A Registered Investment Adviser

Trade Findings and Adjustments 09-10-2019

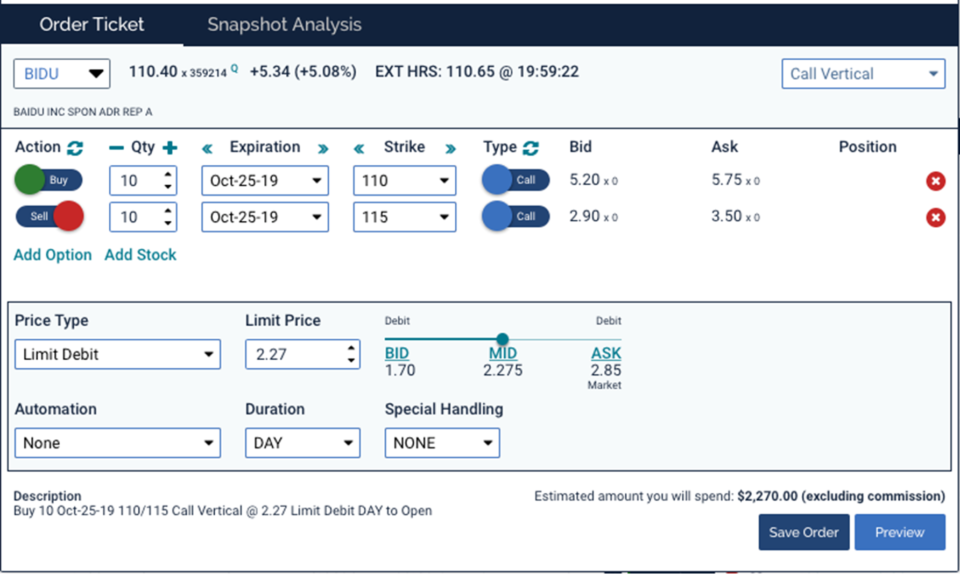

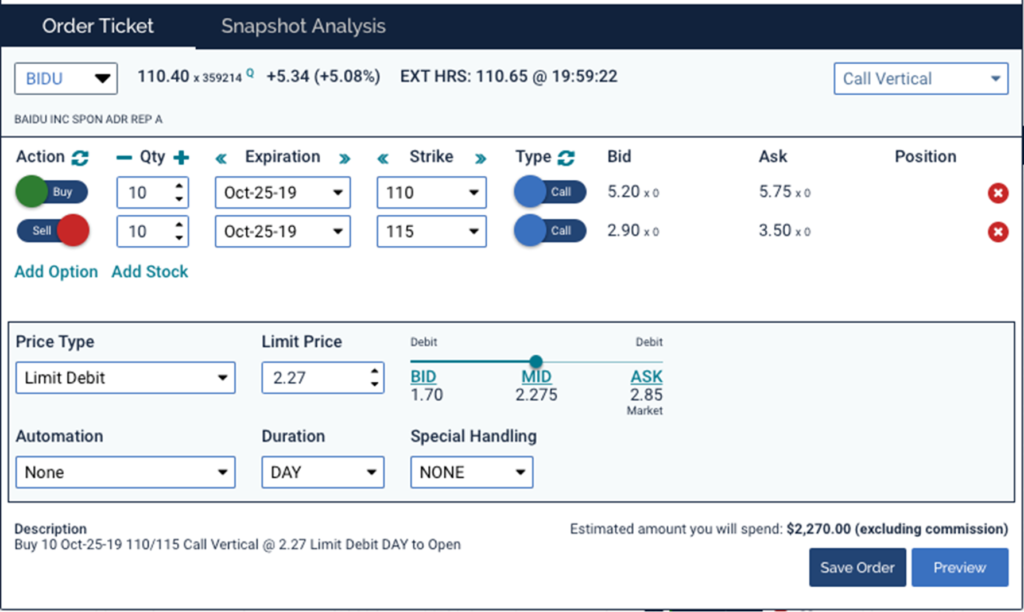

BIDU – break out above 50 day moving average. Looking to go up to 115ish resistance level

– Bull call option June 2020 120 strike for about $11.

– Bull call spread OCT 25 110 long call-115 short call for about 2.27

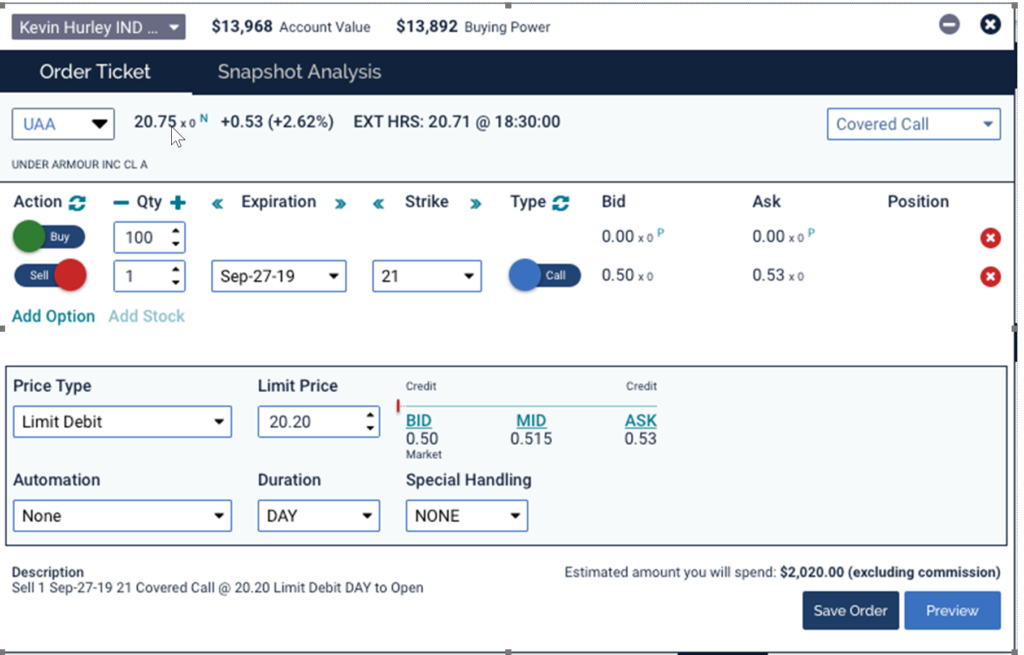

UAA – 20 support level and room to run up to 22.06 at the 50DMA

– Covered Call – buy 100 shares @ 20.75 – .50 = 20.15 or an order around 20.20 limit. $21 strike covered calls trying to book .50 – 1.

– If it’s above $21 look at 22 strike short calls to get close to .50 of credit.

F – technical bounce down from 50DMA and support at 200DMA

– Naked Short PUT at $9 strike Oct 4th Expiration for about .13 cents.

– If you’re assigned stock you can be in a collar or covered call trade for a Dividend around Oct. 20ish. Just make sure to keep an eye on the Dividend Ex date.

V – Big money taking profit from good performer and reallocating money to something else.

– Wait and see other “big money” see the opportunity to buy V cheaper.

AAPL – let’s see if it breaks the trend of falling down after a product reveal. $5 for Apple TV+.

– Watch for some followthrough to continue up from 215

DIS – holding a support level for now. Down from AAPL tv subscription announcement. $7 for DIS streaming sub +5 for TV+ =$12 or about the same or less than NFLX at $13-16. Better for AAPL and DIS and not NFLX.

keve@hurleyinvestments.com

www.hurleyinvestments.com www.myhurleyinvestment.com www.KevinMhurley.com