HI Market View Commentary 11-25-2019

| Market Recap |

| WEEK OF NOV. 18 THROUGH NOV. 22, 2019 |

| The Standard & Poor’s 500 index fell 0.3% this week, breaking its six-week winning streak as anxiety over the trade situation between the US and China emerged and sent stocks lower for the week.

The S&P 500 ended the week at 3,110.29, down from last week’s closing level of 3,120.46. The biggest decliner was the materials sector with a drop of 1.7% week-to-week and real estate lost 1.1%. Technology and industrials both fell 0.8%. Energy declined 0.4%, communications services added 0.1% and consumer staples fell 0.1%. The healthcare sector had the largest percentage increase of the week, up 0.8%, followed by a 0.6% advance for financials. Utilities increased by 0.2%. Foot Locker (FL) was among the biggest decliners for the week, losing about 12%. The footwear retailer had underperformed in recent quarters, but on Friday reported Q3 earnings that exceeded expectations and revenue that missed forecasts. Jack in the Box (JACK) lost about 10% for the week, also one of the bigger mid-cap losers. The restaurant operator on Nov. 20 reported earnings and revenue both missed expectations. Carvana (CVNA) shares were up 10% for the week, among the biggest large-cap winners. The auto seller earlier this month reported earnings that missed forecasts and revenue that topped expectations. Citi analysts reiterated their buy rating on Carvana shares this week. Provided by MT Newswires. |

Today is one of my favorite weeks in the stock market!!!

Optimism with low volume and usually is a bullish week

What id going on with Target?!??!!!!

Where will our markets end this week?

Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end Nov 2019?

11-25-2019 +2.25%

11-18-2019 +2.25%

11-11-2019 +2.25%

11-04-2019 +2.25%

Earnings:

Mon: PANW, PVH

Tues: ANF, BBY, BURL, CHS, DLTR, DKS, DELL, GME, GES, HPQ, VMW

Wed: DE

Thur:

Fri:

Econ Reports:

Mon:

Tues: FHFA Housing Price Index, Consumer Confidence, New Home Sales, S&P Case Shiller

Wed: MBA, Initial, Continuing, Personal Income, Personal Spending, PCE Prices, Core PCE Prices, GDP, GDP Deflator, Durable Goods, Durable ex-trans, Pending Home Sales, Fed Beige book

Thur: MARKET CLOSED – Thanksgiving

Fri: Chicago PMI

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Saturday/Sunday –

How am I looking to trade?

Letting things run during the shortened week

AOBC – 12/05 est

MRVL 11/26 est

TGT – 11/20 BMO

www.myhurleyinvestment.com = Blogsite

support@hurleyinvestments.com = Email

Questions???

Gary Cohn: Trump knows he’ll lose ‘credibility’ with China if he blinks on tariff deadline

PUBLISHED MON, NOV 18 20197:33 PM ESTUPDATED MON, NOV 18 20199:59 PM EST

KEY POINTS

- Former White House chief economic advisor Gary Cohn says he thinks President Trump will impose the Dec. 15 tariffs if the U.S. and China haven’t agreed to a trade deal.

- “I think he thinks that that’s a forcing function and if he keeps blinking, he losses credibility in the Chinese eyes,” Cohn tells CNBC.

- Cohn also urges his former boss to sign the “phase one” that the U.S. and China announced in October.

Former White House chief economic advisor Gary Cohn said Monday that he believes President Donald Trump will go forward with the Dec. 15 tariffs if the U.S. and China haven’t agreed to a trade deal.

“I think he thinks that that’s a forcing function and if he keeps blinking, he loses credibility in the Chinese eyes,” Cohn said on “Fast Money.”

Treasury Secretary Steven Mnuchin has also said he expects the mid-December round of tariffs on Chinese goods if there’s no deal.

Cohn, who announced in March 2018 that he was leaving his White House post, is a free-trade advocate whose disagreements with Trump’s embrace of tariffs are widely documented.

In October, after the U.S. and China agreed to a partial trade agreement, Trump decided not to go through with a tariff increase that had been set for the following week.

But that “phase one” deal has yet to be signed, adding to the unpredictability of the long-running trade dispute, during which the world’s two largest economies have imposed billions of dollars in tariffs on each other’s goods.

The October deal was said to address concerns over intellectual property and financial services, in addition to Chinese purchases of about $40 billion to $50 billion U.S. agricultural products. But the exact terms have yet to be agreed upon, with the U.S. pushing for stronger concessions on intellectual property, for example.

Officials from the two countries had “constructive discussion” over the weekend, according to the Chinese Ministry of Commerce.

In August, Trump announced that he was delaying some scheduled tariffs — on certain electronics such as cellphones, laptops and video games — over concerns that they might impact the holiday shopping season. Trump often suggests that China, not U.S. consumers and businesses, pay for the tariffs despite evidence to the contrary.

Part of the reason why Cohn said he believes Trump would go forward with the Dec. 15 batch of tariffs is because “he’s got them through the other side of the holiday season.”

“And Dec. 15 is a long time from now in terms of tariff negotiations,” added Cohn, the former president of Goldman Sachs.

Cohn has said he believes the trade war is hurting the U.S. economy, a belief which he reiterated Monday. He urged Trump to at least sign the phase one deal in order to give a boost to U.S. agriculture, which has been hurt by retaliatory Chinese tariffs.

“Our farmers deserve to be growing crops. Our farmers deserve to be exporting. It’s important for our U.S. economy,” Cohn said. “We should not be in this position right now … So at a minimum, we should go through with that” .

https://www.armstrongeconomics.com/products_services/products/the-repo-crisis/

Blog/Reports and DVDs

Posted Nov 19, 2019 by Martin Armstrong

QUESTION: Marty; The goldbugs are back and claiming the Repo Crisis is MMT and this is again just printing money endlessly to cover up a major banking crisis in the USA so buy gold of course. You said at the WEC cocktail party this would happen because these people never understand the world economy. Is this because they are so fixated on the dollar crash to make gold viable?

Thanks for a great WEC. It was your best ever!

HN

ANSWER: Of course, they will call this Quantitative Easing and Modern Monetary Theory. They are biased and in favor of gold, which makes them incapable of being real analysts. First, you must establish a base method of inquiry which cannot begin with a predetermined conclusion that all paper money is evil and gold is the only real money. Because they begin with this PRESUMPTION, they only look at things to support that predetermined outcome. They fail to provide the reason or support their proposition with historical evidence. They never provide any collective investigation that would put their expectations in question.

The Fed is NOT engaging in QE nor is it engaging in MMT. The Fed is standing in the middle because banks do not trust banks. The crisis is by NO MEANS in the United States. They also fail to grasp why the dollar is the world’s reserve currency, the hoarding of dollars globally, or what this crisis is even about. They interpret any increase in the quantity of money as inflationary. We have had more than 10 years of QE in Japan and Europe with no inflation, which proves their theory is WRONG. They will never address that reality and instead constantly argue gold will rally with QE.

I will do a special report on the Repo Crisis because it just seems people are using this crisis to sell nonsense and outright bullshit. They are so far off the mark about the cause of this crisis, as always, and it would be funny if they were not misleading people into risking their entire life savings. The banks won’t talk to each other and the central banks are living in absolute terror that the truth will come out and the world will just go nuts.

I always seem to be in the middle of every crisis. Not sure how this happens. I get calls asking me what have I heard because nobody will talk among themselves but somehow they come to me to ask what I have heard. I am writing the report now because it just seems imperative to explain the real cause that the press will never print. Nobody will talk and the central banks cannot dare utter a single word about the source of the crisis for fear of creating a political crisis. Even the heads of states are being left in the dark. Trump has called for negative interest rates because he does not understand the crisis because nobody is talking. All they can do is pray at the foot of their bed every night to PLEASE let this crisis pass. Sorry, your prayers will not be heard.

Categories: Reports and DVDs

Tags: Interest Rates, MMT, QE, repo crisis

https://seekingalpha.com/article/4307703-baidu-still-undervalued

Baidu: Still Undervalued

Nov. 19, 2019 10:27 AM ET

About: Baidu, Inc. (BIDU), Includes: IQ

Portfolio strategy, macro, currencies, long-term horizon

Summary

Strong Q3 drives post-earnings pop.

Emerging businesses, e.g., the cloud and AI initiatives, are gaining traction.

Market is not fully recognizing the value of the Baidu complex — on a sum-of-parts basis, shares offer an additional ~16% upside.

Ongoing $1 billion buyback program could serve as a key catalyst.

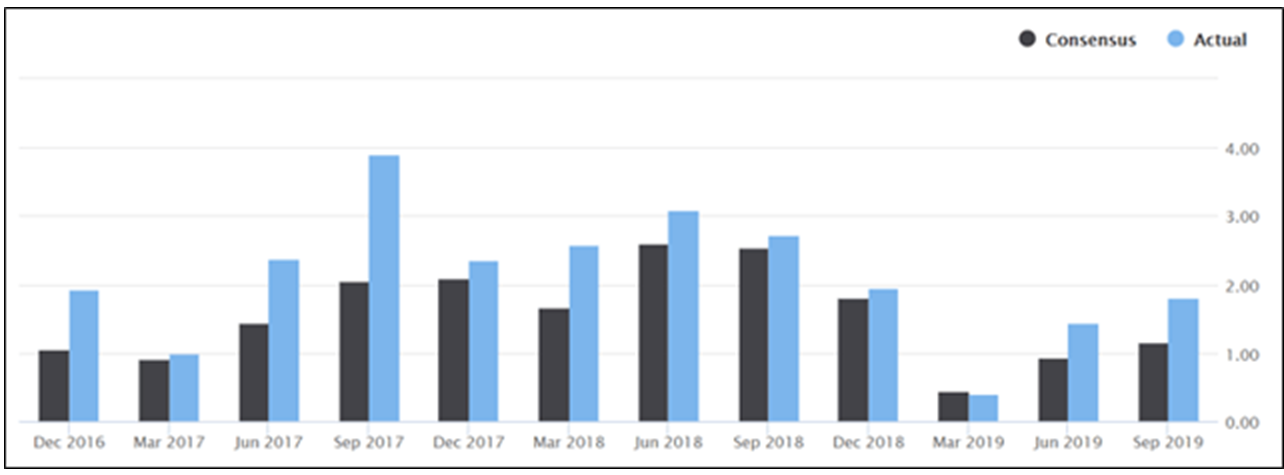

Baidu (BIDU) holds an impressive portfolio of digital services that have proven to be highly potent over the long run — in the last nine years, the firm has increased its revenue by a staggering 22 times, representing a compounded annual growth rate of 46%. Furthermore, the firm has delivered massive growth in user engagement and profitability throughout the first three quarters this year — in the last twelve quarters, Baidu has beaten consensus EPS estimates eleven times.

Source: Seeking Alpha

The out-performance has extended across the Baidu ecosystem — its entertainment streaming service, iQIYI (IQ), reached 105 million users in September, representing quarterly adds of 5.3 million or 31% growth year over year. Upcoming initiatives such as Baidu’s machine learning-based ad management system (Phoenix nest system) could significantly enhance the core search and news feed offering, while the self-driving car initiative (Apollo 3.5) could create a brand new sustainable business over the long run.

The good news for investors is that Baidu is not resting on its laurels and plans to further increase its investments this year to expand its customer base. The valuation scenario, coupled with its long-term corporate strategy and internal economics, bodes well for the firm’s long-term growth trajectory.

While these prospects lend well to Baidu’s long-term fundamentals, its $1 billion share buyback program should provide ample support to the price. On a sum-of-parts basis, Baidu shares look especially undervalued, even on conservative estimates. Thus, even following the recent post-earnings pop, I rate BIDU shares a buy.

Q3 2019 recap

Baidu reported a better-than-expected quarter, with earnings coming in line with guidance. Meanwhile, Baidu’s top-line was especially strong, beating consensus estimates by a noticeable margin, driven by a stabilizing macro environment in the online advertisement market. Travel was also a vertical management called out as a “one of our strong verticals.”

Baidu Cloud revenue growth slightly decelerated this quarter at 70% YoY (vs. 92% in 2Q19) as profitability starts to become more of a focus going forward. Cost savings, however, continued to deliver better operating margins, with non-GAAP operating margins beating consensus and translating into a non-GAAP EPS beat.

Guidance did not disappoint either — Baidu core revenue was guided to 0% to 6% YoY growth, suggesting a reversal of the YoY declining trend in 2Q19 and 3Q19.

Operational highlights

Critics have argued that Chinese consumers are reluctant to pay for video services, with their argument based on the proposition that piracy will eventually disrupt the video services’ business models. Yet, iQIYI’s performance continues to go from strength to strength. In its Q3 report, iQIYI added 5.3 million subscribers, reaching 105 million in September. The performance translated to a year over year subscription growth of 30%.

The entertainment services giant has proven itself to be a highly competent rival against services like Tencent Video (OTCPK:TCEHY), Kuaishou, and ByteDance’s Douyin/TikTok. iQIYI’s CEO, Tim Gong, assured that the firm has a strong content pipeline heading into the fourth quarter of 2019, reflecting Chinese mainstream values and culture. Besides, Baidu will also broadcast UEFA EURO 2020, La Liga, 2022 FIFA World Cup qualification games in Asia, as well as the Australian Open, Wimbledon Championships, WTA PGA tour, and other top sporting tournaments.

In Baidu App, the daily active user base grew 25% year over year, reaching 189 million. During the period, in-app search queries grew 25% while feed time spent increased by 16% year over year. The evolving content ecosystem and service at Baidu has drawn considerable interest from publishers to showcase their content in its platform — this was reflected in its total publisher accounts on BJH (Baijiahao), which grew by 57%+ on a year over year basis, reaching 2.4 million as of September.

Cloud and AI initiatives

Earlier in August, Baidu introduced new AI enterprise solutions at the Baidu cloud ABC summit. The solutions were introduced to optimize visual and speech processing capabilities to assist users in improving operational efficiency and productivity. In its third-quarter this year, Baidu’s AI platform reached a 1.5 million strong developer base, which reflects more than two-fold increase over the last year. Recently, Baidu Maps has also improved its voice feature with synthesis technology, which enables users to customize the factory voice with the user’s voice. In the last year, 280 million-plus users have used Baidu Maps’ voice feature, which is a 2x improvement compared to the previous year.

Baidu’s AI businesses have gained strong traction in the market. Its new AI businesses, which include DuerOS smart devices and Baidu cloud, saw their user base increase by 100% year over year. Solid improvement in unit economics also led Baidu’s Xiaodu smart speakers to attain greater market adoption. On the other hand, cloud revenue slowed to 70% year over year growth as the firm cited a greater emphasis on margins over growth.

Valuation

Using a sum-of-parts valuation method, I believe the fair value of Baidu shares lies at $167 per ADR. The valuation is achieved by employing a non-GAAP EPS multiple of ~12x based valuation on Baidu’s core business while accounting for the market caps for the iQIYI and Trip.com stakes as well as the company’s reported net cash position. Note that the 12x multiple for “core Baidu” is deployed with a conservative mindset, although it is a fact that most of its peers are trading well above a 15x (for example, BABA, JD, TCHEY, NVDA) non-GAAP EPS multiple.

| Method | Market Value / Valuation (USD ‘Millions) | Baidu’s Stake | Implied value | Implied value per BAIDU ADR (USD) | |

| Core Baidu | Non-GAAP 12x P/E multiple | NA | 100% | 27,260 | 78.0 |

| iQIYI | Market Value | 12,680 | 57% | 7,228 | 20.7 |

| Trip.com | Market Value | 18,320 | 12% | 2,198 | 6.3 |

| Net Cash | NA | 10,776 | NA | 10,776 | 30.8 |

| Total valuation | 135.8 |

Source: Author Estimates, Company Data, Yahoo Finance

Conclusion

In sum, I believe that Baidu is poised for long-term growth, and the current market value of ~$117 is far below fair value, offering an opportunity for investors to buy into the Baidu growth story at a significant discount. Baidu has not only strengthened its core business but also actively expanding its machine learning-based systems, AI features and autonomous vehicle system, and from a bird’s-eye view, it is clear that the firm has multiple long-term opportunities. My target price of ~$136 offers ~16% upside from here, while leaving additional margin for error. Furthermore, the company’s ongoing $1 billion buyback program could serve as a key catalyst to unlock value in the upcoming months.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

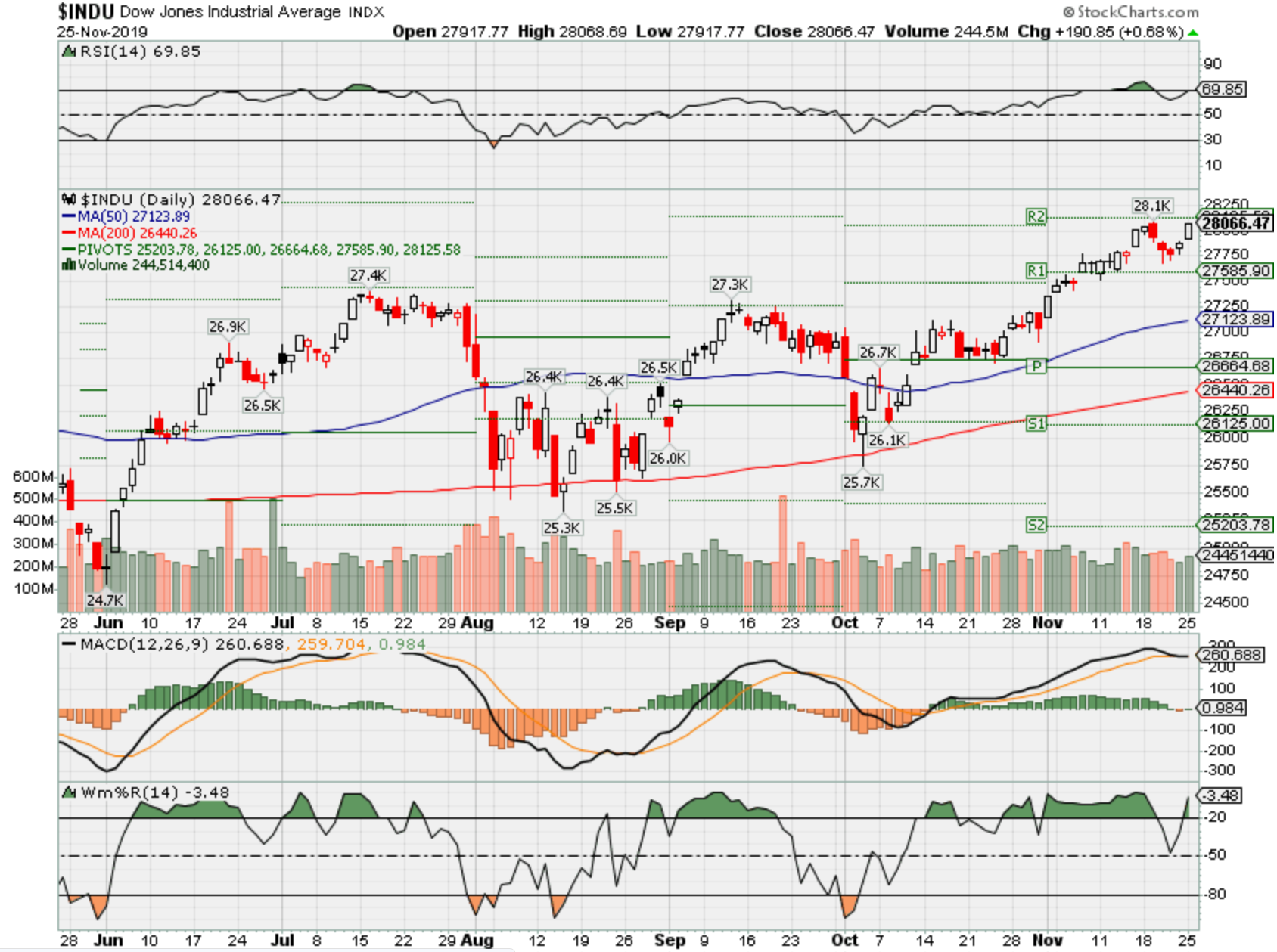

Markets are overbought, but there’s not much worry on Wall Street — yet

PUBLISHED TUE, NOV 19 20193:23 PM ESTUPDATED TUE, NOV 19 20194:14 PM EST

KEY POINTS

- The market may be overbought, but overbought markets can last for an extended period.

- Technology stocks are leading the march to new highs in market indexes.

- What could go wrong? The market isn’t worried about it yet.

It’s not very exciting, but the market keeps advancing almost every day. The S&P has been up 10 of the 13 trading days this month, yet market technicians do not seem concerned the market is getting too far ahead of itself.

“This market is grinding higher — yes, it’s overbought, but markets that get overbought can stay overbought for an extended period,” Craig Johnson, technical market strategist for Piper Jaffray, said. “This is the exact opposite of what we saw last year. The Fed is now easing or neutral, and they are expanding their balance sheet. Trade war concerns are subsiding. We are not breaking down. We are breaking out.”

An additional factor is moving the market: fear of missing out. “Of the last 20 trading sessions, 15 experienced a positive closing tick, indicative of money inflows,” JC O’Hara, chief market technician at MKM Partners, wrote in a note today.

Dan Wantrobski, technical strategist at Janney Montgomery Scott, wrote in a recent note: ”[W]e realize that ‘FOMO’ (fear of missing out) can trigger a pain trade higher still as we head into year-end.”

Leading the charge in November is technology, with big gains in the largest stocks.

The top 10 tech stocks, in particular, have had outsized gains that are dragging the S&P to new highs. With the S&P 500 up 2.6% in November, seven of the largest 10 technology stocks are outperforming the index, and only one — Cisco — is down on the month.

Big tech, so far this month:

Microsoft, up 4.9%

Apple, up 7.4%

Intel, up 3.1%

Adobe, up 6.9%

Accenture, up 6.8%

Broadcom, up 6.2%

Salesforce, up 4.0%

Mastercard, up 1.5%

Visa, up 1.0%

Cisco, down 4.9%

You would think that with big-cap tech stocks moving this fast there would be more trepidation among market technicians. While everyone agrees the market is overbought, few seem worried for now.

Wantrobski does expect some profit taking soon, particularly if the big-cap indexes keep pushing into new highs.

“The danger here is that eventually, these overbought large-cap indices (S&P 500 DJIA; etc.) will have to be reconciled against lagging small-cap benchmarks (like the Russell 2000 and Smallcap 600) — which have thus far failed to make new recovery highs. This non-confirmation out of the small/midcap area is creating a ‘negative divergence’ of sorts. In the past, such divergences have been resolved via corrections — although the timing of such is difficult to pin down at this time.”

When will it end? What could go wrong? “They’ve been telling us the ink is almost dry [on trade], if that’s wrong that is a problem,” Johnson said. “If GDP is weaker than expected, that’s a problem. Brexit talks falling apart” could also be a problem.

For now, it seems like the world is not so worried about these issues, and because of the lack of worry, this could go on for a while, Johnson wrote in a note today.

“From our perspective, we view signs of overbought conditions as validation of the breakout and not necessarily indicative of an end to the rally for now. … As we have previously noted, overbought conditions can persist for meaningful periods of time before either a time or price correction unfolds.”

Walmart CEO Doug McMillon: ‘We could go away at any minute’

PUBLISHED TUE, NOV 19 20191:46 PM ESTUPDATED TUE, NOV 19 20195:38 PM EST

KEY POINTS

- Walmart CEO Doug McMillon says he’s well aware that “retailers come and go.”

- “It’s really simple: If you’re not meeting the wants and needs of the customer, you’re done,” he says.

Walmart is constantly evolving to avoid dying off, as plenty of other retailers have, according to the company’s chief executive officer.

“Walmart is not arrogant,” CEO Doug McMillon said at CNBC’s Evolve Summit in Los Angeles on Tuesday morning. “We could go away at any minute. I think most of us act that way every day. If you’re not willing to fail — and we are failing at some things — you’re going to go away.”

McMillon went on to say that, at Walmart, “everything is open to change.”

In addition to keeping a photo on his phone that lists the top 10 retailers in the U.S. over the past few decades, the CEO said he keeps a copy of a specific Forbes magazine from the 1990s in his office. The cover story of that issue is titled, “Has Walmart lost its magic?”

“Retailers come and go,” McMillon said. “It’s really simple: If you’re not meeting the wants and needs of the customer, you’re done. There’s not a lot of loyalty here.”

When Walmart reported earnings last week, McMillon admitted the company still had work to do to boost its online business. The company says its grocery business is booming and it has made the most progress there. But it’s still trying to grow a broader assortment of general merchandise online that will bring in greater profit margins and ultimately make that business a profitable one.

During Tuesday’s panel at CNBC’s Evolve Summit, McMillon also said Walmart’s acquisition of Jet.com “hasn’t worked out exactly like we thought it was going to work out.” But it did cause Walmart.com to “accelerate,” he said.

“I didn’t understand how much of a digital transformation was needed [when I first started],” McMillon said. “That is still underway.”

The CNBC Evolve Summit returns to LA on June 9, 2020. Registration for this event is now open.

https://seekingalpha.com/article/4308044-visa-strong-tailwinds-emerge-unexpected-sources

Visa: Strong Tailwinds Emerge From Some Unexpected Sources

Nov. 20, 2019 12:32 PM ET

Summary

Visa demonstrated a very strong earnings result in its most recent earnings.

What was encouraging about this result was the progress being made in the new areas of business to business and business to consumer payments.

Visa has a strong competitive advantage in these new businesses, with an enhanced product and key institutional relationships that will propel growth.

Looking for a portfolio of ideas like this one? Members of Sustainable Growth get exclusive access to our model portfolio. Get started today »

Recently, I compared Visa (NYSE:V) to Mastercard (NYSE:MA) (one of the five great businesses that I’ll never sell), and I had concluded that Mastercard was likely more favorably positioned to execute going forward, given its exposure to emerging markets and some favorable positioning it had in new lines of business, including business to business payment.

After reviewing Visa’s recent results and commentary and reassessing likely future growth in emerging businesses, I’ve come to the conclusion that Visa will be more favorably positioned to extract long-term value form new revenue sources what I had first assessed. Visa remains my 2nd largest holding in my Project $1M high growth portfolio behind Mastercard.

Core business continues to fire strongly

Visa reported strong growth in its fourth quarter, continuing recent trends that have been seen in the business. Net revenue (excluding currency impacts) was up 12% year over year, with payment volumes increasing close to 9% on a constant currency basis. Cross-border payment volume growth was a positive 7% year over year, significant for Visa, given that this business is relatively high margin. The continued growth in the core Visa business has helped operating margins continue to expand. Operating margins within the Visa business are almost 67% and have shown steady progressive increases year over year. With much of Visa’s core payment infrastructure being fixed, it’s likely that this trend in sustained operating margin improvement will continue with growth in the core business.

However, more than the steady and expected growth in core consumer payments, one of the surprising and positive aspects of Visa’s earnings was the positive contribution of its emerging growth areas. Both business to business payments and business to consumer disbursements showed surprisingly good signs of growth.

Business to Business Payments is growing surprisingly quickly

Visa made a considerable note in its Q4 earnings announcement that it crossed the $1 trillion mark in business to business payments during the quarter. For Visa, this represents considerable success in being able to diversify its revenue streams, with B2B payments now representing almost 12% of total business volume. While that’s impressive, it still only represents a very small portion of the total annual business to business spend globally, which exceeds $120 trillion globally. This market is made up of foreign exchange, domestic wires, cash, ACH and checks.

Mastercard Investor Day 2017

Visa, like Mastercard, has been going after the market for fast, real time business to business payments and has formalized Visa B2B connect, live in 62 countries, as the way to go after this opportunity. Traditional ACH or check-based payment can typically take several days to clear. Regulatory and compliance obligations can further delay the clearing of these funds if not handled correctly.

Speed of payments processing is highly valued, and delays are also exacerbated by limited connections between financial institutions, with transfers being moved within financial institutions in a network until payments can get to intended recipients.

It’s here that Visa has been able to see an opportunity, by virtue of its extensive, interconnected relationships with financial institutions that allow Visa B2B Connect to settle funds either same day or next day, which represents a significant competitive advantage. Visa is also able to take advantage of significant relationships with banks globally to bring this capability to market.

Business to Consumer and Peer to Peer payments also showing strong growth

What was also notable in Visa’s recent earnings was the strong growth in Visa Direct, the company’s solution for fund disbursements for business to consumer and for peer to peer payments. It was noted on the recent earnings call that Visa Direct grew triple digits year over year and successfully processed over 2B transactions.

Of particular note has been the usage of Visa Direct by businesses to provide instant disbursements to customers. Companies such as Intuit (NASDAQ:INTU) were cited as customers that took advantage of instant disbursements to eligible debit cards all through a single Visa connection. Visa has been bulking up the Visa Direct solution in recent times through acquisition of capabilities that extend its network. The company most recently acquired Earthport at the end of 2018 to strengthen its cross-border payment service for banks and money transfer. Earthport extended Visa’s network into additional global financial institutions which allowed Visa the opportunity to double the number of bank accounts it could reach, enabling virtually 99% of bank accounts in those countries that Earthport operated in to be accessed.

Visa Direct currently powers Square (NYSE:SQ) and Venmo as well as Zelle, the P2P payment services used by many of the consumer banks (including Bank of America (NYSE:BAC)) for their customers. With the long-term trend towards the gig economy, and workers taking multiple jobs that are more part time in nature, there will be an increasing need to facilitate broad disbursements across a potentially large pool of workers whose payments aren’t managed through formal payroll channels.

Visa Direct powers payouts to Uber drivers and allows drivers to get paid in real time for a small fee of $0.50 or wait for an extended period of time to receive free ACH payment. It’s clear that Uber drivers, like other workers, prefer real-time payments, with over 50% electing to pay a small fee to get paid quickly. Fast access to cash flow is likely to allow Visa to see enhanced monetization of Visa Direct to both new and existing customers.

Potential advantage over Mastercard in new growth areas

Visa may in fact have the advantage over Mastercard in these new markets by virtue of a strong presence in better penetrated digital payment markets. While Mastercard arguably has a better presence in emerging markets throughout Asia, Visa has over 50% market share by purchase volume in the US, Europe, and the Middle East. Business to business payments and business to consumer payments are both plays on Visa’s existing network effects.

Neither B2B nor B2C payment opportunities cannot be deployed unless there are existing financial institutions in market that have strong relationships with Visa and where there is already a high adoption of digital payments. It’s hard to layer on these kinds of services in emerging markets where only 20-30% of consumer and merchant populations have digital payment capabilities. There are just fewer ‘connected merchants’ to send payments to, or ‘connected consumers’ that merchants can send payments.

While Mastercard can benefit from the increase in personal consumer expenditure that will happen in emerging economies as they become more digitized, business to business payments and business to consumer disbursements will take place first in those markets where there is a higher penetration of digital payments, and these will be the markets where Visa has dominant share.

Concluding thoughts

While Visa has a slower rate of growth and poorer returns on invested capital than its close competitor Mastercard, the business arguably stands to benefit more from the high level of adoption of digital payments that is present in the US and Europe for new business opportunities. B2B and B2C payments provide considerable opportunities for the business and are areas where it has a high probability of being successful over the medium term.

To see other ideas of high quality, growing businesses that are positioned to be long term wealth creators, please consider a Free Trial of Sustainable Growth.

- Ideas based on the philosophy of Project $1M, which has outperformed the S&P 500by more than 50% for 2019, and over the last 4 years

- Access to Large Cap, Emerging Leader and High Conviction Model Portfolio

- Watch list that covers a broad universe of businesses with ‘unfair competitive advantages’ in fast growing markets

- Exclusive ideas on potential ‘Wealth Creators of tomorrow’

Disclosure: I am/we are long V, MA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Janet Yellen says ‘there is good reason to worry’ about the US economy sliding into recession

PUBLISHED THU, NOV 21 20194:24 PM ESTUPDATED FRI, NOV 22 201910:17 AM EST

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- Former Fed Chair Janet Yellen said the U.S. economy is in “excellent” shape but facing several risks.

- One of the most prominent is in wealth disparities that she said are “extremely disruptive.”

- In a downturn, the Fed would have little room to move, due to low rates, she added.

- Yellen also said tariffs the U.S. has leveled on Chinese imports aren’t doing any good.

NEW YORK — Pronounced wealth inequality that has built up for decades poses a major threat to a U.S. economy that is in otherwise “excellent” shape, former Federal Reserve Chair Janet Yellen said Thursday.

The central bank leader from 2014 to 2018 also said the U.S.-China tariff war is having a detrimental impact both on businesses and consumers through higher prices and a general air of uncertainty.

While she doesn’t see a recession on the horizon, she also noted that the risks are piling up.

“I would bet that there would not be a recession in the coming year. But I would have to say that the odds of a recession are higher than normal and at a level that frankly I am not comfortable with,” Yellen said at the World Business Forum.

With three rate cuts this year, there remains “not as much scope as I would like to see for the Fed to be able to respond to that. So there is good reason to worry.”

One particular area she cited was inequality, specifically the extent to which benefits during the longest expansion in U.S. history have flowed mostly to top earners and those with post-high school education levels.

Despite the central bank’s efforts to guide the economy, Yellen cited “a very worrisome long-term [trend] in which you have a very substantial share of the U.S. workforce feeling like they’re not getting ahead. It’s true, they’re not getting ahead.”

“It’s a serious economic problem and social problem because it means the gains of our economic system are not being widely shared,” she added. “It leaves people ultimately with the feeling that the economy is not working for them, a sense of social discontent that is extremely disruptive.”

The trade war initiated by President Donald Trump isn’t helping, she added.

For the past year and a half, the U.S. and China have been lobbing tariffs back and forth on billions in goods as part of the White House’s efforts to level the global playing field and halt the theft of technology and intellectual property.

“I see no sign that that’s been successful in turning around these trends,” she said of the protectionist trade actions. “These tariffs are taxes on American consumers and businesses. It’s making it more difficult and more expensive to do business, to control costs, and consumers are seeing higher prices from it.”

Yellen also acknowledged the burden that some of the Fed’s own policies, such as historically low interest rates, put on Americans.

She recalled getting emails during her time from people trying to save for retirement but were being penalized by low interest rates.

The Yellen Fed held the near-zero short-term rates that came into play during and after the financial crisis. She oversaw just two rate increases and the beginning of a reduction in the bonds the Fed holds on its balance sheet, the product of stimulus efforts during and after the crisis.

“Some of the most disturbing notes came from people who said, ’I work and I played by the rules and I save for retirement and I have money in the bank, and you know, I’m getting absolutely nothing,” Yellen recalled. “Savers are getting penalized. It’s true.”

Markets may get a boost from cheery Black Friday consumer sentiment, seasonal strength

PUBLISHED FRI, NOV 22 20193:20 PM ESTUPDATED 5 HOURS AGO

Patti Domm@IN/PATTI-DOMM-9224884/@PATTIDOMM

KEY POINTS

- The coming week is a short one thanks to the Thanksgiving Day holiday, but it could be an important one for markets as they head into the final leg of the year.

- “If we were using history as a guide, that means we could see the final leg of this turkey trot in the week of Thanksgiving where we end [higher], then spend the next week or so digesting the recent gain,” said Sam Stovall, chief investment strategist at CFRA.

- The important holiday shopping season kicks off on Black Friday, the day after Thanksgiving, and analysts expect it to be far better than last year when sales were weak, as the stock market plunged in December.

It’s Thanksgiving time, and investors’ thoughts turn to holiday shopping and a year end Santa rally in the stock market.

Some analysts think both could be pretty good this year.

While Black Friday has probably lost some of its claim as the launch of holiday shopping, the Friday after Thanksgiving could provide an early glimpse of how much the consumer will spend this year. The National Retail Federation estimates sales should grow by about 4% in the holiday shopping season, enough to keep the economy rolling along.

JP Morgan analysts, in a note Friday, said they expect sales to be up 4.9% during the holidays, much stronger than last year, when sales gained just 1.9% and shoppers were discouraged by a major sell off in the stock market.

As for the stock market, it continues to reach for new highs, and some analysts say that shouldn’t change as the calendar progresses deeper into a seasonally strong time of year for stocks.

“I actually like adding to equities through the rest of the year,” said Cayman Wills, global head of equities at J.P. Morgan Private Bank.

Wills said she is looking for a better economy, with now no concern about a recession next year. As a result, she began adding to industrials in September and now expects manufacturing data to turn around, supporting her view. She said, if ISM manufacturing data improves Dec. 2, as she expects, industrial company stocks should go even higher.

The coming week is often a slow one, with markets closed Thursday for Thanksgiving and stock exchanges closing down early on Friday. Fed Chairman Jerome Powell speaks Monday night on the economy, and there are some economic reports worth watching, including durable goods and personal income and spending Wednesday.

A few final earnings reports are also expected, including Best Buy, HP, and Dell.

In the bond market, the Treasury auctions $113 billion in 2-year, 5-year and 7-year notes Monday, Tuesday and Wednesday.

Investors are also watching impeachment proceedings in the House, but analysts do not expect the potential impeachment of President Donald Trump to affect markets, since there is little chance he would be convicted by the Republican majority in the Senate.

Developments on trade talks between the U.S. and China, are by far the most important event for markets.

“It’s a call on trade in our view. You can’t really predict what Xi and Trump will do,” said Michael Schumacher, director rates, at Wells Fargo. The 10-year Treasury yield was at 1.75% Friday, from a high of 1.95% on Nov. 12. Rates have moved lower as concerns have increased that the U.S. and China will fail to reach a deal by Dec. 15, heading off a new round of tariffs expected to take effect that day.

But stocks have not reacted as much to disappointing trade headlines, and are instead looking forward to a new round of talks between U.S. and Chinese officials. The S&P 500 was roughly half percent away from its all time high Friday.

“Trade is the nugget that helped lead the market higher,” Wills said. “In August we were trading at 16 times [earnings], now we’re at 17.8 times. If the market took out the benefit we saw from trade, it would probably be about 8% lower. That’s not our base case.”

She expects to see some form of a phase one trade deal, and investors will continue to monitor every headline and tweet about trade talks. U.S. trade negotiators were invited to China to take part in a new round of face-to-face talks, according to the Wall Street Journal. On Friday, Trump said a deal was close.

“I think there will be continued positive momentum,” said Wills, adding that incumbent presidents know a good economy is important in an election year.

Stocks could ‘turkey trot’ higher

The week around Thanksgiving is often positive for stocks. “If we were using history as a guide, that means we could see the final leg of this turkey trot in the week of Thanksgiving where we end [higher], then spend the next week or so digesting the recent gain,” said Sam Stovall, chief investment strategist at CFRA.

Stovall said there likely will be a Santa rally this year, but the market typically dips in the middle of December before moving higher. “December is the best month [for the S&P 500]. On average, it’s up 1.6% and also has risen 76% of the time since World War II. It’s the highest price change and the best frequency for an up move of any month,” said Stovall.

Scott Redler of T3Live. com said it’s very likely there will be a Santa rally taking the market higher into the end of December. “A lot of analysts have a target of 3,200 for this year, but we were a little ahead of ourselves. A week of digestion is welcome. Traders are looking to make sure the market holds 3,070 to 3,090 to give more confidence that the Santa rally could bring it to 3,200 by year end. The question is can the market hold these levels,” Redler said.

The 3,090 level is the low from this past week, and the 21-day moving average, a momentum indicator, is at 3,075.

“This week stocks took a little bit of a breather. Next week has a better chance of being seasonally strong,” he said. “This week was more of a breather than a break that could have happened on trade talks.”

Retail will dominate in the week ahead, as markets watch the final group of store chains report earnings. Dollar Tree, Dick’s Sporting Goods and Best Buy report on Tuesday.

Target in the past week gave positive indications for the holiday shopping season, as did Walmart the week before. But Home Depot lowered its sales forecast when it reported earnings, and Macy’s slashed its outlook..

“There are six fewer days between Thanksgiving and Christmas but CFRA does not see this weighing on sales,” said Stovall. “Our analysts expect the tight time frame between Thanksgiving and Christmas will be a boon for retailers which have “buy-online-pickup-in-stores” capabilities.”

Retail sales are important since the consumer drives more than two-thirds of the economy.

“The peak of the season includes 27 days between Thanksgiving and Christmas compared to 33 days last year, which is the shortest since 2013. Notably, with Cyber Week and online penetration growing, this is less a risk than the days of yore while the shorter season will likely lessen the depth of the slowdown in early December,” the JP Morgan retail analysts wrote.

Week ahead calendar

Monday

Earnings: Hewlett Packard Enterprises, Palo Alto Networks, Agilent, Jacobs Engineering

8:30 a.m. Dallas Fed manufacturing

1:00 p.m. 2-year Treasury note

7:00 p.m. Fed Chairman Jerome Powell speaks on building on gains from long expansion, Greater Providence Chamber of Commerce

Tuesday

Earnings: Best Buy, Dell, HP, DollarTree, Autodesk, Box, Hormel, VMWare, Dick’s Sporting Goods, Cracker Barrel, Bank of Nova Scotia

8:30 a.m. Advance economic indicators

8:30 a.m. Philadelphia Fed manufacturing 9:00 a.m. S&P/Case-Shiller home prices 9:00 a.m. FHFA home prices

10:00 a.m. New home sales

10:00 a.m. Consumer confidence

1:00 p.m. 5-year note auction

1:00 p.m. Fed Governor Lael Brainard

Wednesday

Earnings: Deere, DouYu

8:30 a.m. Initial claims

8:30 a.m. Durable goods

8:30 a.m. Real GDP Q3

10:00 a.m. Personal income

10:00 a.m. Pending home sales

1:00 p.m. 7-year note auction

2:00 p.m. Beige book

Thursday

Thanksgiving Day

Markets closed

Friday

Black Friday

9:45 a.m. Chicago PMI

HI Financial Services Mid-Week 06-24-2014