HI Market View Commentary 11-17-2019

I do what I do because I can do it anywhere !!!!

Which really allows me the opportunity to give back

I truly enjoy the game !!! I want to make money

SO what’s challenging to you in the stock market

DIS, V, F, UAA, BIDU HUGE upside opportunity

FB, MU, AAPL,

Some things that bother me?!!?!?!!!!

Cycles that you know should happen but for some reason are held up

It bugs me that I don’t do a better job of trading tops and bottoms

The would’a, should’a, could’a s that make you question yourself

I worry about clientele perception and some of their ridiculous comments/thoughts

I am willing to admit I don’t know it all !!!!!

I am collar trading, going longer out in time to give the trade the opportunity to work, dollar cost averaging

Where will our markets end this week?

I don’t know

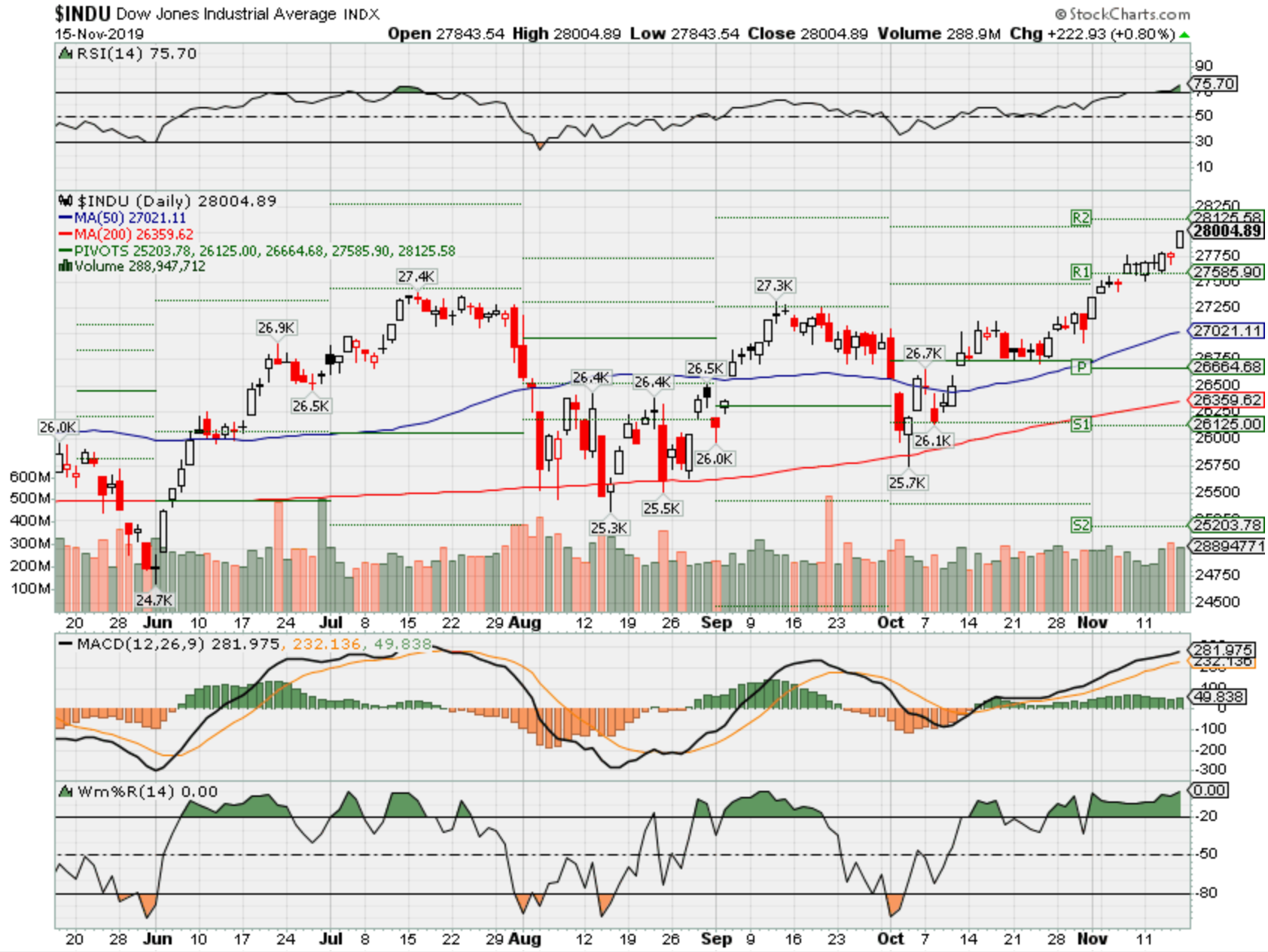

DJIA – Bullish

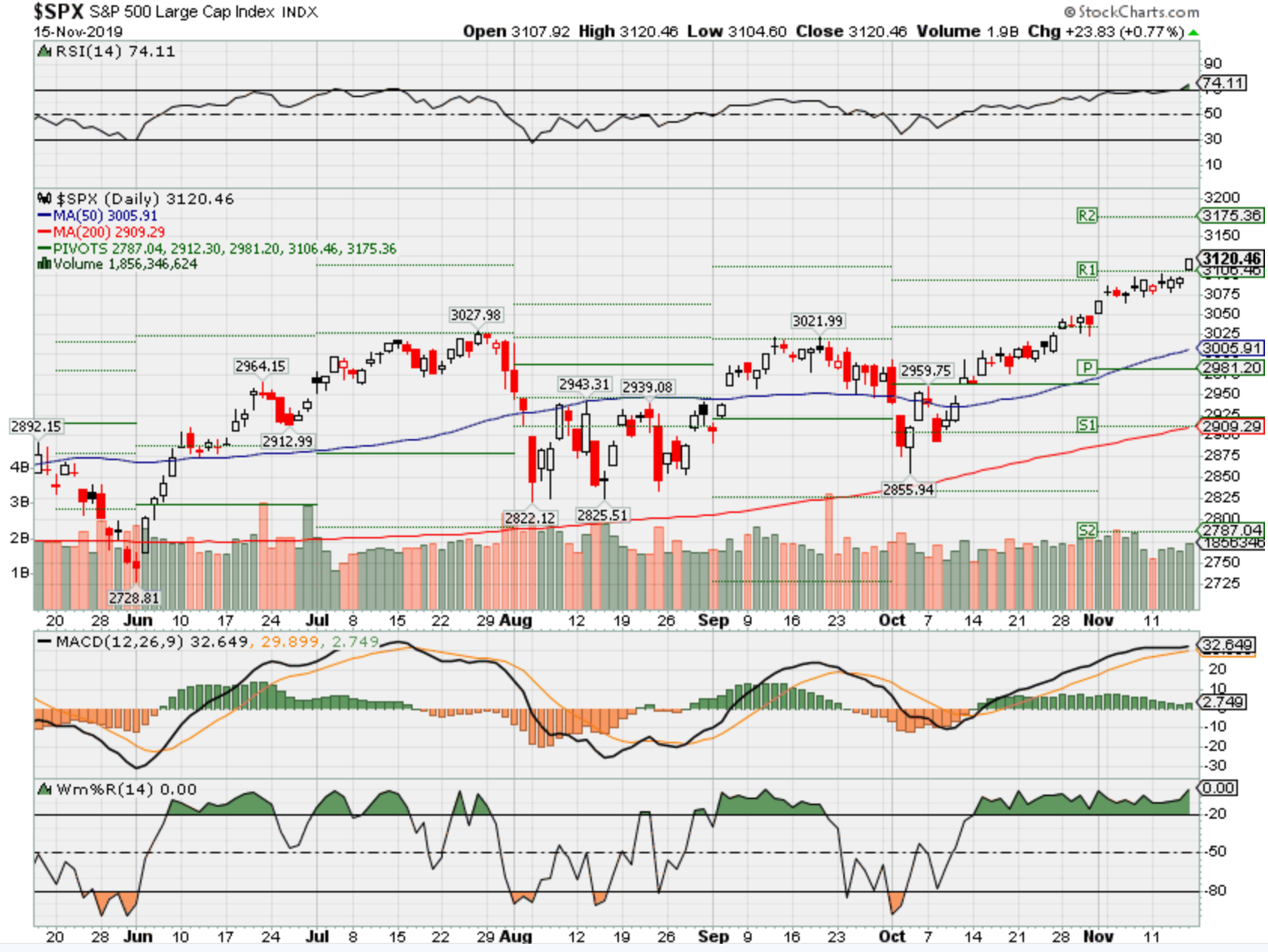

SPX – Bullish

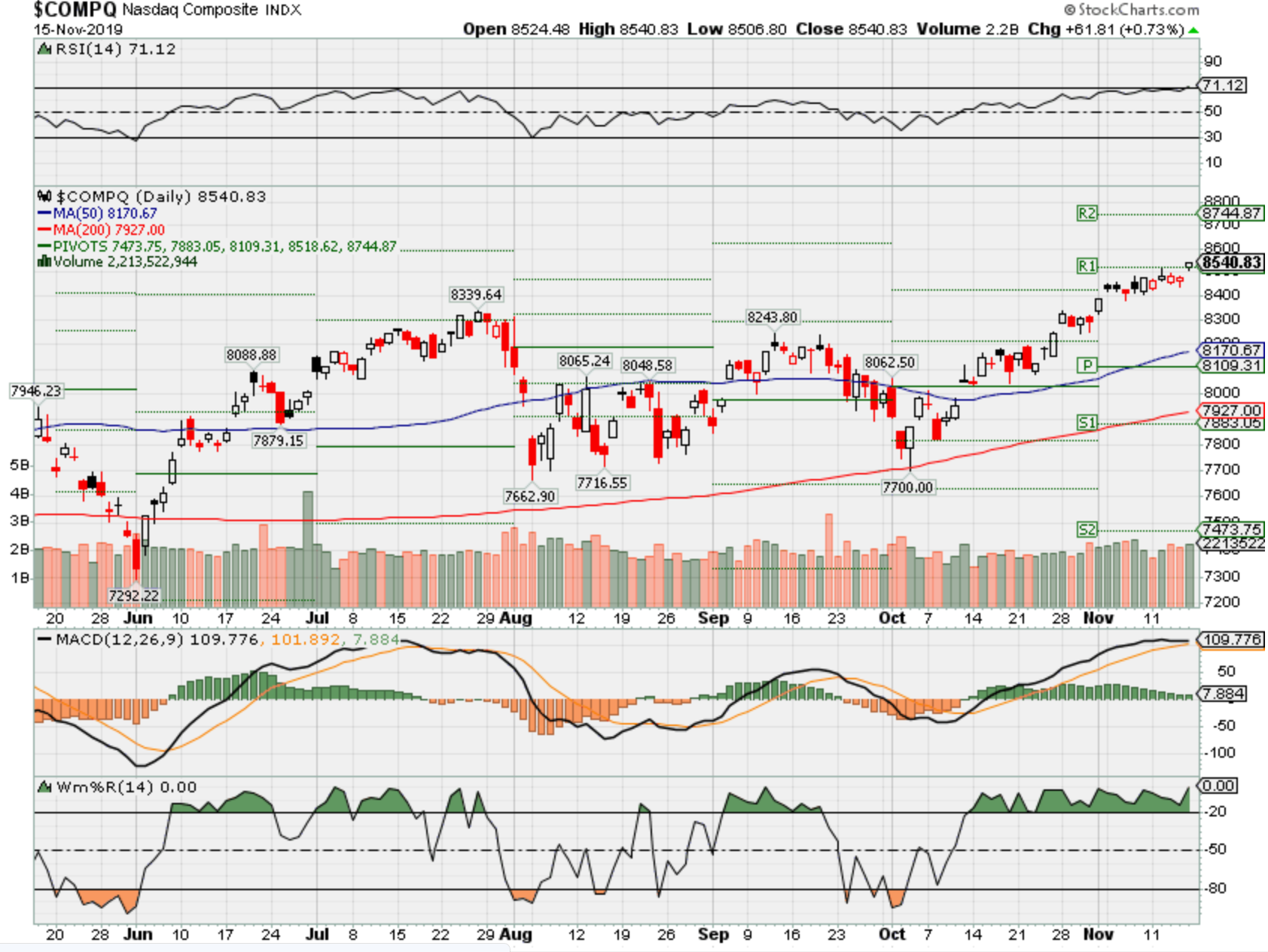

COMP – Bullish

Where Will the SPX end Nov 2019?

11-18-2019 +2.25%

11-11-2019 +2.25%

11-04-2019 +2.25%

Earnings:

Mon:

Tues: HD, KSS, TJX, URBN

Wed: LOW, TGT, JACK, LB, NTES

Thur: M, SDRL, GPS, INTU, JWN, ROST,

Fri: FL,

Econ Reports:

Mon: Net Long Term TIC Flows

Tues: Building Permits, Housing Starts

Wed: MBA, FOMC Minutes

Thur: Initial, Continuing, Phil Fed, Existing Home Sales, Leading Indicators

Fri: Michigan Sentiment,

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Saturday/Sunday –

How am I looking to trade?

I’m preparing for earnings = Adding long puts

Running just stock positions, leap long call positions, and looking at individual stock positions

AOBC – 12/05 est

MRVL 11/26 est

TGT – 11/20 BMO

www.myhurleyinvestment.com = Blogsite

support@hurleyinvestments.com = Email

Questions???

China is building up its ‘shadow reserves’ to counter its reliance on the US dollar

PUBLISHED SUN, NOV 17 20197:21 PM EST

KEY POINTS

- Ongoing trade tensions with the U.S. has “increased the risk of a financial decoupling” between the two largest economies.

- Beijing will therefore manage its risk by diversifying its foreign exchange reserves into other currencies, ANZ predicted, as well as build up its “shadow reserves.”

- Beijing is gradually reducing its holdings of U.S. Treasurys, which it is heavily invested in, and it has been going on a gold buying spree.

China is heavily exposed to the U.S. dollar, but now, with the risk of “decoupling,” Beijing is silently diversifying its reserves to reduce its dependence on the world’s largest reserve currency, analysts say.

Ongoing trade tensions with the U.S. has “increased the risk of a financial decoupling” between the two largest economies, ANZ Research said in a recent report. The White House reportedly considered some curbs on U.S. investments in China such as delisting Chinese stocks in the U.S.

Beijing will therefore manage its risk by diversifying its foreign exchange reserves into other currencies, ANZ predicted, as well as build up its “shadow reserves.”

“Although China still allocates a high share of its FX exchange reserves to the USD … the pace of diversification into other currencies will likely quicken going forward,” ANZ says in the report, adding that the share of the dollar in the country’s foreign exchange reserves was estimated to be around 59% as of June.

Although the exact allocation of China’s foreign exchange reserves in different currencies isn’t known, ANZ told CNBC it believes those would include the British pound, Japanese yen and euro.

Meanwhile, Beijing is gradually reducing its holdings of U.S. Treasurys, which it is heavily invested in — China was the largest foreign holder until June, when it was surpassed by Japan. Since peaking in 2018, China has reduced its holdings by $88 billion in the last 14 months, DBS said in a note.

According to data from the U.S. Treasury department, China held $1.11 trillion of U.S. debt in June.

At the same time, Beijing has been going on a gold buying spree, with its official gold reserves holding at record levels of 1,957.5 tons in October.

Chinese companies are also highly exposed to moves in the greenback, said Pinebridge Investment’s global economist Paul Hsiao, who pointed out the country reportedly has more than $500 billion in foreign corporate debt.

“Much of that is in US dollars, which can be a problem for Chinese corporates,” said Hsiao in an email to CNBC, explaining that occurred during the height of the U.S.-China trade war, when the greenback appreciated “significantly” against the yuan. That caused many Chinese firms to sell their assets as many of their liabilities are still denominated in the dollar, he explained.

“Diversifying its currency holdings, in a way is very much in line with the recent political moves of the Xi administration to focus on China’s trade relationships beyond just the United States. China and, more broadly, the Asian region is still highly exposed to movements in the US dollar,” Hsiao said.

One other big way China could manage that risk is by building up other forms of assets — what ANZ called its “shadow reserves.”

“In fact, we believe that the Chinese government has already discreetly diversified its offshore portfolios to include alternative investments,” the ANZ report said.

China’s ‘shadow reserves’

In recent years, Beijing has been increasing its stakes in alternative investments, and much of that is through several investment vehicles such as its state-owned companies and banks, as well as through funds co-managed with other countries, according to an ANZ analysis.

Those investments include equities, as well as issuing loans via its state-owned banks — especially for its mammoth Belt and Road initiatives, according to the analysis.

China’s State Administration of Foreign Exchange (SAFE), which manages China’s foreign reserves, has four investment entities: Huaxin in Singapore, Huaou in London, Huamei in New York, and Hua’an in Hong Kong. They are reportedly affiliated with other offshore entities which invest in equities, according to the report.

Funds it has invested in include the China-Africa Development Fund, as well as the China-LAC Cooperation Fund — which finances projects in the Latin America and Caribbean regions. Beijing has been increasing its shares in those funds, or injecting more capital in regional banks. It has also been swapping loans to equity, according to the ANZ report.

“These offshore investments, called China’s shadow reserves, amounted to USD1.86 (trillion) in historical value as of June 2019,” said ANZ in the report.

As of July, its total foreign exchange reserves stood at around $3.1 trillion.

“SAFE has now adopted a highly risk averse strategy in managing the USD 3.1 (trillion) reserve base and diversification will help it reduce risk on its reserve portfolio,” said Siraj Ali, chief operating officer of AJ Capital.

A larger global role for the yuan

The U.S. dollar is currently the world’s “reserve currency” — about 58% of all foreign exchange reserves in the world are in U.S. dollars, according to the IMF, and about 40% of the world’s debt is denominated in dollars.

“The global financial system is highly U.S. dollar-centric and the larger economies, including China and the euro area, have been keen to move to a multi-polar reserve currency world,” S&P Global Ratings’ APAC chief economist Shaun Roache told CNBC in an email.

“For China, this would help reduce reliance on U.S. dollar financial conditions and, over time, provide more room for the renminbi to play a larger global role,” he added, referring to the yuan’s other name.

The world’s second-largest economy has been pushing for greater, more globalized use of the yuan.

Efforts are likely to continue to reduce the world’s reliance on the dollar, said Roache. That would include denominating commodity contracts in currencies other than the dollar, and diversifying reserves, he said.

Nvidia revenue guidance misses expectations

PUBLISHED THU, NOV 14 20194:41 PM ESTUPDATED THU, NOV 14 20197:04 PM EST

KEY POINTS

- Nvidia beat on the top and bottom lines, but quarterly revenue guidance was below expectations.

- The company’s revenue has now declined four quarters in a row.

Nvidia shares seesawed in extended trading on Thursday after the company issued better-than-expected fiscal third-quarter results and slightly soft quarterly guidance.

Here’s how the company did:

- Earnings:Excluding certain items, $1.78 per share, vs. $1.57 per share as expected by analysts, according to Refinitiv.

- Revenue: $3.01 billion, vs. $2.91 billion as expected by analysts, according to Refinitiv.

Nvidia’s revenue fell 5% from a year ago in the quarter, which ended on October 27, according to a statement. The company sold inventory that it had previously written off in the quarter, but revenue has now declined four quarters in a row on an annualized basis.

Nvidia’s largest business segment, Gaming, shrunk 6% year-over-year at $1.66 billion in quarterly revenue, which is above the $1.54 billion consensus among analysts polled by FactSet.

The company Data Center business delivered $726 million in revenue, less than the $754.2 million FactSet consensus estimate. The Professional Visualization segment came up with revenue of $324 million, higher than the $315.4 million estimate.

In the fiscal third quarter Nvidia announced new GeForce Super graphics processing units for gaming and a new kind of Microsoft Azure Data Box Edge hardware product containing its T4 GPUs.

In terms of guidance, Nvidia said it expects $2.95 billion in revenue, plus or minus 2%, for the fiscal fourth quarter, which implies a nearly 34% increase. But analysts polled by Refinitiv had expected $3.06 billion in fiscal fourth-quarter revenue.

The company believes the Data Center business will post a sequential improvement in the fiscal fourth quarter. Nvidia’s forecast doesn’t include the impact from Mellanox, a $6.9 billion acquisition that has not yet closed.

Nvidia is calling for $805 million in operating expenses in the fiscal fourth quarter, excluding certain items, more than the FactSet estimate of $768 million.

In the past year Nvidia has dealt with numerous issues, including the disappearance in revenue from selling cards for mining cryptocurrencies and a pause in spending from companies that operate hefty data centers, and they’ve hurt the company’s track record of surpassing expectations, Deutsche Bank analysts led by Ross Seymore wrote in a note distributed to clients on Sunday.

The analysts, who have a hold rating on Nvidia, said it was likely the company would achieve “positive follow-through” in its Data Center segment in the fiscal fourth quarter, although the Gaming business would have a tougher sequential revenue comparison, partly because of negative seasonality effects from Nintendo Switch console sales.

Nvidia stock has risen 57% since the start of 2019.

Fear of missing out on a rally replaces recession worry in the most widely watched investor poll

PUBLISHED TUE, NOV 12 20197:40 AM ESTUPDATED TUE, NOV 12 201912:31 PM EST

KEY POINTS

- Bank of America Merrill Lynch’s regular survey of global fund managers finds investors have traded fears of recession for the “fear of missing out.”

- The investment bank’s latest survey of global fund managers found that cash levels posted their largest decline since President Donald Trump’s 2016 election.

- “The bulls are back…global recession concerns vanish and ‘Fear of Missing Out’ prompts wave of optimism and jump in exposure to equities,” BofA writes.

Portfolio managers who spent much of the summer worried about an impending recession are now instead afraid of losing out as the stock market heads for record highs, according to a widely followed survey conducted by Bank of America Merrill Lynch.

The investment bank’s latest monthly survey of global fund managers found that cash levels posted their largest decline since President Donald Trump’s 2016 election to 4.2% from 5% as investors rushed to take on risk. Cash on hand is now at its lowest level since June 2013.

Michael Hartnett, chief investment strategist at Bank of America, also said that manager global growth optimism surged by the most in 20 years to 18-month highs, a sign investors expect better manufacturing and profit numbers worldwide.

“The bulls are back…global recession concerns vanish and ‘Fear of Missing Out’ prompts wave of optimism and jump in exposure to equities & cyclicals,” Hartnett wrote in a note to clients. “We say…easy part of rally over, tougher part of rally beginning…but rally it can as no ‘excess greed,’ there is ‘excess liquidity’ (and trade/fiscal easing), and corporate earnings set to accelerate.”

“FOMO” or fear of missing out, is a commonly used term among traders to describe herding behavior by investors when the market starts to gain rapidly.

Investors still said “trade war” is the No. 1 trail risk to a rebound in equities, but bulls noted that a “trade truce” might be enough to keep stocks grinding higher to records, the strategist said.

Both the Dow Jones Industrial Average and the S&P 500 have posted records within the last week as warmer trade relations and renewed hopes for a trade cease-fire between the U.S. and China goaded investors back into riskier assets.

The Dow — up more than 3% over the last month — inched higher to a record close on Monday at 27,691.49. Trade-exposed names like Apple, Intel and Dow have all led the charge higher.

More pessimistic investors, however, forecast no more Federal Reserve rate cuts before the 2020 election. That could unwind stubborn long positions in U.S. tech and growth stocks, Hartnett wrote.

The Bank of America survey, conducted Nov. 1 through Nov. 7, included 230 panelists with $574 billion in assets under management. The monthly survey is the most-watched poll of its kind among Wall Street investors and traders.

Hartnett added, however, that the marked drop in cash holdings isn’t necessarily a green light for clients who’ve held off on rejoining the stock market. Rapidly falling cash holdings are often a contrarian sell signal. It often pays off to invest in stocks when the crowd is selling stocks and raising cash, he figures.

Here are the biggest risks to the financial markets in 2020

PUBLISHED SAT, NOV 9 20197:55 AM ESTUPDATED SUN, NOV 10 20196:56 PM EST

KEY POINTS

- Deutsche Bank’s chief economist, Torsten Slok, sent out a list of 20 risks to the economy and markets next year to clients.

- Top on the list of concerns is the “continued increase in wealth inequality,” which is an issue front and center in the current presidential election cycle.

- The bank feared that the trade war uncertainty would continue to weigh on corporate spending.

- Other risks the bank listed include impeachment uncertainty, high-yield credit market and more negative-yielding debt.

Stocks may be at record highs as the year winds down, but Wall Street has already started issuing warnings about a host of threats to the markets in 2020.

Deutsche Bank’s chief economist, Torsten Slok, sent out a list to clients on Friday of 20 risks to the economy and markets next year. CNBC was granted permission to publish the full list.

20 risks to markets in 2020

- Continued increase in wealth inequality, income inequality and healthcare inequality.

- Phase one trade deal remains unsigned, continued uncertainty about what comes after phase one.

- Trade war uncertainty continued to weigh on corporate capex decisions.

- Ongoing slow growth in China, Europe and Japan Triggering significant US dollar appreciation.

- Impeachment uncertainty & possible government shutdown.

- US election uncertainty; implications for taxes, regulation and capex spending.

- Antitrust, privacy and tech regulation.

- Foreigners lose appetite for US credit and US Treasuries following Presidential election.

- MMT-style fiscal expansion boosts growth significantly in US and/or Europe.

- US government debt levels begin to matter for long rates.

- Mismatch between demand and supply in T-bills , another repo rate spike.

- Fed reluctant to cut rates in election year.

- Credit conditions tighten with more differentiation between CCC and BBB corporate credit.

- Credit conditions tighten with more differentiation between CCC and BBB consumer credit.

- Fallen angels: More companies falling into BBB. And out of BBB into HY.

- More negative-yielding debt sends global investors on renewed hunt for yield in US credit.

- Declining corporate profits means fewer dollars available for buybacks.

- Shrinking global auto industry a risk for global markets & economy.

- House price crash in Australia, Canada and Sweden.

- Brexit uncertainty persists.

Source: Deutsche Bank

Top on the list of concerns is the “continued increase in wealth inequality,” which is an issue front and center in the current presidential election cycle. Democratic presidential candidates Elizabeth Warren and Bernie Sanders have called for additional taxes on the richest Americans to narrow the wealth gap.

“Trade war and impeachment are near-term risks that could even be resolved before this year is over, whereas increasing inequality is a longer-term development that may be addressed politically at some point in the future,” Slok told CNBC.

Some on Wall Street claimed Warren’s ascent in the presidential pool is set to become the market’s new “wall of worry.” Billionaire Paul Tudor Jones and longtime investor Leon Cooperman recently warned a market correction is on the way, should Warren take the White House.

Trade uncertainty

While trade tensions between the U.S. and China have eased recently as the two sides work to finalize a limited agreement, the market still faces trade war tensions. President Donald Trump cast doubt on the recent progress, saying Friday that he has not agreed to roll back tariffs on China, dampening hopes about a coming resolution.

The Trump administration has slapped tariffs on more than $500 billion in Chinese goods, while Beijing has put duties on about $110 billion in American products. China has pushed for the U.S. to remove tariffs as part of the “phase one” deal.

Deutsche Bank feared that the trade war uncertainty would continue to weigh on corporate spending.

“The bottom line is that investors need to take into account the possibility that the environment for consumer spending and capex spending could change as a function of which policies may or may not be implemented over the coming years,” Slok said. “Public policy and any potential changes to public policy are important inputs into any investment decision.”

Other risks the bank listed include impeachment uncertainty, high-yield credit market and more negative-yielding debt.

The world’s largest trade deal could be signed in 2020 — and the US isn’t in it

PUBLISHED MON, NOV 11 20196:18 PM ESTUPDATED TUE, NOV 12 20196:55 AM EST

KEY POINTS

- A group of 15 Asia-Pacific countries is aiming to sign the Regional Comprehensive Economic Partnership, or RCEP, in 2020.

- The mega-deal started with 16 countries but India decided not to join the trade pact over concerns that it would hurt domestic producers.

- The urgency to conclude RCEP increased after U.S. President Donald Trump pulled his country out of another major free trade agreement, the TPP.

After more than six years of negotiations, more than a dozen countries in Asia Pacific are now aiming to sign what would be the world’s largest trade agreement in 2020.

The deal, called Regional Comprehensive Economic Partnership or RCEP, involves all 10 countries from the Association of Southeast Asian Nations (ASEAN) bloc and five of its major trading partners: Australia, China, Japan, New Zealand and South Korea.

Together, the 15 countries make up close to one-third of the world population and global gross domestic product, according to a Reuters report. That’s larger than other regional trading blocs such as the European Union and the United States-Mexico-Canada Agreement, or USMCA.

The mega-deal started with 16 countries but India decided not to join the trade pact over concerns that it would hurt the South Asian country’s domestic producers.

Significance of RCEP

RCEP was launched in November 2012 in Phnom Penh, Cambodia as an initiative by ASEAN to encourage trade among its member states and six other countries.

Those six other countries — Australia, China, India, Japan, New Zealand and South Korea — already have standalone free trade agreements with ASEAN. Coming together under RCEP would boost commerce across the group by lowering tariffs, standardizing customs rules and procedures, and widening market access especially among countries that don’t have existing trade deals.

All 16 countries started negotiating RCEP in 2013, when talks for another major trade pact — the Trans-Pacific Partnership or TPP — were underway. Given China’s absence in the then U.S.-led TPP, which was slated to be the world’s largest trade deal, many observers considered RCEP a way for Beijing to counter American influence in the region.

RCEP was hard fought, but a choice made easier by the calculation that Asia needed to push back against protectionism even as the United States chose that path.

Australian National University

In 2017, however, U.S. President Donald Trump pulled his country out of the TPP and slapped punitive tariffs on several U.S. trading partners for what he said were unfair trade practices.

In particular, the U.S.-China trade war has hurt many Asian exporters by reducing demand for their goods and slowing down growth. The urgency to conclude RCEP increased after all that.

“RCEP was hard fought, but a choice made easier by the calculation that Asia needed to push back against protectionism even as the United States chose that path,” academics from the Australian National University wrote in a report.

What will RCEP do?

The final text with details of the trade agreement will go through legal reviews before being signed and released.

Media and analyst reports have said RCEP is primarily beneficial for goods trade because it will progressively reduce tariffs on many products. In addition, the deal will allow businesses to sell the same goods within the bloc but do away with the need to fill out separate paperwork for each export destination, Reuters reported.

Deborah Elms, executive director at consultancy Asian Trade Centre, told Reuters that would help Asian producers to sell more of their products to the rest of the region.

Even for companies that export goods outside the bloc, there’ll be incentives to build their supply chains across RCEP member countries, according to Reuters.

But RCEP is said to lack the quality and scope seen in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership or CPTPP. The latter is the agreement that replaced the Trans-Pacific Partnership or TPP after the U.S. withdrawal.

In particular, RCEP — unlike CPTPP — lacks the call for commitments from member countries to protect workers’ rights and the environment, according to Reuters.

RCEP also covers fewer service sectors — one reason which some reports said led to India walking away from the deal.

India’s role

India, involved in RCEP negotiations from the start, declined to join the trade pact over concerns that the deal would hurt its domestic producers. India’s apprehension toward the deal had been one of the main hurdles in recent RCEP talks.

Some RCEP members, such as Japan, considered New Delhi’s participation crucial “both for economic reasons and as another counterweight to China,” according to analysts from risk consultancy Eurasia Group.

India is Asia’s third-largest economy and a large consumer market.

But the remaining 15 countries are still expected to bring RCEP into force, according to another consultancy, The Economist Intelligence Unit.

“Without India, RCEP will be less significant, but its path to implementation has become much smoother,” the EIU said in a report.

HI Financial Services Mid-Week 06-24-2014