europe stabilized and in fact increased 3% in comparable periods. On a sequential basis, sales in China increased suggesting that the market there may have stabilized.

Ford’s Vehicle Sales By Region From 2016 to 2018

Source: Ford 2018 Annual Report

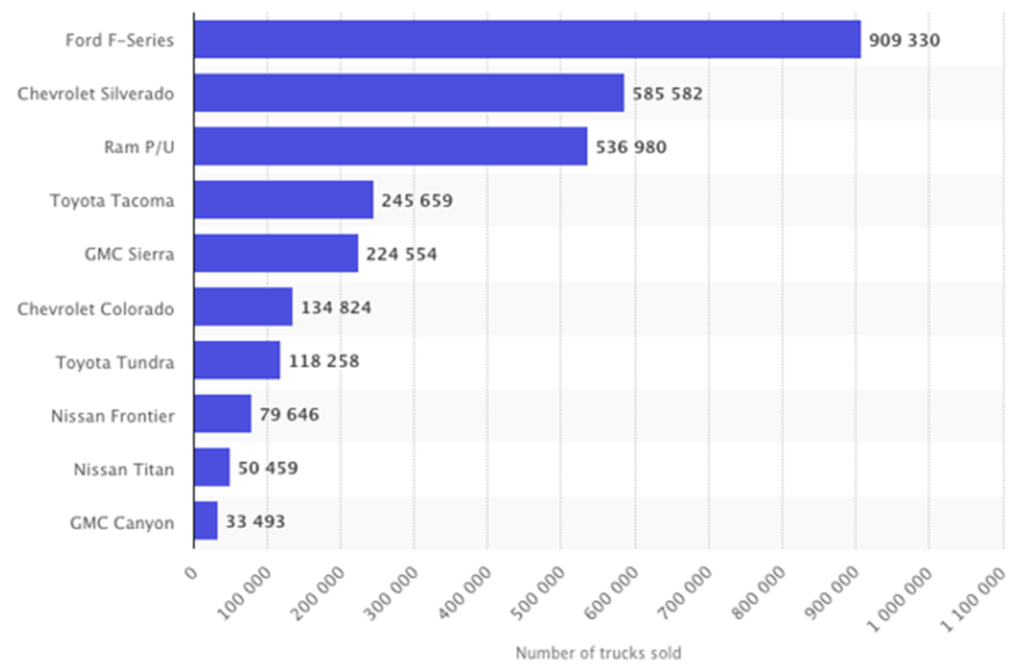

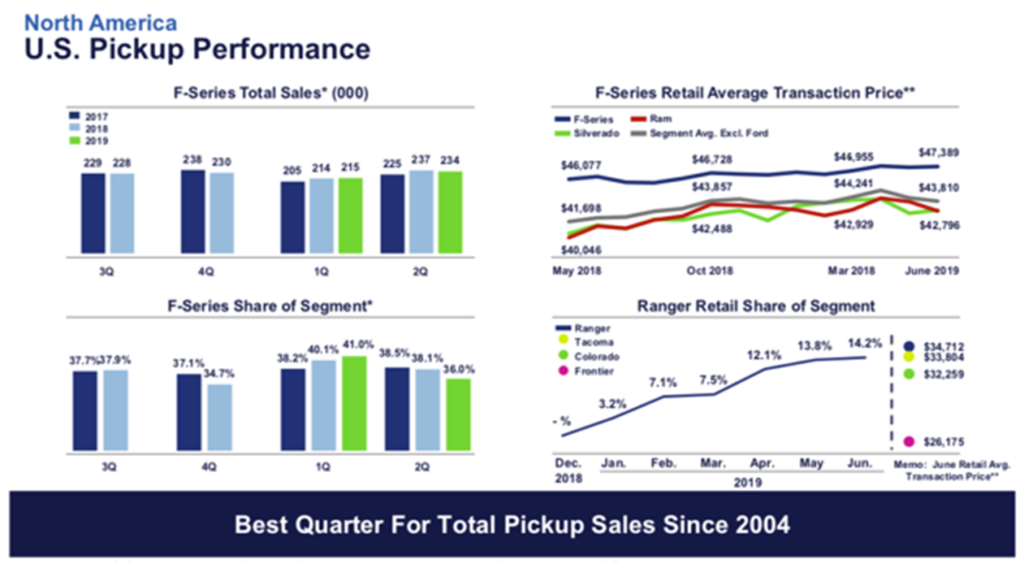

Despite the lower sales in 2018 and continued head winds in 2019, Ford has increased revenue and remained profitable. This is in large part due to robust U.S. and Canadian sales and higher pricing. Ford is the leading car brand in the U.S. Much of this is due to strength of the F-series, which continues to dominate its market segment with more sales and higher pricing than its competitors, as seen in the two charts below. It is the number one selling light truck by a wide margin. The 909,330 F-series sales represent about 15% of Ford’s global vehicles sales. In addition, the recently reintroduced (after eight-year hiatus) Ford Ranger in the U.S. is rapidly gaining market share in its market segment and has higher pricing than its competitors. Notably, Ford did not have a mid-size pickup truck to compete with the Toyota Tacoma, Chevrolet Colorado, and Nissan Frontier. Through Q2 2019, the Ranger has already sold over 30 thousand units in the U.S. If sales momentum keeps up this truck model may enter the top 10 pickup truck brands. The Ranger will be an important vehicle for Ford as the company plans for the pickup truck to be sold globally.

Top Selling Pickup Trucks in The U.S. In 2018

Source: statista.com

Ford’s U.S. Pick Sales Performance

Source: Ford’s 2Q 2019 Earnings Review Slides

Despite Ford’s growing revenue, profitability and margins have been choppy. Gross margins declined from 2010 to 2014 and then reversed to 2016 before declining again. Some of this is likely due to higher expenses from launching operations and sales in China. Ford’s operating margin and net income margin have been on a declining trend since 2010 and 2011, respectively, due to competitive pressures. Both of these metrics were the lowest in 2018 compared to the previous nine years. Recent decline in margins is likely due to the $11B restructuring plan and costs related to discontinuing sedan models in North America. The restructuring plan is a 3 to 5-year effort. But after completion, Ford should be a consistently more profitable company.

Ford’s Revenue and Profitability Metrics From 2009 – 2018

Source: dividendpower.org

Ford Is Restructuring And Making Some Controversial Moves

Ford has started a $11B restructuring globally. A big part of this restructuring will occur in Europe to sustain profitability there. Ford is the No. 1 commercial vehicle brand in Europe but has a lower market share in cars. On the growth front, the company is planning to expand further in commercial vehicles including leadership in the pickup segment. Ford is planning on adding electric vehicle options to all its vehicles in Europe. Ford is also planning on importing niche vehicles. On the efficiency front, Ford is reducing its manufacturing footprint from 24 to 18 facilities by 2020. Ford will discontinue underperforming vehicles including the C-Max, Grand C-Max, and KA+. The company will also reduce 12,000 positions in Europe by 2020, consolidate U.K. offices, and reduce management by 20%. These actions should align Ford’s European cost structure with its reduced footprint and make this region more consistently profitable.

Similarly, Ford is improving efficiencies in South America by exiting heavy truck production and discontinuing the Fiesta and Focus. Labor cuts will occur in South America, North America and other locations as well but on a lessor scale than in Europe.

But perhaps the most controversial part of Ford’s restructuring plan is the shift in focus to light trucks and SUVs and exiting of most sedan models in North America. From this perspective, Ford’s vehicle launches in 2019 and 2020 will focus on light trucks and SUVs. This includes the recently launched Ford Ranger as well as the vehicles seen in the chart below. Although controversial the restructuring plan essentially permits Ford to focus on its franchise strengths of light trucks, SUVs, commercial vehicles, and the Mustang. It will also reduce Ford’s capital expenditure requirements for models that do not sell well or are not profitable but exist only to fill a market segment. This should improve profitability, but this shift is not devoid of risk, as discussed below. Notably, after 1-year of executing this plan, the company is selling fewer vehicles but is more profitable. Earnings in Q1 2019 exceeded estimates and in Q2 2019 revenue increased in North America even though number of vehicles sold decreased. Companywide profitability was lower in the recent quarter but was impacted by restructuring costs of $1,211M and a mark to market loss of $181M for Pivotal software. Notably, operating cash flow was up $1.5B and adjusted FCF was up 80% to $2.1B. In addition, Ford Automotive EBIT was up $1.4B. While the jury is still out, Ford’s restructuring efforts seem to be taking the company in right direction from a cost perspective.

Ford Vehicle Launches in 2019 and 2020

Source: Ford’s 2Q 2019 Earnings Review Slides

Risks

Ford faces major risks related to loss of customers resulting from the shift to pickup trucks and SUVs in the North American market. A recent survey indicated that over half of Ford sedan owners will switch to another brand. For Ford, the risk of loss is minimized since of the 2,539,866 wholesale vehicles that the company sold in 2018 only 445,999 were cars. The remainder were trucks at 1,156,022 and SUVs at 937,845. But still, the question remains whether entry level buyers prefer Ford’s small SUVs and trucks or will go elsewhere to buy a sedan. If buyers go elsewhere then Ford would later have to win those buyers over for its larger vehicles on the strength of product and quality. Another major risk is that consumers may go back to sedans if gas prices increase dramatically. This happened the last time gas prices rose significantly. But saying that, as soon as gas prices declined again, consumers in North America largely went back to buying pickup trucks and SUVs. In fact, of the top 10 selling vehicle models in the U.S., seven were all light trucks and SUVs in 2018. No Ford sedans were on the list. However, Ford’s pickup trucks and SUVs are significantly more fuel efficient now than in the past due to advances in technologies, e.g. EcoBoost, and options for hybrid and electric vehicles.

Beyond the shift away from sedans to light trucks and SUVs, Ford operates in a cyclical industry that is now faced with slowing sales in China, Europe, and some other locations. If this slowdown spreads to North America, then Ford’s top and bottom lines may decline when the company is trying a major strategy shift and restructuring. The company also faces risks of work stoppage related to union contract negotiations. Ford also faces risk to sales due to stronger vehicle emission standards by governments around the world.

How Safe Is Ford’s Dividend?

No discussion of Ford is complete without addressing Ford’s dividend safety. This is a very pertinent question due to the recent history of Ford’s dividend. Ford did not pay a dividend between 2007 and 2011. Let’s examine the dividend from the perspective of payout ratio, FCF, and debt.

The current payout ratio is about 46% based on an annual dividend of $0.60 and estimated 2019 EPS of $1.30. This is a conservative value and below my criteria threshold of 65%. After, restarting the dividend in 2012, Ford’s payout ratio has been relatively low. It did peak in 2018 at ~65%. But EPS was only $0.92 in 2018 and looks to rebound this year. I anticipate that the dividend will be held constant for the foreseeable future and that EPS will grow at low single-digit rates. If EPS grows even as low as 1% then the payout ratio will remain below 50% for the next several years. This is a conservative value. But still a lot depends on the state of the global economy and vehicles sales.

From the perspective of FCF, the dividend is also reasonably well covered. In 2018, Ford’s companywide operating cash flow was $15,022M and capital expenditures were $7,785M. The regular and extra dividend required only $2,905M giving a dividend-to-FCF ratio of roughly 19%. This is a very conservative value and well below my threshold of 70%. But note that that operating cash flow has declined some from 2016 to 2018 and capital expenditures have increased as Ford looks to invest in Mobility and new models. But saying that, Ford should have sufficient FCF to pay for the dividend in the foreseeable future.

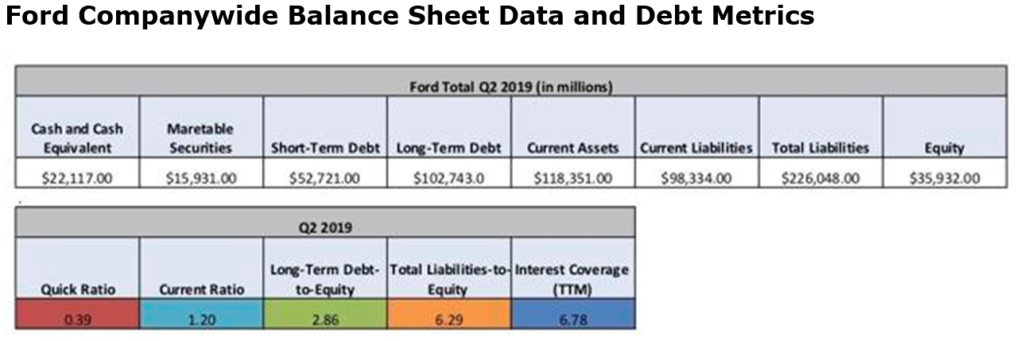

Ford’s balance sheet is difficult to follow due to the activities of both Ford Automotive and Ford Credit. But saying that, Ford seemingly has reasonable debt and debt metrics from the perspective of the dividend. From the companywide perspective, Ford has relatively high short-term debt of $52,721M and long-term debt of $102,740M. But this is largely due to Ford Credit’s debt, which is balanced by receivables from vehicle loans and receivables. But even then, Ford’s current assets exceed its liabilities and it has decent interest coverage indicating that the company’s obligations can be paid. The D/E ratio is high, but this is due to long-term debt from Ford Credit.

Ford Companywide Balance Sheet Data and Debt Metrics

Source: dividendpower.org Research and Calculations Based on Data from Q2 2019 Earnings Release and Morningstar.com

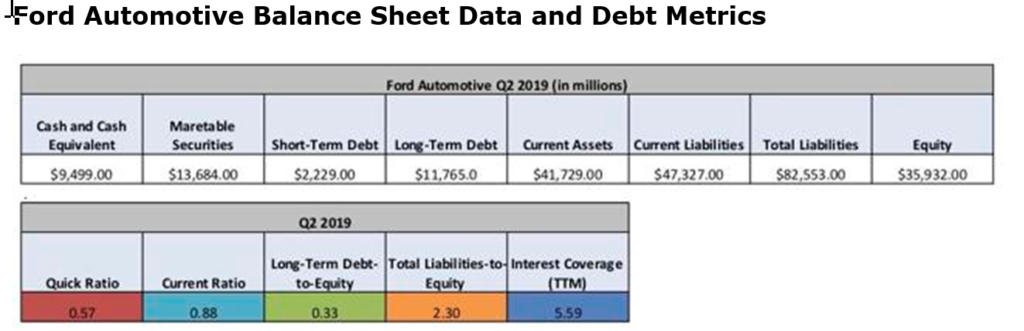

Let’s take a look at Ford Automotive debt separately. Ford Automotive has a reasonable amount of cash and marketable securities that exceeds short-term debt. Furthermore, he company’s D/E ratio is very low 0.33 below my threshold of 2.0. Hence, long-term debt attributable to Ford Automotive does not seem to place the dividend at risk.

Ford Automotive Balance Sheet Data and Debt Metrics

Source: dividendpower.org Research and Calculations Based on Data from Q2 2019 Earnings Release and Morningstar.com

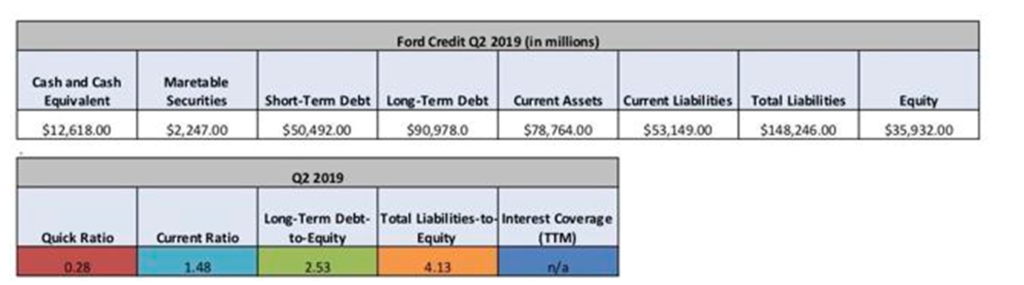

Now let’s take a look at Ford Credit. Ford Credit carries substantial debt of over $141B, but most of it is balanced by receivables. Ford Credit has an investment grade rating. The main risk to the dividend is losses on loans and leases. But saying that, Ford Credit is currently benefitting from higher values on lease returns and lower loss metrics. Repossession rates are only 1.13%, loss-to-receivables ratio of only 0.39%, and charge-offs are $45M in Q2 2019. Ford also does not rely significantly on leases with only 20% of sales versus an industry average of 30%. If losses increase in a recession, then Ford Credit may not be profitable. With that said, Ford Credit carries over $14.8B in cash, cash equivalents, and securities that can be used for covering losses. Due to this and the fact that debt is for the most part balanced by receivables, I do not believe that Ford Credit’s debt is currently a risk to the dividend.

Ford Credit Balance Sheet Data and Debt Metrics

Source: dividendpower.org Research and Calculations Based on Data from Q2 2019 Earnings Release and Morningstar.com

Ford’s Valuation

Let’s now examine Ford’s valuation. I use an expected 2019 adjusted EPS of $1.30, which is slightly higher than the midpoint of current company guidance. For P/E ratio I use 8.0, which is slightly lower than the company’s average 10-year valuation multiple of 8.6. I discount the multiple due to competition, slowing global economy, and uncertainty surrounding the restructuring.

Applying a sensitivity analysis using P/E ratios between 7.0 and 8.0 I obtain a fair value range from $8.96 to $11.52. The current stock price is ~78% to ~101% of my estimate of fair value. The current stock price is ~$9.03 suggesting that the stock is essentially fairly valued.

Estimated Current Valuation Based On P/E Ratio

| P/E Ratio | |||

| 7.0 | 8.0 | 9.0 | |

| Estimated Value | $8.96 | $10.24 | $11.52 |

| % of Estimated Value at Current Stock Price | 101% | 88% | 78% |

Source: dividendpower.org Calculations

How does this compare to other valuation models? Let’s take a look at the Gordon Growth Model using 2019’s expected dividend of $0.60. Assuming a dividend growth rate of 0.0% and a desired return of 8% gives a fair value of $7.50. Morningstar.com is known to use a fairly conservative discounted cash low model and provides a fair value of $12. An average of these three models is ~$9.91 and thus we can comfortably say that Ford is trading pretty much near its fair value at the current stock price. I personally would view a stock price below ~$6.50 as good entry point. The slowing global economy and slower vehicles sales will pressure the stock price. Uncertainty about the restructuring will also keep a lid on the stock price.

Final Thoughts

Ford is an iconic American company. It has continuous operations going back over 100 years. Ford has survived many recessions and still exists in essentially the same form. The company has a strong connection to the Ford family who retain voting control. Ford’s business is relatively stable due to the strength of pickup truck franchise, SUVs, Mustang, and commercial vehicles. These cars sell for Ford and have higher profit margins than sedans. Furthermore, Ford Credit is profitable. On a negative note Ford is struggling in China, Europe, and some other locations. But saying that, Ford’s financial health is dependent on the health of the North American economy. The main interest for this stock is the dividend yield, which at 6.6% is well above the broader market averages. In fact, it is greater than some REITs and MLPs. The dividend is reasonably safe from the perspective of EPS, FCF, and debt. However, I do not view the stock as a buy for DGI since the dividend is not growing and past bottom line results have not been consistent.

If you would like notifications as to when my new articles are published, please click the orange button at the top of the page to “Follow” me.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

https://seekingalpha.com/news/3494134-apple-launching-pro-iphones-fall-bloomberg

Apple launching Pro iPhones this fall – Bloomberg

Aug. 22, 2019 3:29 PM ET|About: Apple Inc. (AAPL)|By: Brandy Betz, SA News Editor

Apple’s (AAPL -0.1%) fall launch event will have two camera-focused “Pro” iPhones that will include a wide-angle lens for the first time, according to a Bloomberg report.

The Pro phones will also include wireless charging, a multi-angle Face ID sensor, improved waterproofing, and new shatter-resistant tech.

The iPhone 11 (placeholder name) line will also include a lower-cost upgrade for the iPhone XR. The camera and processors will get slight upgrades, but no major changes.

Bloomberg’s report also includes new iPad, MacBook Pro, and Apple Watch models, which could debut sometime this year.

The iPhone launch event is rumored for September 10.

China’s enormous debt ‘no longer can be ignored,’ analyst says

PUBLISHED FRI, AUG 23 2019 1:49 AM EDTUPDATED FRI, AUG 23 2019 2:16 AM EDT

Shriya Sharma

KEY POINTS

- Fraser Howie, an independent analyst, told CNBC: “China is very much past the tipping point where the debt simply no longer can be ignored.”

- The trade war has put a dent in efforts to pare its massive debt as Beijing sought ways to boost its slowing economy, which was at its lowest growth in 27 years this year.

- In what some analysts called effectively a rate cut, the People’s Bank of China also this week launched a key interest rate reform — the loan prime rate — that would make borrowing costs for companies cheaper.

- But Howie told CNBC that the issue was really whether there would be demand for more credit.

The world’s second biggest economy, which is slowing, is past a point where it cannot ignore its enormous debt anymore, according to an analyst.

Fraser Howie, an independent analyst, told CNBC Tuesday that there’s a “whole host of hidden debt” in China, which had kick started stimulus this year as its economy slowed.

“China is very much past the tipping point where the debt simply no longer can be ignored. The cost of servicing the debt … simply distracts from almost everything else,” said Howie.

China’s total debt — corporate, household and government — rose to over 300% of its GDP in the first quarter of 2019, slightly up from the same period a year earlier, according to a report by the Institute of International Finance.

“China … (had) this huge stimulus and turn on the credit taps and they drove all this global demand,” Howie said. “But there clearly was going to be a cost … and now they are suffering (from) it.”

China’s debt levels rapidly shot up a few years ago as its banks extended record amounts of credit to drive growth, which led to the Asian giant undertaking deleveraging efforts, or the process of reducing debt.

But the trade war has put a dent in its efforts to pare its massive debt as Beijing sought ways to boost its slowing economy, which was at its lowest growth in 27 years. Earlier this year, banks started to increase its lending again, with new loans surging to a record high.

In what some analysts called effectively a rate cut, the People’s Bank of China also this week launched a key interest rate reform — the loan prime rate — that would make borrowing costs for companies cheaper, and theoretically boost investment.

But Howie told CNBC that the issue was really whether there would be demand for more credit.

“The Chinese economy is clearly slowing, there are a lot of headwinds, there’re companies leaving China. China’s becoming a much harder investment case for a number of reasons. So is the underlying demand there or not?” he asked.

Here’s what we learned about Disney’s upcoming films at the D23 Expo

PUBLISHED SAT, AUG 24 2019 4:57 PM EDTUPDATED SAT, AUG 24 2019 6:28 PM EDT

KEY POINTS

- “Black Panther” sequel will be released in May 2022.

- “Raya and the Last Dragon” is an animated feature coming Thanksgiving 2020.

- Disney revealed exclusive clips from “Rise of Skywalker,” “Black Widow,” “Jungle Cruise,” and more.

Disney is the king of the box office. The company, which houses a half dozen studios under its film umbrella, has hauled in nearly $8 billion globally since January, and still has three more film releases before the end of the year.

On Saturday, the company gave fans more to feast on. In addition to providing information about already announced and upcoming releases like “Frozen II,” “Star Wars: The Rise of Skywalker” and “Black Widow,” Disney shared details about previously unannounced projects like “Raya and the Last Dragon” and “Black Panther II” during a panel at its D23 Expo in Anaheim.

The panel was packed with more than 7,000 Disney fans eagerly awaiting every scrap of a detail or glimpse into Disney’s upcoming catalog of feature films.

Here’s a breakdown by studio of what movie audiences can expect from Disney in the coming years.

Fox

Co-chairman of Walt Disney Studios Alan Horn was the host of the panel Saturday. He began the presentation showcasing the titles from 20th Century Fox that Disney had acquired and would be released in the next year and beyond.

“Ford v Ferrari” will hit theaters in November; “Spies in Disguise,” an animated feature comes in December; “The King’s Man,” arrives in February of next year; and the first sequel to “Avatar” will be released in 2021.

The recent Fox acquisition is just another feather in Disney’s cap and the work of CEO Bob Iger. Horn praised Iger’s 14-year tenure at the helm of the company saying, “three of the studios we are celebrating today wouldn’t be possible without Bob Iger.”

Fox marks the fourth major studio acquisition that Iger has completed during his time with the company.

Star Wars

“The Rise of Skywalker,” the final film in the Skywalker saga arrives to theaters in December. The much anticipated film has been kept under wraps by the folks at Lucasfilm. A teaser trailer was released in April at Star Wars Celebration in Chicago, but very few stills, clips or videos have been released since.

Fans got a brief glimpse at another teaser which received deafening applause and chants for it to be played again.

In the footage was a duel between Rey and Kylo Ren, C-3PO with red eyes, a glimpse of General Leia and shots of the group of heroes standing on a cliff above a bustling desert city. However, the shot that truly made the crowd roar was a quick scene with Rey in a hooded black robe unfolding a red double-sided lightsaber.

“It’s hard for me to understand the story is ending,” said Anthony Daniels, the actor behind C-3PO said on stage at the Expo. “But what an ending. You’ll love it.”

Fans are still eagerly awaiting an official trailer for the upcoming film, but these new visuals will keep them buzzing until one is released.

Marvel

The 23 film epic that is the “Infinity Saga” has ended and Marvel is headed toward a new beginning. Old favorites and new faces met at D23 as the studio announced a sequel to “Black Panther” due out in May 2022, as well as the cast behind the upcoming “Eternals.”

“Game of Thrones” alum Kit Harrington was announced as the character Dane Whitman, aka the Black Knight, and Angelina Jolie was revealed as the warrior Thena.

Other cast members include Richard Madden as Ikaris, Gemma Chan as Sersi, Salma Hayek as Ajak, Brian Tyree Henry as Phastos, Barry Keoghan as Druig, Kumail Nanjiani as Kingo, Lia McHugh as Sprite, Dong-seok Ma as Gilgamesh and Lauren Ridloff as Makkari.

Also during the panel, Marvel revealed footage from “Black Widow,” which teased that fans will finally get to see exactly what happened in Budapest all those years ago.

Live-action

Following the monumental success of the “Pirates of the Caribbean” franchise, Disney will release a film based on the iconic Jungle Cruise ride.

The film features Dwayne Johnson as the skipper and Emily Blunt as a scientist looking for a magical tree with healing properties.

The company also provided more context for its upcoming sequel to “Maleficent.” “Maleficent: Mistress of Evil” takes places several years after the first. Aurora is now older and she and her adoptive mother must deal with a world that wants to keep them apart.

Jolie, who reprises her role as Maleficent, said the film explores how family is not just defined by blood, but love.

Disney showed several clips from “Mulan,” which hits theaters next year. The scenes detail the epic battle sequences and costuming for the reimagining. The film will blend together elements of the original ballad of Mulan with the animated Disney feature.

The studio also revealed an image of Emma Stone in “Cruella,” but not much else was revealed about the film. Stone did reveal via a video that the movie is set in 1970′s London.

Pixar

Next year, Pixar will release two original features “Onward” and “Soul.”

“Onward,” which will arrive in theaters in the spring, centers around two elf brothers who lost their father at a young age. The pair are given a chance to see him via a magic spell. However, when they attempt to perform the spell, something goes wrong.

The brothers now must travel on a quest to complete the spell and reunite with their dad. The story takes place in a mythical realm where centaurs, unicorns and gnomes roam.

The second film, due out in the summer, is “Soul.”

The feature focuses on the question “why am I here?” and tells the story of how each person on the planet received their soul. Souls are trained in a place called the “You Seminar,” and only after completing the course are they placed into a body.

Pixar executives explained that the film details how souls earn their personalities, traits and quirks.

The story centers around Joe Gardner, a middle school band teacher who dreams of becoming a famous jazz musician. Gardner has a misstep on the streets of New York and is accidentally transported back to You Seminar. There he meets a soul named Twenty-Two, who has been at the Seminar for years, and is terrified of Earth.

Jamie Foxx, Tina Fey, Ahmir “Questlove” Thompson, Phylicia Rashad and Daveed Diggs are all lending their voices to the film.

Walt Disney Animation

To end the presentation, Disney revealed its Thanksgiving feature for 2020: “Raya and the Last Dragon.” The animated adventure film centers around Raya, a warrior in search of the last dragon in the fictional world of Kumandra. The production team pulled inspiration from South East Asia.

However, when she finds this creature, it’s not quite as she had expected. Sisu is trapped in human form and needs help to reclaim her power and transform into her true form.

Cassie Steele voices Raya while Awkwafina voices Sisu.

The studio also revealed the first glimpses of “Frozen II,” including three new songs. If you thought “Do You Want to Build a Snowman?” and “Let It Go” were catchy — just wait. Bobby and Kristen Lopez, the Academy Award-winning duo behind the music of the first film, have returned with gusto.

The film will answer questions like “why does Elsa have powers, but Anna doesn’t?” “Where did Elsa get her powers?” and “Where were Anna and Elsa’s parents going when they died?”

The creative team revealed that Evan Rachel Wood would voice Anna and Elsa’s mother in a flashback and Sterling K. Brown would voice Lieutenant Mattias, the leader of a group of people who have been trapped in an enchanted forest for decades.

Trump hints at a ‘very big trade deal’ with Britain post Brexit

PUBLISHED SUN, AUG 25 2019 5:41 AM EDTUPDATED SUN, AUG 25 2019 10:26 AM EDT

KEY POINTS

- President Donald Trump said that he would have a major trade deal with U.K. after it leaves the European Union.

- Clouding the G-7 gathering, which represents the world’s major industrial economies, is Britain’s uncertain removal from the European Union.

- In less than three months, Johnson will be at the helm of overseeing Brexit, a move considered to be one of the most significant political and economic changes for the kingdom.

SAINT-JEAN-DE-LUZ, France — President Donald Trump met Britain’s Prime Minister Boris Johnson kicking off Group of 7 meetings in the French seaside town of Biarritz.

Clouding the G-7 gathering, which represents the world’s major industrial economies, is the U.K.’s uncertain exit from the European Union.

“He needs no advice, he’s the right man for the job,” Trump said when asked if he had any guidance for Johnson on how to deliver Brexit. “This is a different person and this is a person that is going to be a great prime minister in my opinion,” Trump added of the new prime minister.

In less than three months, Johnson will be at the helm of overseeing U.K.’s exit from the European Union, a move considered to be one of the most significant political and economic changes for the kingdom. And yet, it is still unclear, how, when or if Britain will still leave the European Union. The uncertainty around Brexit has rocked global markets and spooked allies.

Trump said that he would have a major trade deal with U.K. upon leaving the European Union.

“We’re are having very good trade talks between the U.K. and ourselves. We’re going to do a very big trade deal, bigger than we’ve ever had with the UK,” Trump said. “At some point, they won’t have the obstacle of, they won’t have the anchor around their ankle, because that’s what they had. So, we’re going to have some very good trade talks and big numbers,” he said without adding any more detail on a potential deal.

Johnson said he was similarly looking forward to future trade deals with the United States and praised Trump’s work on the American economy.

“We’ll be having some pretty comprehensive talks about how to take forward the relationship in all sorts of ways, particularly on trade and we are very excited about that,” Johnson said. “And I just want to actually congratulate the president on everything that the American economy is achieving, it’s fantastic to see that,” he added.

Self-made millionaire: 6 biggest money lies young people need to stop telling themselves

Published Fri, Aug 23 2019 10:35 AM EDTUpdated Fri, Aug 23 2019 3:51 PM EDT

Ramit Sethi, Contributor@RAMIT

People have lots of reasons for not managing their money properly. A few of those reasons are valid, but most are just poorly veiled excuses for being lazy and not wanting to spend 10 minutes on research.

I’ve heard some blame the education system for not teaching them about money. It’s easy for people in their 20s to wish that their colleges had offered some personal finance training. But guess what? Most colleges do. You just didn’t take them!

The harsh truth is that you’re not victims. You’re in control of your own finances — and the sooner you internalize that, the sooner you can start to go on the offense.

The first step is to acknowledge some of the biggest money lies young people tell themselves:

1. “I need to focus on making passive income.”

To many millennials, passive income sounds like a dream. They hear about some guy who took a three-week vacation — while still continuing to earn money — and then say, “I can’t do that!” What they don’t see, however, is the amount of time and work it took to get there.

Most people, especially the young ones who are just entering the workforce, don’t need to focus on passive income. Instead, they should be putting more effort into improving their active incomes — by focusing on their careers. They can do this by sharpening their work skills, solving more problems for their bosses and basically out-hustling their co-workers.

A lot of people hate hearing this because it means that instead of fantasizing about earning a passive income of $500 a day, they actually have do some real work at their jobs.

I’ve also seen people who are hard workers, but are too afraid to ask for a salary increase because their “company doesn’t have the funds” or because “economy is bad.”

Why? Because it’s easier: If we accept a force that we believe is out of our control (like a “bad economy”) in dictating whether or not we get a get a raise, we feel less pressure to put in the effort.

Solution: Put in the hours and get better at your job so you can earn more money. If getting a raise isn’t an option, find another job and negotiate a higher salary.

2. “If I just try harder, I can save more money.”

We all know we need to save money, the same way we know we need to exercise more, eat healthier and call our families regularly. But there are serious barriers to doing all these things.

Simply “trying harder” won’t help you succeed (there are even studies that will tell you the same thing). Trying to save money by buying the cheaper item isn’t enough. Trying to cut back on buying lattes won’t help, either.

In order to see results, you need to actually sit down and have a conversation with yourself about what needs to be done, step-by-step.

Take a look at your finances and ask yourself: What are you trying to do that takes a lot of effort, but for little gain? What’s not working no matter how hard you try? How can you make things easier for yourself?

Solution: Automate your finances so you’re not dependent on your willpower. in Brooklyn spends her money

3. “I’m going to start keeping a budget.”

Most of us, at some point in our lives, will get motivated and decide: “Yes! I’m going to start keeping a budget!”

Creating a budget to cut down on your expenses is the sort of worthless advice that personal finance experts feel good prescribing to millennials. But the few people who actually attempt to budget completely fail after a few days because they eventually realize that it’s really difficult (and overwhelming) to track every penny they spend.

Also, more often than not, it doesn’t work because a budget tracks what you’ve already spent, and so when you look back at the end of the month, you feel horrible and guilty after realizing that you overspent. Budgets offer no forward-looking information.

Creating a budget to cut down on your expenses is the sort of worthless advice that personal finance experts feel good prescribing.

Instead of keeping a budget, I recommend creating what I call a “Conscious Spending Plan,” a strategy that forces you to look to the future while also allowing you to spend extravagantly on the things you love — as long as you cut costs mercilessly on the things you don’t love.

Solution: Create a Conscious Spending Plan by splitting up your income into four categories:

- Fixed costs: Rent, groceries, student loans, utilities, etc. (50% to 60% of your income)

- Long-term investments: 401(k), Roth IRA, etc. (10% of your income)

- Savings goals: Holiday gifts, vacations, down payment on a home, etc. (5% to 10% of your income)

- Guilt-free spending: Dining out, movies, shopping, etc. (20% to 35% of your income)

By allocating your money this way, you can make sure you have enough to pay off all your responsibilities first. Then, any money left over can go towards your savings goals and everyday spending.

The guilt-free spending category allows you to buy what you want while knowing that your most important expenses are taken care of. (More on how to create a Conscious Spending Plan here.)

4. “My friends earns less than me, yet they’re still able to go on four vacations every year!”

You friends are either highly skilled practitioners of Conscious Spending — or have absolutely no clue how to manage their money.

Think back to when you were a kid: How many times did you hear one of your parents ask the other: “Why can’t we go on vacations the way our neighbor does?” — without actually understanding how their neighbor’s spending breaks down. Chances are they’re not conscious spenders, but rather over-spenders.

Put another way, would you ask your friend who failed his English 101 class for grammar lessons? Hopefully not. So why would you look at your ordinary friends — who make ordinary money decisions and end up with ordinary results (a.k.a. not having enough money) — as role models?

Solution: Refocus your financial aspirations and strive to become like people who make conscious money decisions. Don’t follow the examples of those who show off by spending more than they have. If you suspect they can’t afford it, they probably can’t.

5. “I’m going to start investing.”

Ask any of your friends how much they’ve invested in stocks, and most of them will probably say they “don’t earn enough money” or “don’t have enough expertise” to do it.

According to a recent Gallup poll, only 37% of young Americans ages 35 and under said they owned stocks between 2017 and 2018, compared to the 61% of people over the age of 35 did own stocks.

Opening an investment account gives you access to the biggest money-making vehicle in the history of the world — and you don’t have to be rich to do it. Many account providers will waive minimums (the amount required to open an account) if you set up an automatic monthly transfer.

So many people say they’re “going to start investing,” and then end up not doing it. Why? Because they don’t think they’re capable of understanding the basics and don’t want to risk losing their hard-earned money.

But for every day that you don’t invest, you’re losing moneydue to inflation — and you’ll never realize this until you’re in your 70s, at which point it’ll be too late.

Solution: Any new topic is overwhelming (i.e., diets, workout regimens, parenting). The answer isn’t to avoid it — it’s to pick a source of information to learn from and then actually start investing.

6. “Wanting to ‘get rich’ is bad.”

Obsessing over money and being consumed by greed is bad, but wanting a better future for you and your loved ones is anything but.

Having more money opens up an incredible amount of options for you and everyone around you. I’ve said this many times, and I’ll say it again: “Getting rich” isn’t just about money — it’s about living a rich life, and living a rich life might mean different things to different people.

For some, it means having the financial freedom to spend extravagantly on their hobbies. For others, it means having the luxury of paying for a house cleaner every week.

For me, part of what living a rich life means is the ability to step away from my business for six whole months to go on my honeymoon.

Solution: Think about what living a rich life means to you and let that inspire you to take action in growing your money.

Ramit Sethi, author of the New York Times best-seller ”I Will Teach You To Be Rich, ” has become a financial guru to millions of readers in their 20s, 30s and 40s. He became a self-made millionaire at a young age, thanks to his website(which he started as a Stanford undergraduate in 2004), book and personal finance courses.

HI Financial Services Mid-Week 06-24-2014